HSBC Q1 net profit doubled! Minority shareholders "failed to force the palace" two motions were rejected

On May 2, HSBC Holdings released its first-quarter results, which showed revenue of $20.2 billion in the first quarter, up 64% year-on-year; EBIT was 128.$8.6 billion, up 207.14%。

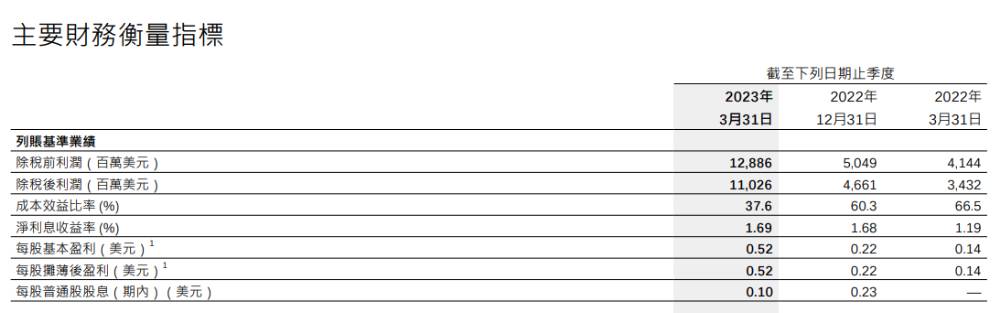

On May 2, HSBC Holdings released its first quarter 2023 results.。Performance data show that the company's revenue in the first quarter was $20.2 billion, up 64% year-on-year; net profit after tax was 110.$2.6 billion, up 221.27%; net interest margin of 1.69%, up 50 basis points year-on-year and 1 basis point month-on-month;.7%, an increase of 0.5 percentage points; diluted earnings per share of 0.52 USD。

In addition, the company announced that it would pay a dividend of 0 per share..$1 and will start a share buyback of up to $2 billion after the shareholders' meeting.。The share repurchase is expected to have an impact of approximately 25 basis points on the common equity capital ratio.。

Acquisition of UK Silicon Valley Bank draws attention, HSBC says acquisition has slight impact on CET1

Back in March, HSBC's acquisition of the UK's Silicon Valley Bank for £1 sparked market concern。For the follow-up impact of the acquisition, HSBC said in Q1 earnings, the acquisition of Silicon Valley Bank in the United Kingdom to obtain temporary gains of $1.5 billion, customer accounts increased by $8 billion, loan balances increased by $7 billion, risk-weighted assets increased by $9.6 billion, HSBC believes that the acquisition of the common equity ratio slightly affected.。HSBC also said that by March 31, 2023, HSBC UK had provided $2.8 billion in funding to UK Silicon Valley banks, which had seen deposit outflows in the early stages of the acquisition, but had now returned to stability, with a negligible number of customers terminating their accounts.。

In his quarterly report, HSBC Holdings Chief Executive Officer Qi Yunian also mentioned his post-acquisition outlook, saying: "An investment in the UK's Silicon Valley Bank will help accelerate the Group's growth plans" and "The acquisition of the UK's Silicon Valley Bank will allow us to reach out to more entrepreneurs in the technology and life science industries to achieve future business development.。"

Minority shareholders' demand to spin off Asia business rejected by HSBC, Ping An issues statement saying it respects vote result

In addition to the quarterly report, HSBC's recent shareholders' meeting on May 5 has also attracted attention.。

Previously, a group of minority shareholders, represented by Lu Yujian, proposed two motions to the HSBC Board of Directors, respectively, requiring HSBC to carry out structural reforms (including, but not limited to, a spin-off, strategic restructuring and restructuring of its Asian business ("Motion 17"), and to declare dividends to shareholders at pre-epidemic levels ("Motion 18").。Ping An, one of HSBC's major shareholders, is also a "platform" for these minority shareholders.。Ping An said it supports the two motions in principle and hopes HSBC will listen to and study shareholder views with an open mind.。

After yesterday's shareholders' meeting, the voting results of the meeting showed that the 17th and 18th motions of concern to the outside world were rejected, with more than 80% of the votes against them.。

After the meeting, Group Chairman To Ka-Chi issued a statement in response to Motion 17: "The global business contributes a significant portion of the Group's revenue and is at the heart of our entire strategy.。Restructuring or splitting up the business means we will lose this revenue because the bank will no longer have the connections that our customers value。This will create a period of uncertainty when the attention of customers, employees and shareholders will be distracted and adversely affected.。This will result in significant expenditures being wasted for many years to come, as well as posing significant implementation risks.。Therefore, it is in no way in everyone's interest to spin off HSBC's business。"

For Bill 18, Mr. Du said, "Fixed dividends are not a prudent financial management strategy, either for banks or for businesses in general.。The Group's current strategy is effective。The strategy is improving the Group's performance and increasing your dividends.。It's really not appropriate for everyone to take a risk.。Group Chief Executive Officer Qi Yaonian also said: "Setting dividend payout ratios and linking dividend and profit levels is a more pragmatic approach.。"

In a statement issued after the results of the vote, Ping An said: "We respect the choice of HSBC shareholders.。At the same time, we recommend that HSBC's board and management listen to the advice of shareholders with an open mind and improve their operations and management to enhance the value of the company.。"

A number of major banks raised their HSBC target prices, and Xiaomo expects the company's share price to rise in the short term.

A number of major banks believe that HSBC Q1 performance is better than expected, have updated the rating and target price。

Citi Releases Research Report, Updates Forecast for HSBC Holdings to Sell Canadian and French Retail Businesses。Due to revenue growth, reduced impairments and buybacks, Citi raised its buyback forecast to $4 billion this year and $6 billion next year, and raised its basic earnings per share forecast by 6% to 14% this year and next.。In addition, the bank's target price for HSBC Holdings' sale of its Canadian business is expected to be recorded next year, which is expected to have an impact on earnings per share this year, from 63.HK $9 raised to 71.HK $7, Reiterates "Buy" Rating。

HSBC's quarterly results were significantly higher than expected, mainly due to the excellent performance of non-interest income and lower credit costs, according to a research report released by CICC.。The bank believes that shareholder returns are more attractive given the 21-cent special dividend from the sale of the Canadian business and the subsequent share buyback.。Bank maintains "neutral" rating, price target raised 8.4% to 75.HK $5。

HSBC Holdings' better-than-expected first-quarter results, with costs 4% lower than expected, driving pre-provision profits 17% higher, says Xiaomo。Low impairments and exceptional earnings drove strong profits with a core Tier 1 capital ratio of 14.7%, while the market consensus is expected to be 14.4%。The bank expects the company's share price to rise in the short term, but advises investors to take profits on the uptrend, mainly because demand and savings deposits have fallen and net interest margins may have peaked。Xiao Mo reiterated that HSBC Holdings' pre-provision profit and profit growth had peaked in the first quarter of this year and appeared to be at risk of adverse effects, maintaining the Group's "Neutral" rating with a target price of HK $61.。

HSBC Holdings did well in the first quarter, according to a report released by Damore。Quarterly interest per share resumed 0.$1 and the announcement of a $2 billion buyback should be supportive。Morgan Stanley has its target price from 65..HK $2 up slightly to 67.HK $5, maintain "overweight" rating。

Goldman Sachs said in a research note that HSBC Holdings had a strong first quarter, driven by higher-than-expected revenue, lower costs and lower real provisions。Goldman Sachs raises its price target to HK $81, maintains "buy" rating。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.