Quick hand Q1 quarterly report out to achieve the first profit since the listing! Overseas revenue increased 6 times year-on-year.

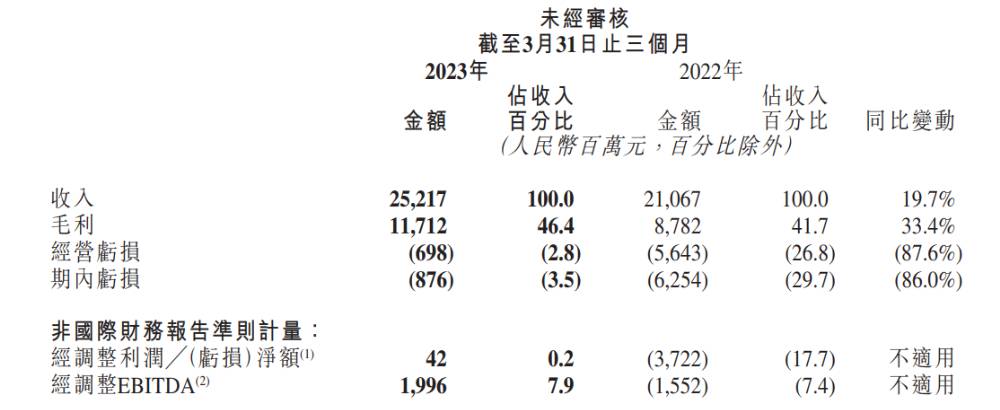

On May 22, Kuaishou released its first-quarter 2023 earnings report.。Performance data show first-quarter revenue of 252.1.7 billion yuan, up 1.9.7%, adjusted profit was RMB42 million, compared with a loss of RMB3.7 billion in the same period last year.。Adjusted EBITDA to 19.9.6 billion yuan, compared with a loss of 15% in the same period last year..5.2 billion yuan。

On May 22, Kuaishou released its first-quarter 2023 earnings report.。Performance data show that fast hand revenue in the first quarter was 252.1.7 billion yuan (RMB, the same below), up 19.7%, gross profit of 117.1.2 billion yuan, up 33.4%。Adjusted profit was $42 million, compared with a loss of $3.7 billion in the same period last year.。Adjusted EBITDA to 19.9.6 billion yuan, a loss of 15% in the same period last year..5.2 billion yuan。

It is worth noting that this is the first time that Kuaishou has achieved net adjusted profit at the group level since its listing on the Stock Exchange in 2021.。In the first quarter, the three major business segments of Kuaishou, namely online marketing services, live broadcasting and other services (mainly e-commerce), all achieved year-on-year revenue growth, outperforming their respective industries.。Kuaishou said the strong results in the first quarter were driven by new high user metrics, revenue growth and improved operational efficiency.。

In addition, Kuaishou will conduct share repurchases from time to time from May 22 to the end of the annual general meeting to be held in 2024, with the size of the repurchase not exceeding HK $4 billion.。Kuaishou believes that the share buyback in the current situation shows that the company is confident in its business outlook and prospects, and will ultimately bring benefits to the company and create value for shareholders.。The Board is of the opinion that the Company's existing financial resources are sufficient to support share buybacks while maintaining a sound financial position。

All three business segments grew, and online marketing still accounted for half of revenue.

In terms of online marketing services, revenue grew 15% year-on-year in the first quarter..1% to about $13.1 billion, or 51% of total revenue.8%。The year-over-year growth of the business was mainly driven by the further enhancement of data infrastructure, optimization of product capabilities and refined industry management strategies.。But on a month-on-month basis, it fell 13.4%, mainly due to the seasonal impact of the advertising industry。

In the first quarter of 2023, the number of advertisers on the Kuaishou platform also continued to grow rapidly year-on-year and month-on-month.。Thanks to Kuaishou's multiple initiatives to promote the release of the ecosystem's potential for brand advertisers, coupled with major promotional activities such as the Spring Festival and Women's Day in the first quarter, Kuaishou's brand advertising revenue maintained its growth momentum in the first quarter, up more than 20% year-on-year.。

