Q2 Strong results HSBC raises full-year earnings guidance! $2 billion buyback program "re-release"

HSBC raises 2023 guidance on strong results。

At noon on August 1, HSBC Holdings released its interim results report for 2023, handing over a very bright "report card."。

Report data show that in the second quarter of 2023, the company's revenue increased by $4.5 billion to $16.7 billion; EBIT increased by $4.1 billion to $8.8 billion, higher than the analyst's estimate of $8 billion; net interest margin of 1..72%, up 3 basis points from the previous year; operating loans were $7.9 billion, down $100 million from the same period last year; customer loans were $9 billion lower than in 2023, and customer accounts were $18 billion lower than in 2023.。

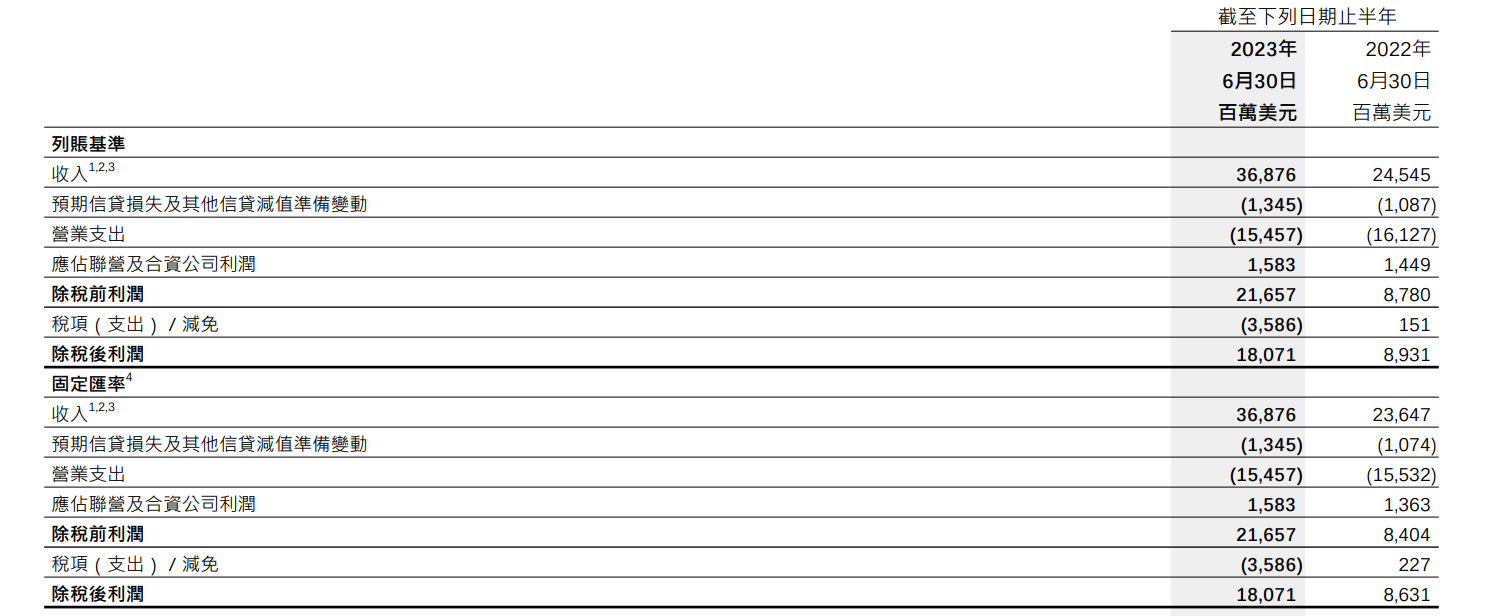

● In the first half of 2023, the company's revenue increased by 50% year-on-year to $36.9 billion.。The increase in revenue was primarily due to an increase in net interest income for all of the Group's global businesses due to higher interest rates;.7%, up 46 basis points year-over-year; EBIT jumped to $21.7 billion, up $12.9 billion or nearly 147% year-over-year; expected credit losses of $1.3 billion and operating losses of $15.5 billion, down 4% year-over-year; customer loans of $36 billion from $12.31 in 2022。Customer accounts will increase by 25 billion US dollars from December 31, 2022。

