Ideal Q1 turnaround! April deliveries up fivefold year-on-year Li wants to reiterate: no price cuts!

Ideal Motors released its first-quarter 2023 earnings report yesterday evening, with a bright performance.。The ideal total revenue for the first quarter was 187.900 million yuan, an increase of 9.6.5%; net profit of 9.RMB 3.4 billion, up 252% month-on-month。Affected by this, today's ideal H shares rose more than 17%。

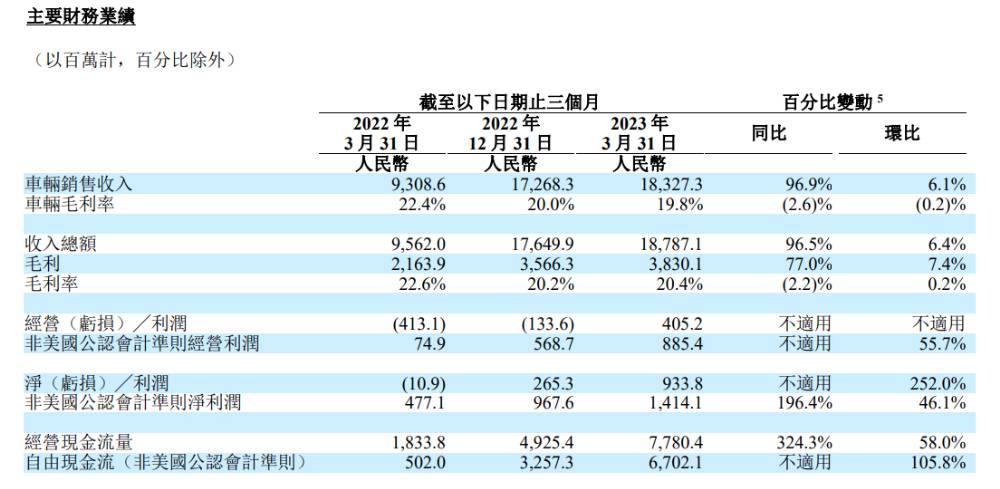

Ideal Motors released its first-quarter 2023 earnings report yesterday evening, with a bright performance.。Performance data show that the ideal total revenue in the first quarter was 187.900 million yuan (RMB, the same below), an increase of 96.5%, an increase of 6.4%; gross profit of 38.300 million yuan, an increase of 77.0%, an increase of 7.4%; operating profit of 4.05 billion yuan, compared with an operating loss of 4.1.3 billion, with an operating loss of 1 in the fourth quarter of 2022..3.4 billion yuan; net profit of 9.3.4 billion yuan, up 252% month-on-month, compared to a net loss of 10.9 million yuan in the same period last year.。

Although revenue and profit both rose, but the ideal 2023Q1 gross margin has not yet achieved significant improvement.。Data show that the ideal Q1 gross margin of 20.4%, down 9.73%, up 0.1%。The Company explained that the year-over-year decrease in gross margin was primarily due to a decrease in vehicle gross margin due to differences in product mix between the two quarters, which in turn led to a decrease in gross margin。

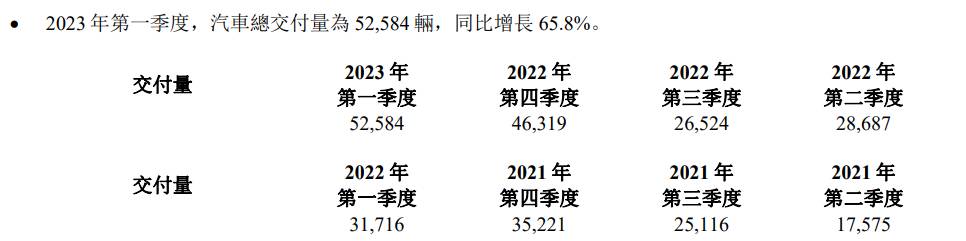

In addition, Ideal also disclosed the delivery of cars in the first quarter of 2023.。Data show that the ideal Q1 car delivery total 52,584 units, an increase of 65.8%。It is worth noting that ideal April deliveries surged 516 YoY.3% to 25,681 vehicles。

Q1 Quarterly Report Exceeds Expectations, Ideal Bottom Line, Raises Q2 Results Guidance

Ideal had previously set a delivery target of 5 for the first quarter..20,000 to 50,000.50,000 vehicles, with a total revenue of 174.$500 million to $184 million.500 million yuan。This Q1 financial report shows that a total of 5.30,000 vehicles, revenue of 187.900 million yuan, have reached the target。

