How is Budweiser Asia Pacific Q1 increasing revenue and reducing profits high-end liquor selling??

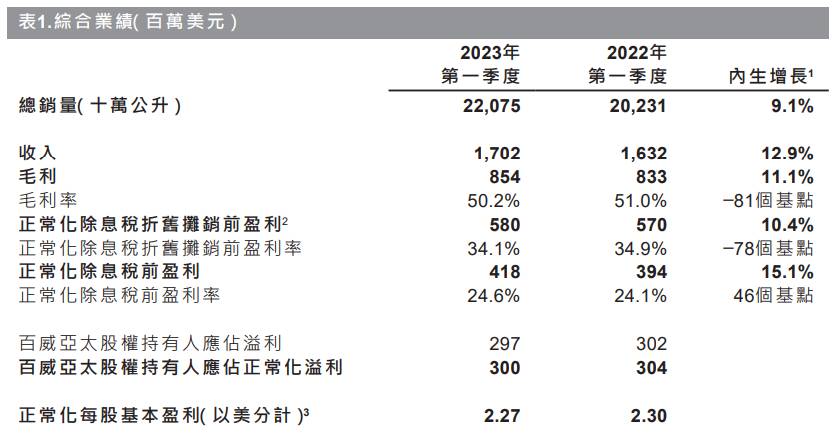

On May 4, Budweiser Asia Pacific released its first quarter results report。Data show that revenue in the first quarter of 2023 was 17.$02 billion, up 12.9%; gross profit of 8.$5.4 billion, up 12.9%; adjusted EBITDA of 5.$800 million, up 10.4%

On May 4, Budweiser Asia Pacific released its first quarter 2023 results report.。Performance data show that revenue in the first quarter of 2023 was 17.$02 billion, up 12.9%; gross profit of 8.$5.4 billion, up 12.9%; adjusted EBITDA of 5.$800 million, up 10.4%; profit attributable to equity holders in the first quarter was 2.$9.7 billion, down 1.7%。Adjusted earnings per share of 2.27 cents。

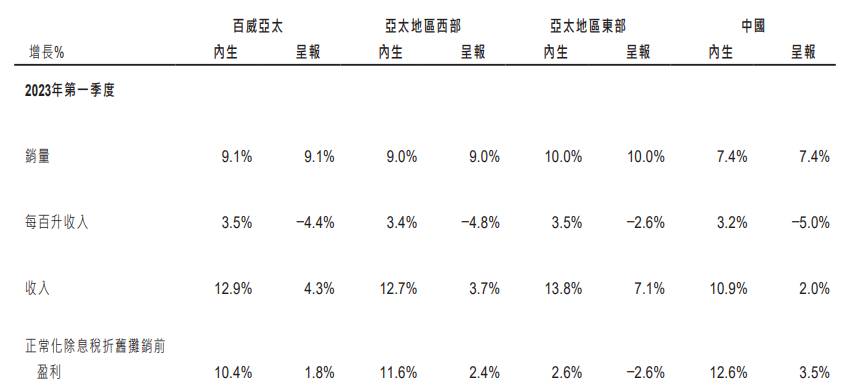

India and South Korea both saw double-digit growth, with a slight lack of upward momentum in the Chinese market.

Budweiser Asia Pacific's performance in India and South Korea was impressive in the first quarter, with double-digit sales growth in both regions in the first quarter.。But its most important market, China, has performed slightly worse.。

According to financial data, sales growth in the Chinese market was 7.4%, weaker than 9 in the western and eastern Asia Pacific region.0% and 10.0%。Revenue growth of 10.9%, while the value of the western and eastern Asia Pacific region was 12.7% and 13.8%。Compared to other regions, Budweiser's upward momentum in the Chinese market is slightly less。

Specifically, the company's sales and revenue in China fell 3% and 4%, respectively, last year due to the outbreak..2%。In particular, its high-end and ultra-high-end categories experienced a double-digit decline in revenue in the fourth quarter of 2022.。However, after the recovery of the epidemic, sales and revenue in the Chinese market have recovered.。Data show that sales in the Chinese market rose 7 in the first quarter of this year..4%。Revenue growth of 10.9%。

In this regard, Budweiser Asia Pacific said: "January's results were affected by the Chinese Lunar New Year 10 days earlier than in previous years and the gradual recovery of catering channels, but since February and March, sales in all channels and cities at all levels have recovered strongly, far exceeding pre-epidemic levels, and market share has grown further.。"

High-end strategy continues to advance, high-end and ultra-high-end alcohol growth is strong

In recent years, many domestic beer brands such as Tsingtao Brewery and China Resources Brewery have gradually promoted their own high-end brand strategies, and Budweiser is no exception.。In the Asia-Pacific region, Budweiser is a leader in the high-end and ultra-high-end beer segment, launching a portfolio of more than 50 beer brands, including Budweiser, Time, Corona, Fujia, Kaishi and Harbin.。In the Chinese market, Budweiser Asia Pacific's high-end and ultra-high-end categories continued to increase in the first quarter of this year, with double-digit revenue growth compared to last year, far exceeding pre-epidemic levels.。The company also achieved strong double-digit growth in the high-end and ultra-high-end categories of the Indian market, while driving significant double-digit growth in overall revenue in the Indian market.。