In addition, HSBC's average return on tangible equity for the first half of the year was 22.4%, compared to 10 in the same period last year..6%。The common stock capital ratio is 14..7%, an increase of 0% from the fourth quarter of 2022.5 percentage points。

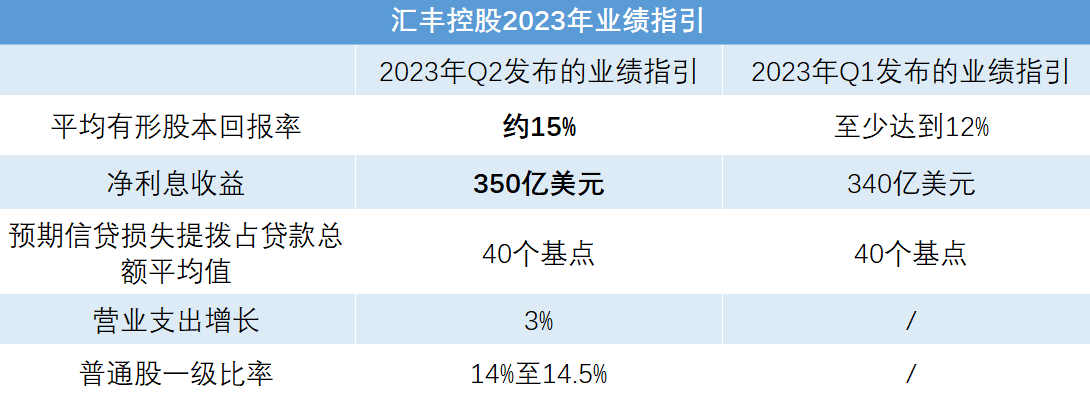

HSBC: Raises full-year net interest income to over $35 billion

HSBC raises 2023 guidance on strong results。

HSBC, one of the world's largest depository institutions with total assets of $3 trillion, is particularly sensitive to interest rates。Rising interest rates give the company big profits。Against the backdrop of rising interest rates, the company recorded growth across its global business in the second quarter, the company said。The strong performance of the insurance business under Wealth Management and Personal Banking and the debt capital markets business under Global Banking and Capital Markets offset the decline in the global foreign exchange and equity business.。

Given the current market consensus on global central bank interest rates, the company raised its full-year net interest income to more than $35 billion.。While the interest rate outlook remains positive, the company expects the focus to continue to shift to term deposits as short-term interest rates rise。

In addition, the Company still expects expected credit loss provisions to average approximately 40 basis points of total loans in 2023。HSBC's expected credit losses in the second quarter were $900 million, up $500 million from a year earlier.。This includes an allocation of $300 million for the commercial property sector in Mainland China and $300 million for the UK region.。It is understood that HSBC currently has $14.3 billion in exposure to commercial real estate in mainland China。

HSBC believes that there is still a certain degree of uncertainty about the future economic outlook, especially in the UK, and that the company is also concerned about the risk-taking associated with the commercial property industry in Mainland China.。

"HSBC had a strong performance in the first half of the year and is confident of achieving a revised return on tangible equity of approximately 15 per cent in 2023 and 2024," said Group Chief Executive Officer Qi Yiu Nian.。Profits were generally recorded around the world, with strong net interest income performance, coupled with continued cost control, driving revenue growth in global business.。I am also pleased that the Group has been able to pay 0 per share..$1 in the first dividend and up to $2 billion in the first round of share buybacks in 2023, with the expectation that the Group will continue to have strong capital distribution capacity in the future.。We still have to redouble our efforts, especially in the face of the many challenges of the global economy, but I am confident about the future as we move to the next stage of our strategy and are committed to taking advantage of opportunities to create value and diversify our revenues while continuing to keep costs under control.。"

To appease Ping An: HSBC will launch another $2 billion share repurchase program

In its earnings report, HSBC Holdings said it would pay a second dividend of 0 per share..$1, in line with the first quarter。The company also intends to move forward with share buybacks of up to $2 billion.。The share repurchase is expected to commence shortly and be completed within 3 months。

Earlier, HSBC Holdings announced a $2 billion share buyback when it reported its first-quarter results in May this year。The company said it has completed the buyback program.。

There is speculation that HSBC's share buyback program is an attempt to appease its majority shareholder, Ping An of China, and to seek investor support。