In terms of live streaming, in the first quarter, fast-hand live streaming revenue increased by 18% year-on-year..8% to $9.3 billion, driven by year-over-year growth in average monthly paying users and average monthly paying user revenue。Specifically, the average monthly paying users increased by 6.4% to 60.1 million, while the average monthly paying user revenue showed double-digit year-on-year growth.。However, as the live annual gala event at the end of 2022 contributed incremental to the fourth quarter of 2022, live revenue decreased by 7% in the first quarter from the previous quarter..1%。

Fast-track "live +" services such as fast hiring and idealists also achieved steady development in the first quarter.。The average number of daily resume deliveries for quick hires increased by over 300% year-on-year, with a peak daily resume delivery of over 500,000 copies.。By the end of the first quarter of 2023, Ideal's business covered more than 70 cities across the country, with a cumulative total transaction value of more than 8 billion yuan in the first quarter.。

In terms of other services, other services revenue reached $2.8 billion in the first quarter, up 51% year-on-year..3%。The significant growth of this business segment was mainly due to the growth of the e-commerce business.。The total amount of e-commerce commodity transactions in the first quarter increased by 28% year-on-year..4%, up to 224.8 billion yuan。The number of brands per month increased by about 30%。Brand self-broadcast total merchandise transactions increased by about 70% year-on-year。

At the same time, from the first quarter of 2023, Kuaishou began to receive commission income from Daren distribution, which the company expects will help future revenue growth in the e-commerce segment.。

In the first quarter, overseas business grew more than 6 times year-on-year, and the content of short drama explosions frequently "broke the circle."

Kuaishou also disclosed the latest developments in other areas in its first-quarter earnings report.。

Overseas business, thanks to the strong expansion of live streaming and online marketing services, business revenue in the first quarter increased more than six times year-on-year to 3.3.8 billion yuan。In core regional markets such as Brazil and Indonesia, daily active users and user usage continued to grow year-on-year and month-on-month due to continued content enhancement and effective user acquisition.。At the same time, overall operating losses in overseas markets narrowed by 45% in the first quarter from the previous quarter due to further improved operational efficiency and ROI-oriented investment to continue to reduce costs..1%。In addition, the first quarter of the fast hand also launched e-commerce services in Brazil。

In the field of skits, fast players stay ahead in terms of short drama explosions content breaking the circle。A total of 55 short plays produced by "Star Mountain Project" will be launched during the winter vacation in 2023.。Among them, "Donglan Snow" has been watched 100 million times in 40 hours on the line, breaking the record.。In the first quarter, the brand investment revenue of Xingmeng's planned short drama increased by more than 300% year-on-year.。In addition, Kuaishou also continues to enrich the educational inclusion program "New Knowledge, Like Teachers," and cooperates with universities such as Qingbei to provide courses covering a wide range of fields such as history, science and technology, economy and fine arts.。

The search function also continued to make progress in terms of commercialization, with total e-commerce merchandise transactions generated by search doubling year-on-year in the first quarter and search advertising revenue increasing by more than 50% year-on-year.。

In terms of user size, the average daily active users of fast hands in the first quarter reached 3.7.4 billion, up 8.3%, average monthly active users 6.5.4 billion, up 9.4%。In live streaming, the average monthly paid users increased by 6.4% to 60.1 million, while the average monthly paying user revenue showed double-digit year-on-year growth.。In terms of viewing duration, the average daily usage per active user is 126.8 minutes, while the total number of views of short videos and live content increased by more than 10% year-on-year, and the growth rate of total views was higher than the growth rate of total user duration.。

Multi-platform to join the "tens of billions of subsidies," "618" war is imminent

