Open a Hong Kong bank account with "0 threshold, no queuing, 0 management fee, no account opening"-Zhongan Bank

The steps to open an account are very simple, and it takes as fast as 5 minutes.

ZA Bank not only provides services to permanent and non-permanent residents in Hong Kong, but even visitors to Hong Kong can apply for ZA Bank accounts. No appointment is required and the account opening application can be completed in just a few minutes.

This article introduces the details of opening an account for ZA Bank, Hong Kong's first virtual bank, including the account opening process and required documents. It also introduces Zhongan Bank's service scope, handling fees, and some common questions.

丨 What is Zhongan Bank?

Zhong 'an Bank is a newly opened virtual bank in Hong Kong in recent years. It focuses on online banking services and does not have physical branches.You can use Zhongan Bank's mobile APP to make deposits, loans and other banking services.

The following is a list of the personal banking services provided by Zhongan Bank:

- For current and fixed deposits of Hong Kong dollars/RMB/US dollars, the fixed deposit amount can be as low as 1 yuan.

- Use FPS or CHATS for payments and transfers (only local transfers are supported for the time being)

- ZA Card debit and ATM withdrawal services

- Electronic monthly statements and notices

- Mobile APP instantly views transaction records

- Cross-border inward remittance (Hong Kong dollar/RMB/US dollar)

- Apply for a personal loan

丨 Zhongan Bank Account Opening Documents

Visiting visitors must be 18 years old or older to open an account, be in Hong Kong when opening an account, and must provide the following documents/information:

- Original valid China Resident ID Card

- Original valid passport for travel to and from Hong Kong and Macao (valid for at least 30 days or more when opening an account)

- Mainland mobile phone number (you can receive local text messages and calls in Hong Kong)

- Mainland bank savings card (must be bound to the same mainland mobile phone number)

丨 Zhongan Bank account opening process

The steps to open an account are very simple, and it takes as fast as 5 minutes:

Download the ZA Bank mobile APP on the App Store or Google Play.

1. Open the ZA Bank mobile APP and select Open an account now-allowed when using the APP-I have read and agreed.

2. Select the ID type. Mainland users should select the People's Republic of China resident ID card to confirm that they meet the opening conditions.

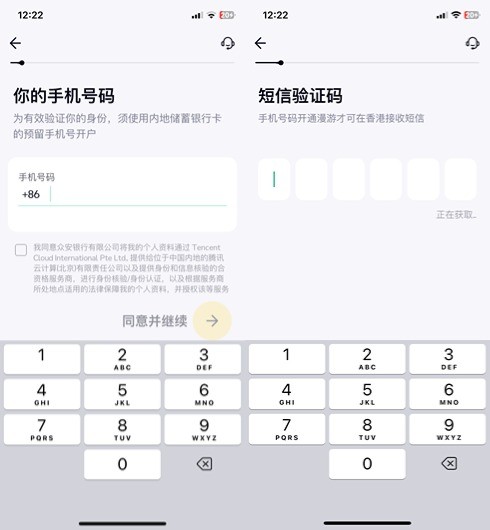

3. Enter your mobile phone number to receive the Captcha.

* In order to effectively verify your identity, you must use the reserved mobile phone number of your mainland savings bank card to open an account and confirm that your mobile phone number has been activated for roaming.

4. Fill in the invitation code [CNVQ52]

(1) Customers in Hong Kong (including Hong Kong residents and visitors to Hong Kong) can receive a 20% discount coupon on foreign exchange differences after successfully opening an account in Hong Kong using the friend invitation code.

(2) If you successfully open an investment account within 14 days after opening an account, you will receive an additional HKD15, HKD35, HKD70, and HKD200 fund position refund coupon, for a total of HKD320. The fund position refund coupon is subject to the terms and conditions.