Earlier this year, a group of minority shareholders proposed two proposals to HSBC's board of directors for structural reforms (including, but not limited to, a spin-off, strategic restructuring and restructuring of its Asian business, as well as a declaration of dividends to shareholders at pre-epidemic levels.。As soon as the news came out, it immediately attracted widespread attention from the outside world.。One of HSBC's major shareholders, Ping An of China, is also a "platform" for these minority shareholders.。Ping An of China said it supports the two motions in principle and hopes HSBC will listen to and study shareholders' opinions with an open mind.。

However, at the general meeting of shareholders held in May, both bills were rejected, with more than 80% of the votes against them.。

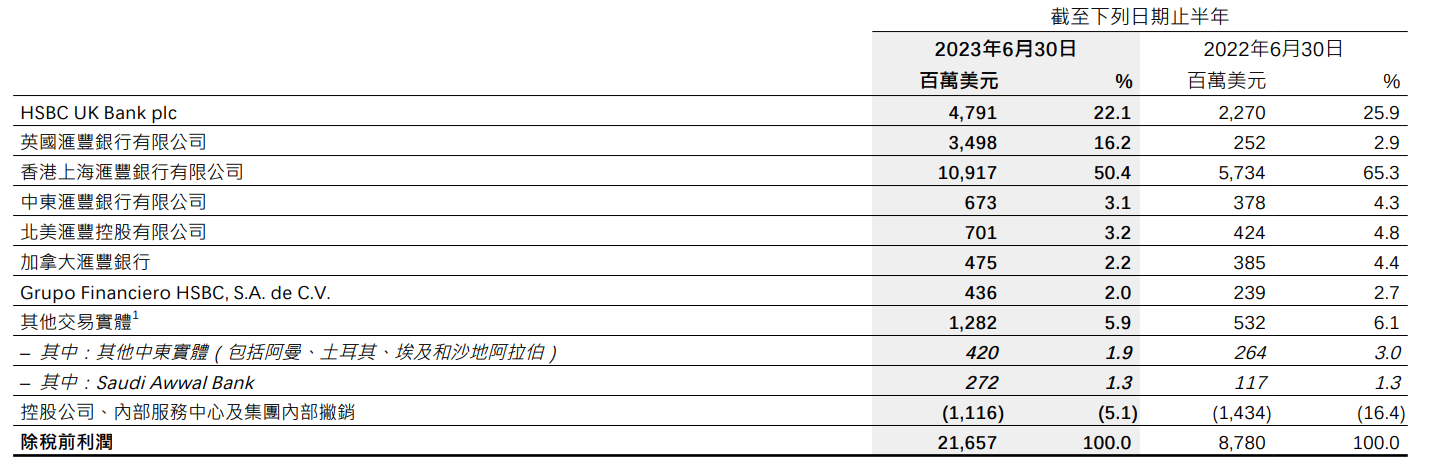

It is not "unreasonable" for these shareholders to make these demands.。Because in fact, although HSBC Holdings is headquartered in the UK, most of its profits come from mainland China and Hong Kong.。

According to the financial report, the Hongkong and Shanghai Banking Corporation Limited contributed 50% to the Group in the first half of 2023..4% of profits。In the first half of 2022, this ratio even reached 65.3%。

The focus is on Asia.

In June, HSBC had agreed to amend terms to sell its unprofitable French retail banking business to My Money Group, a unit of US private equity group Cerberus Capital Management.。

The sale of the French unit is part of HSBC's transformation strategy, which aims to reshape underperforming businesses, streamline complex organisations and reduce costs.。After the study, HSBC plans to focus on its profitable Asian operations, while cutting costs and planning to scale back its operations in Europe and North America。In June 2021, HSBC announced the sale of the business after a review of the French business unit found it unprofitable.。

In addition to the sale of the French business, HSBC will also sell its Canadian banking business to Royal Bank of Canada in November 2022, a deal that is expected to close in the first quarter of 2024.。In addition, the company has exited the US retail banking sector and expects to exit Greece and Russia soon.。

Meanwhile, HSBC acquired the issued share capital of Singapore's AXA Insurance and L & T Investment Management Limited (LTIM) last year.。In addition, the company increased its stake in HSBC Qianhai Securities Limited, its joint venture securities company in China, from 51 per cent to 90 per cent.。

In early July, HSBC also launched its global private banking business in India, serving high net worth and ultra-high net worth professionals, entrepreneurs and their families.。The new business targets clients with more than $2 million in investable assets。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.