Xiaopeng Q1 Financial Report "Terrible" Delivery Volume Declines Same as Month-on-Month G6 Can Save Xiaopeng?

Xiaopeng Motor's first quarter 2023 results report was released on the evening of May 24, with total revenue of 40% in the first quarter..RMB 300 million, down 4.5% YoY.9%; net loss of 23.400 million yuan。Profits recorded a sharp decline, with gross profit of only 0 in the first quarter..700 million yuan, down 92% year-on-year.6%, gross margin is only 1.7%。Car deliveries fell in the first quarter from the same period last year!

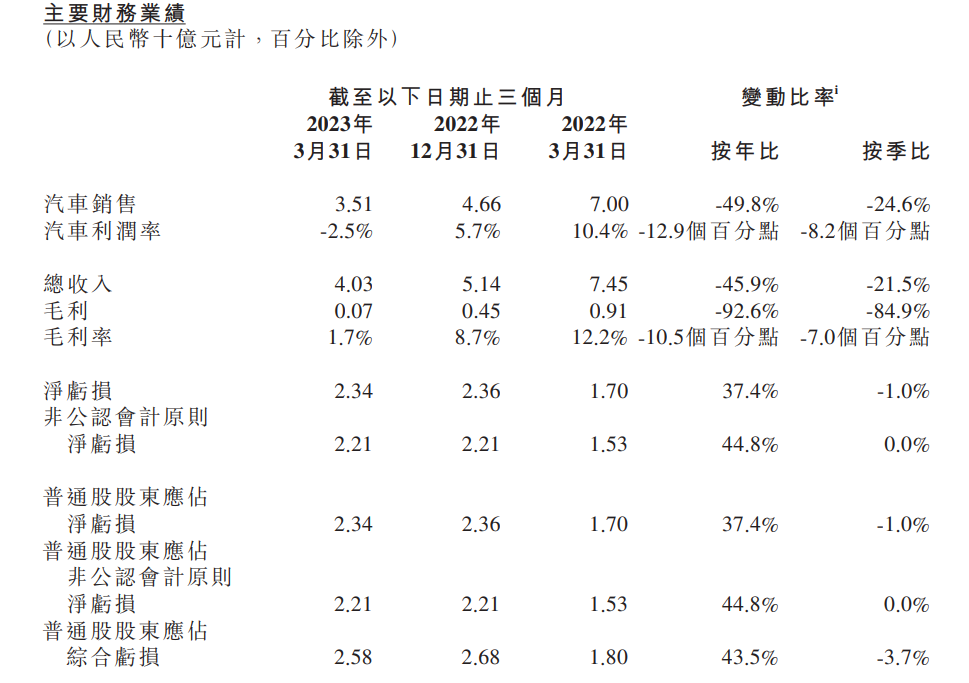

Xiaopeng Motors disclosed its first quarter 2023 results on the evening of May 24.。In terms of revenue, total revenue in the first quarter of 2023 was 40.300 million yuan (RMB, the same below), down 45.9%, down 21.5%。Among them, automobile sales revenue is 35.100 million yuan, down 49.8%, down 24.6%。Mainly due to lower vehicle deliveries and termination of NEV subsidies。In addition, service and other income is 5.200 million yuan, up 13.9%, up 8.4%。Mainly due to increased sales of parts, super charging services and other services, in line with the cumulative increase in vehicle sales。

The company is still operating at a loss.。Operating loss for the first quarter was 25.900 million yuan, a loss of 1.9 in the same period last year..200 million yuan, a loss of 25 in the previous quarter..200 million yuan。Net loss for the first quarter was 23.400 million yuan, a loss of 17% in the same period last year..0 billion yuan, a loss of 23 in the previous quarter..600 million yuan。Basic and diluted net loss per American depositary share was 2.71 yuan, compared with 2 in the same period last year.00 yuan, 2 last quarter.74 yuan。

Profits recorded a sharp decline。Gross profit in the first quarter was only 0.700 million yuan, down 92% year-on-year.6%, down 84.9%。Gross margin is only 1.7%, down 10% YoY.5%, down 7% month-on-month。