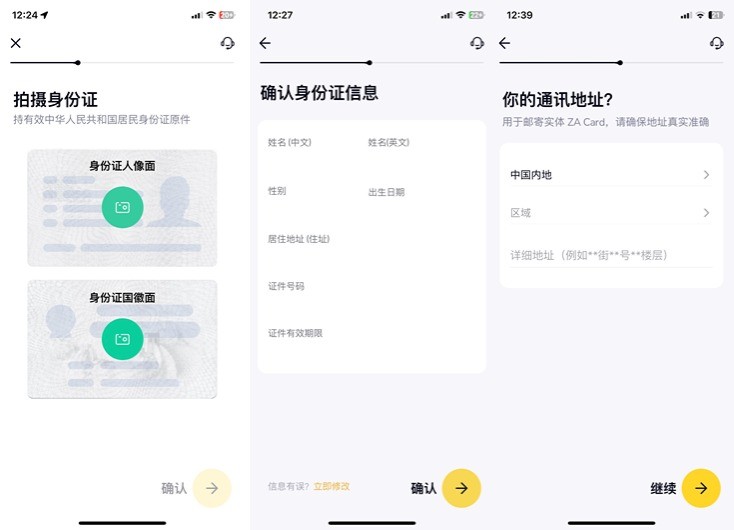

5. Take photos on the front and back of your ID card and confirm that your ID information and mailing address are correct.

6. Select your tax status, career information, and purpose of opening an account in mainland China based on your own situation.

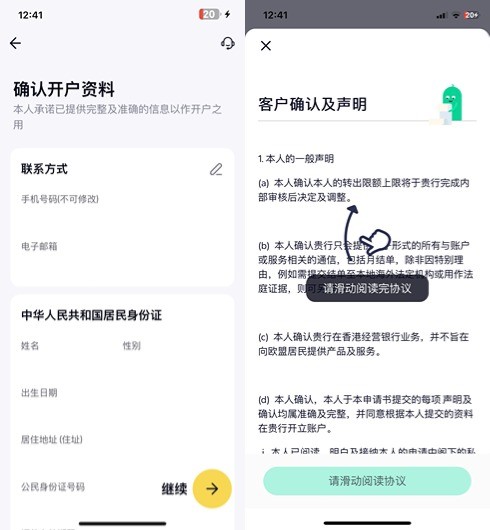

7. Confirm account opening information and customer confirmation and statement.

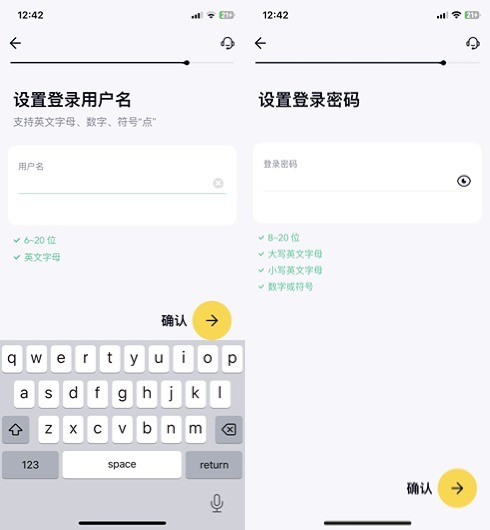

8. Set the login user name and login password, please be sure to save them to avoid inconvenience caused by forgetting.

9. Verify bank card and upload entry and exit records.

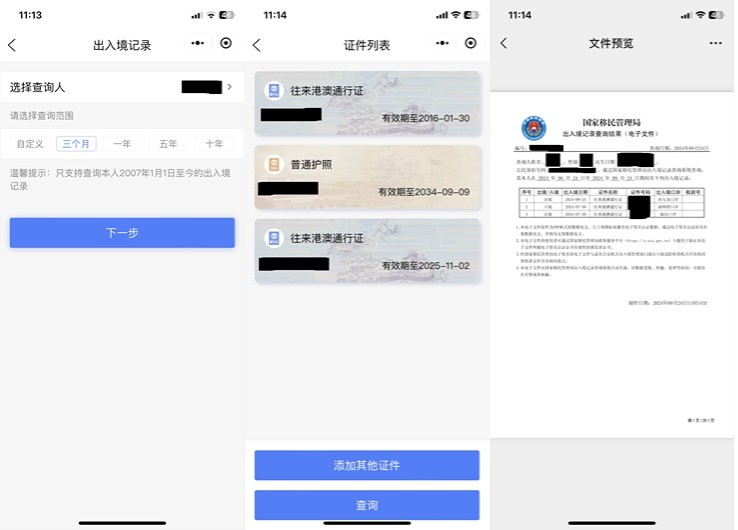

How to obtain entry and exit documents?