For the second quarter of 2023, Ideal expects to achieve deliveries of 76,000 to 81,000 vehicles, up 164.9% to 182.4%。Total revenue is 242.200 million to 258 million.600 million yuan, up 177.4% to 196.1%。Regarding gross margin, Ideal Auto CFO Li Tie said that although there is uncertainty about subsequent BOM costs, etc., it still maintains the guidance of 20% gross margin。

Li would like to say that in June this year to achieve a single month to deliver 30,000 vehicles。Hope ideal car in the second quarter of the Chinese market more than 200,000 yuan of new energy brand sales, the market accounted for 13%。

In addition, Li Xiang said that Ideal's first pure electric model will be released in the fourth quarter of this year, maintaining a similar release rhythm to Ideal L7, Ideal L8 and Ideal L9。

Ignoring the "price cut tide" of domestic car companies, Ideal once again declares that it will not cut prices

In January this year, Tesla first began to announce price cuts。Including Chery, SAIC-Volkswagen, Geely, Deep Blue, Lynk & Co and many other domestic car companies began to follow suit, opening the "price reduction mode"。In order to compete for market share and inventory, whether it is a fuel car or an electric car, whether it is an independent brand or a joint venture brand, they have ended up fighting a price war, which eventually led to the "melee" of the entire domestic car.。According to media statistics, so far, about 50 car brands have followed up on price cuts.。

In this fight, there are also car companies that are standing still, and Ideal is one of them.。

Competition among domestic auto brands is heating up, and the price of lithium carbonate, the battery raw material for electric vehicles, has fallen sharply this year compared to last year, which has triggered speculation about whether Ideal will cut prices.。Ideal Auto's chairman, Lee, would like to state again at the earnings meeting that Ideal Auto is not considering a price cut。Li Xiang said: "When we do planning, we have already set the price at the most competitive price in the corresponding price range according to the level and size of each model, and there will be problems with both upward and downward price fluctuations.。This is the fundamental reason why we have been very cautious in pricing and insist on long-term considerations.。"

Ideal still chooses not to cut prices, perhaps more for profit margin considerations

Fitch published a report yesterday that in the first quarter of 2023, despite steady year-on-year growth in retail deliveries of new energy vehicles and a decline in deliveries of fuel vehicles, both Chinese traditional and new energy vehicle companies are facing short-term profitability challenges due to industry-wide price competition.。

Lower battery prices may ease profit margin pressure on new energy vehicle companies in the coming quarters。Domestic battery-grade lithium carbonate prices fell 27% quarter-on-quarter, from an average of 550,000 yuan / tonne in the fourth quarter of 2022 to 400,000 yuan / tonne in the first quarter of 2023, before plummeting further to around 180,000 yuan / tonne at the end of April.。According to Shanghai Steel Union news, today's battery grade lithium carbonate rose 13500 yuan per ton, the average price of 230,000 yuan / ton, lithium carbonate prices have signs of recovery。

However, Fitch believes that the risk of continued spread of price competition in the auto market is still not completely eliminated。The aggressive targets of some automakers (e.g., GAC Aean's growth target of 85% this year; Geely's 95%) are much higher than Fitch's previous forecast of moderate growth in China's new energy vehicle market at 30-40%, suggesting that fierce competition for market share will continue this year, which could delay the point at which profitability improves significantly.。

Outperform results favored by big banks, Bank of America raises Ideal H-share target price to HK $144

Bank of America Securities said in a research report that Ideal Motors outperformed expectations in the first quarter。While gross margins were slightly lower than the bank expected, net profit in the first quarter was 9.RMB300 million, up 262% month-on-month, exceeding the bank's and market expectations, mainly due to improved operating expenses to sales ratio.。

Bank of America Securities believes Ideal Auto says it prioritizes market share over further profitability expansion。It will not consider getting more orders by adjusting prices or discounts, and will plan product lineup plans and pricing over the long term.。The bank raised its sales forecast for 2023 to 2025 and significantly raised its net profit forecast for this year.。Its H-share price target rises from HK $133 to HK $144, reiterates "buy" rating。

Soochow Securities issued a research report, considering the ideal car gross margin to remain high and continue to strengthen the ability to control fees, raised the company's net profit forecast。Optimistic about the follow-up of a number of new cars are expected to bring sustained high sales growth, compared to the industry leader Tesla PS valuation, give 2023 3 times the target PS, corresponding to the H-share target price of 149.HK $11, Maintain "Buy" Rating。

Boosted by this quarter's bright results and satisfactory second-quarter guidance, Ideal Auto-W opened higher today, and as of the close of Hong Kong stocks, Ideal closed up more than 17% at 115.HK $9。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.