"Wei Xiaoli" Xiaopeng has begun to fall behind

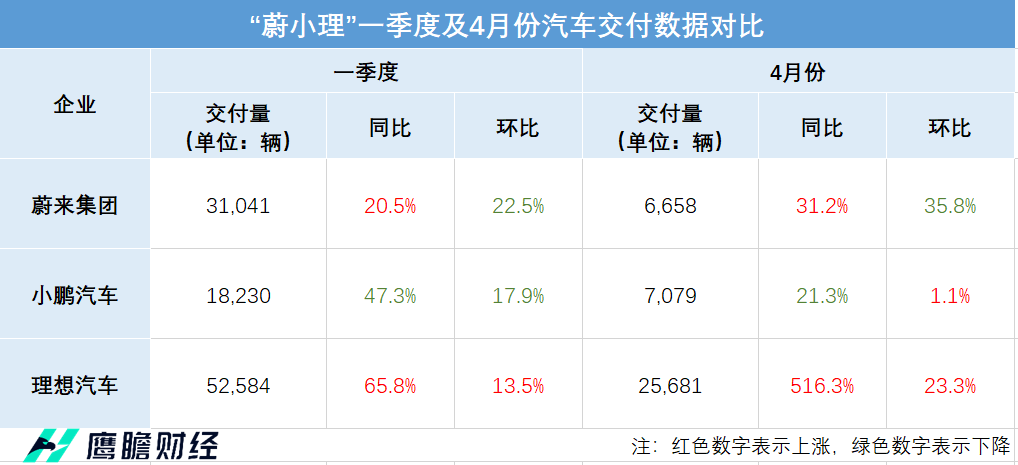

In the new car-building forces, "Wei Xiaoli" by the market attention more, from the delivery volume, the three companies in the first quarter has opened the gap。

As can be seen from the table, for these three manufacturers alone, the ideal growth momentum is very rapid, not only in the first quarter of the same month-on-month growth, but also in April.。In contrast, Weilai and Xiaopeng are like a pair of brothers and sisters, both of which have seen their deliveries shrink significantly。Xiaopeng's deliveries fell in the first quarter from the same period last year.。In April, Weilai's deliveries fell month-on-month, and Xiaopeng's deliveries were almost in place, one step away from going backwards.。

Earlier this year, Tesla announced the price reduction of all domestic models, opening the prelude to the domestic car price war.。In this price war, Xiaopeng chose to follow up。In January this year, Xiaopeng Motors announced the adjustment of its G3i, P5, P7 and other models of the price system, the starting price was reduced to 14.890,000 yuan, 15.690,000 yuan and 20.990,000 yuan, the largest decline of about 13%。This rate of price reduction can be described as full of sincerity.。

But the follow-up price cuts did not translate into a significant increase in sales, but instead squeezed Xiaopeng's profit margins。Superimposed on the impact of the end of subsidies for new energy vehicles, Xiaopeng's gross margin in the first quarter was horribly low, only 1.7%, compared to 12.2%。In contrast, the ideal first quarter gross margin of 20.4%, new energy vehicle leader BYD's first quarter gross margin of 17.85%。Xiaopeng said that the decline in gross profit margin was mainly due to the increase in sales promotion and the expiration of subsidies for new energy vehicles.。

Can Xiaopeng continue to burn money even as revenues and profits double down??Xiaopeng Q1 financial report shows that due to the increase related to the development of new model projects, the company's research and development expenditure in the first quarter was 1.3 billion yuan, an increase of 6.1%, an increase of 5.3%。

R & D can't stop, then it can only reduce costs and increase efficiency.。In the first quarter, Xiaopeng's auto sales, general and administrative expenses were 13.900 million yuan, down 15.5%, down 21% month-on-month。The company said it was mainly due to lower commissions from franchised stores and lower marketing and advertising expenses.。He Xiaopeng, chairman and CEO of Xiaopeng Motors, said that a series of cost optimization projects for batteries and electric drives will be implemented in the second half of the year, and a clear and feasible technical solution has been developed to achieve the goal of 25% cost reduction by the end of next year.。

When will Xiaopeng usher in a new growth point?

At present, Xiaopeng in the sale of models, P7i is a hot model。On March 26, Xiaopeng P7i began nationwide delivery。As an upgraded version of Xiaopeng's once explosive P7, the shape and intelligence of the P7i has won high reputation in the market.。But the car has a fatal problem - the delivery cycle is as long as 8 weeks。Nowadays, the domestic automobile industry is highly competitive, and the long delivery time has become a major pain point for P7i, which also makes P7i always in a situation where it will explode.。The company is also clearly aware of the problem, He Xiaopeng said: "P7i's strong order performance exceeded our expectations.。Starting in June, we will work with our supplier partners to significantly increase P7i component capacity, accelerate delivery, and further expand P7i sales.。"

In addition, in June, Xiaopeng will also launch a new SUV model G6 with a price between 200,000 yuan and 300,000 yuan, and start delivery at the same time.。G6 will be the first SEPA2 to adopt Xiaopeng's latest technology architecture.0 of the new models。SEPA2.0 is the company's introduction of a new generation of end-to-end integration technology architecture.。Company claims SEPA2.0 will optimize R & D efficiency, save costs and enhance product experience。It is reported that SEPA2.0 can shorten the R & D cycle by nearly 20%, and the generalization rate of some parts may reach 80%, which will help to achieve a significant reduction in new model R & D costs and BOM costs.。

For the delivery of G6, He Xiaopeng said that G6 from the standard operating procedures (SOP) to the delivery of about two months of time as a buffer, is expected to be the third quarter monthly delivery rate will be much faster than G9 and P7i.。