For China's beer market outlook for the second quarter, Zhongtai Securities recently released a research report pointed out that the total amount affected by the epidemic in April-May last year is still under pressure, the low base effect will continue to reflect。What is more noteworthy is that with the repair of night markets, high-end catering and other drinking channels, the average price of beer is expected to accelerate and achieve higher-than-expected growth.。

In addition to continuing to advance the high-end strategy, Budweiser is also working hard in many ways.。In terms of product innovation, Budweiser recently launched its latest innovative product, Harbin Icy Genuine Draft。In terms of digitalization, the company's B2B dealer-customer interaction platform BEES has expanded to more than 180 cities in China, accounting for about 40% of China's revenue in March.。Domestic consumption is currently picking up on a large scale, and the beer economy is no exception。In the first quarter of the flat performance of Budweiser Asia Pacific, can seize the opportunity of consumer recovery in the second quarter to achieve another good result, all still to be tested by time。

After the release of Budweiser's Asia Pacific quarterly report, a number of major banks have given it the latest evaluation

CICC released a research report saying that the company's Q1 2023 results were in line with the bank's expectations。The bank said it expects the company's performance to improve month-on-month under the full-year consumer recovery trend.。Therefore, CICC's 2023 / 24 earnings forecast remains unchanged, while giving it a target price of 30.HK $3, Maintain OUTPERFORM INDUSTRY rating。

BOCOM International also believes that Budweiser Asia Pacific had a solid first quarter, with revenue up 13% and EBITDA up 10%。Normalized net profit, however, was flat YoY。Gross margin down 87 basis points due to higher costs。Cost pressures remained high in the first quarter due to the lag effect of the raw material hedging mechanism, but are expected to ease in the second half of the year。The bank said the trend of high-end beer remains one of the relatively certain structural growth stories in China's consumer sector.。With Budweiser's largest market - China - consumption returning to normal, especially in the more profitable ready-to-drink channel, coupled with a low base effect from the second quarter, the bank is optimistic about Budweiser's continued sales recovery and margin expansion。The bank has given it a target price of HK $30.。

Lyon reported double-digit year-on-year growth in revenue and EBITDA in the first quarter as the epidemic slowed。The bank believes that the year-to-date situation shows that the increase in the average selling price of the mainland beer industry is slowing down。The bank lowered its Budweiser Asia Pacific target price from HK $29 to 26.HK $6, but raised its rating to "buy" from "outperform," expecting less competition in the high-end market.。

Goldman Sachs released a research report stating that Budweiser Asia Pacific's first-quarter results were slightly better than expected, with normalized EBITDA exceeding the bank's and market expectations during the period; normalized profit attributable to shareholders exceeded the bank's expectations but was in line with market expectations。Based on expectations that cost pressures for raw materials are expected to subside this year, the bank believes the company will continue to be high-end and benefit from the reopening of mainland entertainment venues.。In addition, the bank believes that Budweiser's current valuation is attractive, so it gives it a "buy" rating with a target price of 28.HK $1。

Citi released a research report saying that Budweiser Asia Pacific's first-quarter results were in line with expectations, and its China business has been performing well year-to-date, with sales, revenue and EBITDA higher than pre-epidemic levels.。The bank said, Budweiser Asia-Pacific first-quarter results show that China's re-opening after the high-end consumption again accelerated the trend, is also the bank's main investment theme for China's beer industry this year, in the stock selection is more optimistic about the revenue contribution all from China's China Resources Beer, followed by Budweiser Asia-Pacific and Tsingtao Beer, with a "buy" rating.。Citi pointed out that China, including the western Asia-Pacific region sales endogenous growth of 13%, of which, the Chinese market high-end and ultra-high-end product revenue year-on-year growth reached double digits, driving Budweiser Asia-Pacific overall performance growth, so the target price of 28.HK $1。

Xiaomo said that after deducting foreign exchange factors, Budweiser Asia Pacific's performance in the first quarter of this year was basically in line with market expectations, but still lower than the major peers.。The bank noted that Budweiser Asia Pacific's EBITDA grew 11% in the first quarter of this year compared to the same period in 2019, with a 19% increase in the Chinese market, which was also below peer performance.。Xiao Mo pointed out that the company's share price fell after the performance, which is believed to be due to investors' concerns about the slowdown in market demand from April to May.。

It is worth noting that after the announcement of Budweiser Asia Pacific earnings, its shares in Hong Kong stocks today fell more than 6% at the beginning of the session, although the intraday decline has narrowed, but eventually still closed down more than 4%, now reported 22.3 Hong Kong dollars。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.