(1) Search "Immigration Bureau" Mini programs on WeChat

(2) Click on "Home/Entry and Exit Record Query"

(3) Upload entry and exit documents (upload the original pdf of the document, screenshots are not supported)

10. The approval of account opening is expected to take 5 working days, and the results will be notified through the App and email. If more information is needed, the official will contact us via phone 36653665. Supplementary information can also be submitted after leaving Hong Kong.

After successfully opening an account and passing relevant internal reviews, you can easily click "ZA Card-Collect Now" on the Zhongan Bank APP. You can wait about 10 working days (Hong Kong local surface mail) or 1 month (overseas air freight) to receive the ZA physical bank card!

丨 Zhongan Bank Card ZA Card

ZA Card is a debit card with no annual fee. You can use it to spend and withdraw money at Visa merchants and ATMs around the world. You can also add Apple Pay and Google Pay e-wallets.

ZA Card supports online and offline consumption, and is directly deducted from ZA's current Hong Kong dollar account when booking.

If the transaction involves foreign currency exchange, or the merchant is registered overseas, a "cross-border Hong Kong dollar transaction fee" of 1.95%(Visa charges 1%, ZA Bank charges 0.95%) will be incurred. You should also check with the merchant before the transaction. The applicable foreign currency exchange rate will be applicable.

In addition, it should be noted that you cannot use the ZA Card at an ATM to deposit money into a Zhongan Bank account, nor can you transfer funds to the ZA Card number to deposit money.

Currently, you can only use ZA Card to check the balance of your Hong Kong dollar current account or withdraw cash at an ATM that supports Visa. You cannot make cash deposits or transfers.

丨 How does Zhongan Bank deposit money?

You can deposit money into your ZA Bank account from other banks in the following 4 ways:

- Fast FPS speed: First register the FPS identification code in the ZA Bank APP, and then issue FPS instant transfer by other banks to support Hong Kong dollar and RMB transfers.

- ZA Bank Account Number: General bank transfers are issued directly from another bank. If necessary, you can enter ZA Bank's bank number 387 or branch number 747.

- "Deposit Money Easy" electronic direct payment authorization: After binding to other bank accounts, you can directly deposit from other banks to ZA Bank on the APP.

- Cross-border inward remittance (not applicable to inbound visitor accounts): Use cross-border remittance service, fill in the ZA Bank account number, ZA Bank SWIFT Code and agent bank information for the recipient's information.Only Hong Kong dollar, RMB and US dollar remittances are accepted and deposited directly into a current deposit account in the corresponding currency.

丨 Zhong 'an Bank transfer limit

The following is the daily transfer limit for ZA Bank account, and the amount will vary depending on your account status:

ZA Bank currently only supports local transfers (Hong Kong dollars) and cross-border inward remittances (Hong Kong dollars/RMB/US dollars), and does not support transfers to the mainland or overseas.

Does ZA Bank have minimum deposit requirements?

There are no minimum deposit requirements for opening a ZA Bank account.

Do Zhongan Bank need to charge for transfers?

No.ZA Bank will not charge any fees for deposits (Hong Kong dollars/RMB/US dollars) and local transfers (Hong Kong dollars).However, the issuing bank and the receiving bank may impose fees based on different circumstances. Please check with them for details.

What is the ZA Card withdrawal fee and withdrawal limit?

The withdrawal fee for ZA bank card is as follows:

As for the withdrawal limit, ZA Bank's default daily withdrawal limit is HKD 20,000.

You can also use the ZA Bank APP to freely set this limit (Account>ZA Card> Set Limit). The setting range is HKD0-HKD50, 000.

ZA Bank is Hong Kong's first virtual bank. It not only accepts Hong Kong residents to open accounts, but also welcomes visitors to Hong Kong to apply for Zhongan Bank's services.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.