How to Open an Account at HSBC?

In this article, we will introduce the requirements, process and account types of HSBC account opening in Hong Kong, so that you can easily grasp the key information of HSBC account opening.

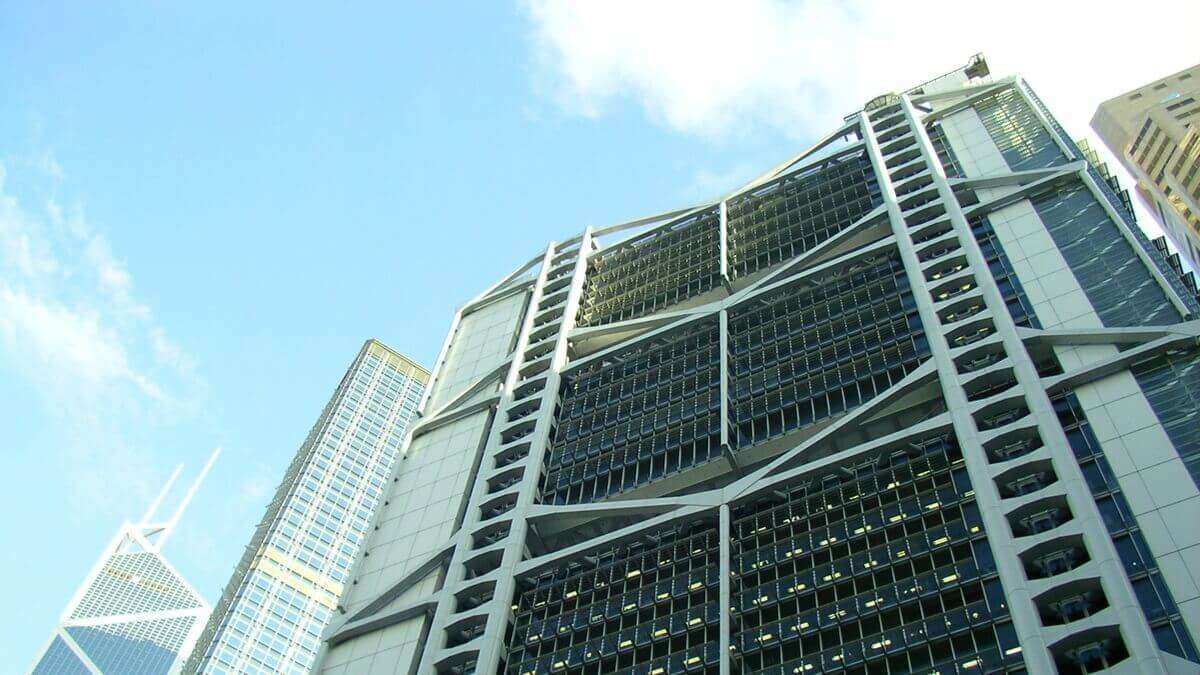

As one of Hong Kong's largest registered banks and one of the three note-issuing banks for the Hong Kong dollar, HSBC (0005.HK) is committed to providing diverse banking services to its customers.

Below is a detailed introduction to HSBC's account opening requirements, procedures, and account types to help customers better understand and utilize HSBC's services.

Account Opening Requirements

HSBC offers various types of bank accounts. Applicants aged 11 and above can apply for a bank account. Minors aged 11 to 17 can apply for a children's savings account, accompanied by a guardian who must present valid identification.

Applicants using the “HSBC HK Mobile Banking” app to open an account must meet the following criteria:

- Aged between 18 and 64

- Hold a Hong Kong ID card (permanent or non-permanent resident) or a specified overseas passport

- Reside in a designated country or region

- Do not hold any HSBC banking or investment accounts, or credit cards

Applicants need to provide a valid Hong Kong ID card or travel document and proof of residential address (required for investment account opening).

Open An Account on Mobile Phone

In 2019, HSBC launched an online account opening service. Applicants can open a personal integrated account, HSBC Advance, or HSBC Premier account through the “HSBC HK Mobile Banking” app. The steps are as follows:

- Download and open the “HSBC HK Mobile Banking” app

- Select “I don’t have any accounts”

- Take a photo of the Hong Kong ID card

- Take a selfie for identity verification

- Fill in personal information

- Register for online banking

After successfully opening an account, applicants can immediately use basic banking services. Withdrawal and online transfer services will be activated after two business days. Generally, HSBC will mail the ATM card to the registered address within 4 to 6 business days, and the activation PIN will be sent separately.

Account Types

HSBC currently offers three main types of integrated banking accounts: HSBC One, HSBC Advance, and HSBC Premier. Below are the details of these accounts:

| Account Type | Minimum deposit | Main features |

|---|---|---|

| HSBC One | No minimum deposit | Support for 12 major currencies |

| HSBC Premier | HKD 1,000,000 (service fee HKD 380 for low balance) | Single account for savings, time deposits, current accounts, and investment services; offers exclusive investment products and preferential rates |

| HSBC Shangyu | HKD 7,800,000 | Provides exclusive investment products and services, concierge services, and various fee waivers |

These accounts offer basic deposit and transaction services and support overseas remittances, with fees ranging from HKD 50 to 240 depending on the remittance method.

Appoint for Account Opening

If applicants do not meet the criteria for using the “HSBC HK Mobile Banking” app for account opening, they need to visit an HSBC branch in person to open an account. Alternatively, they can save time by using the online appointment service. Appointment requests must be made at least two business days in advance.

FAQs

Account Opening Fees

HSBC offers free account opening services. However, some account types may have minimum deposit requirements. For detailed information, please consult HSBC.

Student Accounts

HSBC provides children's savings accounts for applicants aged 11 and above without any fees or minimum balance requirements. Students aged 18 and above can consider the HSBC One account, which has no minimum deposit or balance requirements.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.