Ruisheng Technology 2022 "Answer Sheet" Mixed Net Profit Drops 37 Year - on - Year.6%

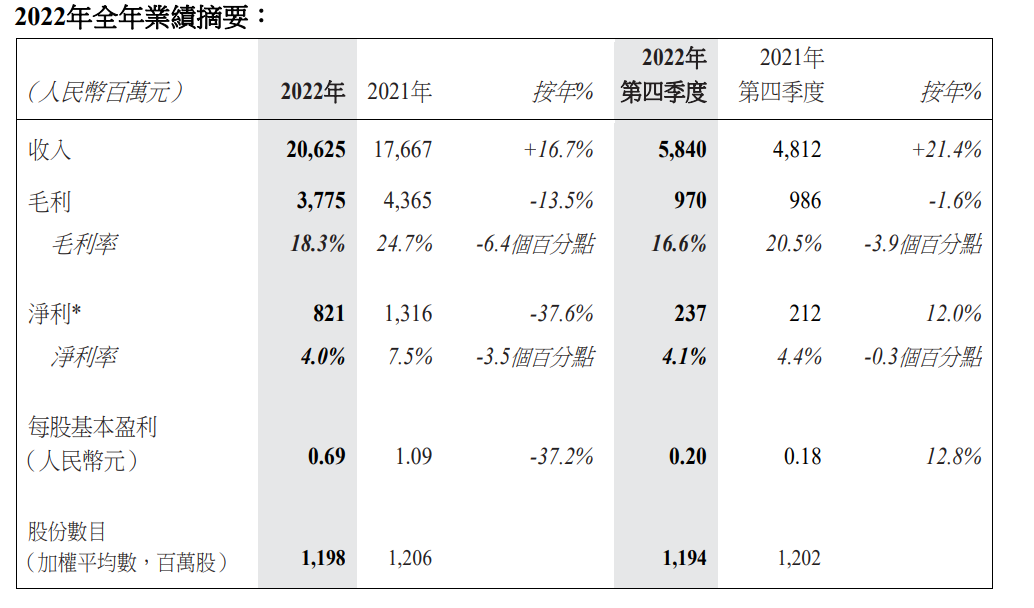

On March 23, Ruisheng Technology released its 2022 annual results announcement.。Financial data show that the company's 2022 revenue reached 206.300 million yuan, up 16.7%。

On March 23 (Thursday), Ruisheng Technology released its 2022 annual results announcement.。Financial data show that the company's 2022 revenue reached 206.300 million yuan (RMB, the same below), up 16.7%; Net profit reached 8.2.1 billion yuan, down 37.6%; basic earnings per share 0.$69, annual final dividend of 0 per share.HK $12。

Mixed revenue and cash flow improved but earnings figures were unsatisfactory

Ruisheng Technology said that 2022 is a very challenging year, but also the company's energy to strive for a year.。Despite the ups and downs of the epidemic, high inflation and relatively weak market demand, the company has consolidated its position in the smartphone market with its leading technology research and development capabilities and sound operation management, achieving a counter-trend increase in market share in the acoustics, electromagnetic transmission and precision structural parts, optics, sensors and semiconductors businesses.。

The company also said that the Group remains prudent in its financial management and strictly manages capital expenditure and research and development expenses, with full-year capital expenditure of RMB18 in 2022..500 million yuan, and carried out active debt management during the reporting period, successfully optimized the debt structure and maintained a sound cash position.。

Ruisheng Technology said that the double-digit growth in revenue in 2022 was mainly due to strong demand from its overseas customers, consolidated revenue from its electromagnetic transmission and precision structural components business and increased contribution from its optical business.。Among them, revenue from electromagnetic drives and precision structures and optical products increased by 16%, respectively..$3.7 billion and 8.2.8 billion yuan, while the acoustics business was relatively stable compared to the same period last year.。

For the sharp drop in net profit, Ruisheng Technology said the company's gross profit for 2022 was 37.800 million yuan, down 13.5%。The Company noted that the decline in gross profit last year was mainly due to market competition in the optical business, which was partially offset by improved gross profit resulting from increased sales of electromagnetic drives and precision structural parts.。In addition, the company's gross margin last year was also up from 24.7% down to 18.3%。In response, the company blamed lower gross margins on precision structural parts and increased sales in its optical business.。

In addition, Ruisheng Technology also said that the decrease in the company's net profit in 2022 was mainly due to the decrease in gross profit and the increase in operating costs during the period, which has been partially offset by the increase in other income and the decrease in non-controlling shareholders' equity.。

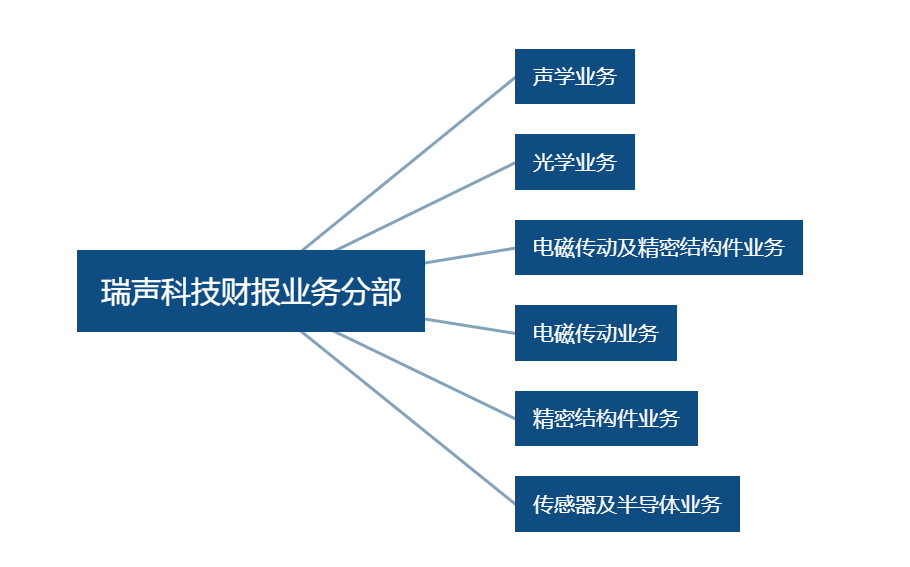

Acoustics business dragged down by Android market Optical business annual shipments doubled year-on-year