This year's 618 war is very fierce。Traditional old players Taobao and Tmall, this year also launched a "10 billion subsidies" program。In addition, Taobao Tmall this year in the "618" full cycle is expected to achieve more than 60 billion traffic exposure, but also provide a total of 2.3 billion red packets for more than 1 million merchants to bring 10 billion traffic support.。Amoy Group said that this year's "618" will be the largest investment in history.。

Jingdong is also full of strength this year.。In March, Jingdong launched the "10 billion subsidy" channel, and during the "618" period, it is expected that the number of goods participating in the 10 billion subsidy will reach more than 10 times that of March.。Jingdong Retail CEO Xin Lijun said that this year's Jingdong 618 will be the industry's largest investment in a "618," but also the history of the largest investment in business growth, the strongest initiative "618."。

Other e-commerce, it is reported that the tremolo plan through marketing, user subsidies and other ways of playing, fully open up the content, shelves, live field to create explosive goods.。Suning Tesco announced the joint nearly 200 industry brands to start 618 years of large promotion, the launch of "a thousand home appliances half-price grab," "save money and worry shopping season" and other activities.。The "10 Billion Subsidy" veteran even shouted out the slogan "618 every day"。

Multi-platform to join the "tens of billions of subsidies" camp, behind the refraction of the e-commerce industry growth fatigue。Affected by many factors last year, the performance of e-commerce during the "618" period was not ideal.。This year in the consumer recovery situation, many platforms want to seize the opportunity to fight a turnaround。

Quick hands are no exception.。In recent years, e-commerce is no longer dominated by traditional shopping platforms, and more and more social platforms have joined the e-commerce industry.。Among them, the tremolo and fast hand growth is very rapid。Relying on the short video + live broadcast marketing model, abruptly from the traditional shopping platform to take a piece of the pie, e-commerce has also become an important source of revenue。Therefore, Kuaishou is also actively participating in various shopping festivals.。

On May 19, Kuaishou announced that the "618" shopping festival pre-sale was officially launched.。The pre-sale period is May 18-31, and the official period is June 1-18.。This "618" fast flashlight merchant will introduce a variety of subsidy games such as cross-store full reduction, tail payment reduction, big-name subsidy, interest-free installment, live broadcast room consumption fee and brand merchant members.。It also plans to launch a variety of platform support, such as traffic investment, pre-sale of goods and commodity subsidies, and is expected to invest 10 billion platform traffic and 1 billion yuan of commodity subsidies to help boost business.。

Big banks: fast hand quarterly results exceeded expectations, Lyon, Daiwa to its "buy" rating

Lyon released a research report saying that fast-moving e-commerce and live growth was solid in the first quarter of this year, offsetting weak external advertising demand.。Total revenue is expected to rise 16% year-on-year to $24 billion, driven by a 29% year-on-year increase in merchandise transactions in the e-commerce business.。With more top key opinion leaders (KOLs) on board, Kuaishou's live streaming business is expected to outperform the industry, up 1% year-over-year。In addition, the company's adjusted net loss is expected to narrow to 5% year-on-year as domestic earnings remain profitable while overseas losses narrow..3.5 billion yuan。The bank believes that the e-commerce business is still the main growth driver of the fast hand, is expected to increase the volume of commodity transactions by 30% year-on-year, and fast hand target this year can achieve break-even.。Therefore, Lyon maintains its "buy" rating with a target price of HK $78.。

Daiwa released a research report saying that Kuaishou outperformed expectations in the first quarter, with adjusted ENITDA about 38% higher than market expectations, thanks to better revenue performance from live streaming and e-commerce, as well as lower-than-expected quarterly marketing and R & D spending.。Daiwa also said that the Chinese and overseas markets continued to improve, and in the first quarter to achieve the group's balance of payments, more than expected, so reiterated its "buy" rating, target price of HK $92.。

Fast Hand-W shares rose more than 6% in early trading today before narrowing their gains to 55 as of press time..2 HK dollars, up 1.7%。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.