In addition, Xiaopeng Motors made internal organizational restructuring in the first quarter。He said: "In the first quarter of 2023, I made decisive adjustments to the company's strategy, organization and management team.。I am confident that in the next few quarters, we will build a positive cycle of product sales, team morale, customer satisfaction and brand reputation.。"

"Going forward, we will make it our primary strategic goal to rapidly expand our sales and market share.。Dr. Hongdi Gu, Honorary Vice Chairman and Co-President of Xiaopeng Motors, said, "With the rapid growth of sales driven by the G6 and other new products, we expect a significant improvement in operating cash flow.。"As of March 31, Xiaopeng's cash and cash equivalents, restricted cash, short-term investments and term deposits were 341..200 million yuan。

Xiaopeng Automobile also said that in the future, it will continue to adjust its sales channels and survive the fittest on its existing sales network, not only to improve the efficiency of its sales network in first- and second-tier cities, but also to introduce more excellent dealer partners in third- and fourth-tier cities.。

Whether the P7i or G6 will be Xiaopeng's explosion in the second quarter and whether it will bring new growth to the company is still unknown.。However, it may be due to the decline in sales in the first quarter, the company for the second quarter of the delivery of a slight lack of confidence.。Xiaopeng expects vehicle deliveries in the second quarter to be between 21,000 and 22,000 vehicles, a year-on-year decrease of about 36.1% to 39.0%。Total revenue is expected to be between $4.5 billion and $4.7 billion, a year-on-year decrease of about 36.8% to 39.5%。

Credit Suisse expects new energy vehicle sales to increase by single digits in May, with Xiaopeng's H-share target price cut by CICC

Credit Suisse released a research report saying that it expects sales of new energy vehicles in mainland China to increase by single digits in May。Observing the different performance of new energy vehicle companies under the trend of market consolidation, Ideal-W and BYD performed well, while Xiaopeng and Weilai performed poorly, the bank said。

Credit Suisse estimates that Ideal May deliveries will grow 10% month-on-month and 145% year-on-year to 28.20,000, a record monthly delivery。BYD's wholesale volume in May is also expected to grow 10% month-on-month and 100% year-on-year to 230,000 vehicles.。

Citi released a research report stating that sales in the electric vehicle industry are widely expected to recover month-on-month from May to July, but Xiaopeng's performance in May and June is expected to be flat on a month-on-month basis, so the company's 2.10,000 to 2.The sales guidelines for 20,000 vehicles may be difficult to meet the standards.。

The bank expects industry competition to be more intense in the third quarter than in the second quarter, as BYD has recently cut prices for Han and seals by more than 10 percent, meaning they are priced close to the Xiaopeng P7i.。In addition, the bank expects Tesla to cut prices further to maintain sales in mainland China.。The bank expects 30% utilization of the electric vehicle industry in mainland China as most brands burn money and have negative net margins.。Xiaopeng G6 pricing of more than RMB 230,000 may make it unattractive at the industry level, but less than RMB 220,000 may eat into P7i sales。

In addition, the bank believes that Xiaopeng's general and administrative expenses declined in the first quarter, but will not change the overall situation, as the company's second quarter outlook is weak, looking ahead, as the company's cash consumption pressure increases, it is expected that its working capital position may deteriorate.。The bank has given its H-share target price of 24.HK $48。

CICC released a report saying that Xiaopeng's first-quarter operating income was 40.300 million yuan, down 21.5%, non-GAAP net loss of 22.1.2 billion yuan, basically flat month-on-month, on the whole, the company is still in the period of business adjustment, the old model terminal promotion and the withdrawal of state subsidies so that the performance is slightly lower than market expectations.。

CICC says the company plans to deliver 2 in the second quarter.10,000 to 2.20,000 vehicles, CICC believes that is still in the adjustment period, some P7 old model inventory is still on sale, battery cost decline is expected to be reflected in the statement side, is expected to increase gross margin by about 3 to 4 percentage points, operating cash flow driven by sales growth is expected to continue to improve month-on-month。CICC cuts Xiaopeng's H-share target price by 21.9% to HK $41, maintaining its "OUTPERFORM INDUSTRY" rating。

Bank of Communications International says Xiaopeng Auto's first-quarter earnings were lower than expected and second-quarter guidance was weak。The company's gross margin is expected to remain under pressure in the second quarter and may improve after G6 and P7i volumes in the third quarter.。The new model development cycle will be shortened in the future, and Xiaopeng's new car launches next year are expected to be more intensive, but weak sales are difficult to reverse in the short term。At the same time, Xiaopeng's sales are expected to improve in the third and fourth quarters, but due to peers also released a number of new models, the Xiaopeng G6 and P7i new orders have a certain impact, but also affect the pace of sales recovery。The bank maintains a "neutral" rating with an H-share price target of 33.HK $6。

Xiaopeng's post-performance share price plummeted as its Q1 results and Q2 delivery outlook fell short of market expectations。On May 26, Xiaopeng H-shares opened low and went low, opening down more than 4%, then all the way down, closing at 31.HK $35, down more than 9%。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.