Ruisheng Technology said that in 2022, the company will actively build a second growth curve, while maintaining its position in the smartphone market, actively seize new market opportunities, explore strategic emerging markets, and activate new growth momentum through new businesses such as automotive acoustics, automotive optics, and AR / VR.。

By business, the Acoustics business, in the fourth quarter of 2022, the Acoustics business of Ruisheng Technology achieved revenue of 23.800 million yuan, up 6.3%, gross margin of 31.2%, YoY growth of 4.4 percentage points, thanks to the increase in revenue contribution from overseas customers.。For the full year 2022, the company's acoustics business achieved revenue of RMB88.500 million yuan, up 3.1%; gross margin 28.1%, down 1.5 percentage points, mainly due to weak demand in the Android market and lower shipments of Android acoustic products.。

The company pointed out that in response to the needs of different customers, the company has launched original Combo and coaxial Opera products, which can effectively enhance consumers' auditory and tactile experience in special scenes such as audio and video, games and vertical screens while reducing costs.。In addition, in the fourth quarter of 2022, the company continued to mass-produce and deliver on-board acoustic solutions and pioneered several new landmark projects.。

In the optics business, in the fourth quarter of 2022, the optics business achieved revenue of RMB7, benefiting from continued shipments and market share gains in the plastic lens and optical module business..9.8 billion yuan, up 55% year on year.6%, an increase of 40.8%。For the full year 2022, the optical business achieved revenue of RMB32.200 million yuan, up 34.7%, mainly due to the smooth progress of the optical module business and the increase in market share.。The company said that in 2022, its plastic lens business will continue to consolidate its market share and enhance its market position in the fierce market competition.。In addition, the module business continued to grow steadily, with full-year shipments up 121.5%。

In the electromagnetic transmission and precision structural parts business, the fourth quarter of 2022 benefited from an increase in shipments of motors and metal mid-frame structural parts products, as well as the contribution of its acquisition of Dongyang Precision.。Ruisheng said the combined segment's 2022 revenue was 22.900 million yuan, up 27.5%, up 11.5%; gross margin of 22.2%, an increase of 2.5 percentage points, up 0.7 percentage points。For the full year 2022, the consolidated segment achieved revenue 72.800 million yuan, up 29.0%; gross margin of 21.3%, remaining relatively stable, down 0% year-on-year..4 percentage points, mainly due to changes in product mix。

In the electromagnetic drive business, Android client horizontal linear motor product shipments increased by 41% year-on-year in 2022..9%, further increase in market share。In addition to the increase in smartphone penetration, the group's ultra-wideband X-axis linear motors can also be used in smart watches, tablets, smart cars, game consoles and VR / AR, providing consumers with one-stop, multi-dimensional and full-scene high-quality haptic feedback experience。

In the precision structural parts business, the company said that with years of advanced precision manufacturing capabilities, the company's metal frame business has achieved a leading market share in the flagship and high-end machines of major customers.。In the fourth quarter of 2022, the capacity utilization rate of metal frame products increased and gross margin improved year-on-year due to the increase in customer shipments of high-end models.。In addition, the company's business integration with Dongyang Precision is progressing smoothly, bringing new growth momentum to the business segment.。

In the sensor and semiconductor business, in the fourth quarter of 2022, the company's sensor and semiconductor business revenue was 3..5.6 billion yuan, up 49.5%, mainly due to strong demand from overseas customers and increased penetration of Android MEMS products; gross margin of 13.9%, up 1.4 percentage points and 6.6 percentage points。In addition, for the full year 2022, the business achieved revenue of 12.600 million yuan, up 24.0%, mainly due to increased market share; gross margin of 11.6%, down 3.5 percentage points, mainly due to the impact of rising raw material costs。

At the results conference, Ruisheng executives responded to concerns and remained optimistic about the future.

On March 23, Ruisheng Technology announced that it would stop voluntarily publishing and publishing quarterly results for the first quarter and the first three quarters, and instead publish financial reports twice a year, causing market concern.。In this regard, after the results conference, Ruisheng executive director Mo Zuquan said that the adjustment does not prevent investors from understanding the company, but more linked to the company's business.。He pointed to the original quarterly earnings announcement arrangement, which led to more periods of silence and became a barrier to communication with investors.。

The company also said that reducing the frequency of financial reporting would allow management to focus on operating and developing its main business, reduce the time, effort, cost and administrative burden required to publish quarterly financial results, and help investors consider the Group's performance, strategic deployment and trends at a more appropriate time.。

For the outside world is concerned about the company's business problems, Mo Zuquan said, the first two months of this year, the company's business performance is still not normalized, is expected to have more business opportunities in the second half of the year。In terms of dividends, he believes that last year's 15% dividend payout ratio was moderate and confident that it can be maintained at that level this year, will increase or decrease the dividend payout ratio in due course, and will combine a variety of tools to give back to shareholders.。

In addition, Ruisheng Chief Financial Officer Guo Dan added that Android phones will have more models launched in the second half of this year, Ruisheng is expected to improve further market share this year, and revenue and gross margin will rise steadily.。

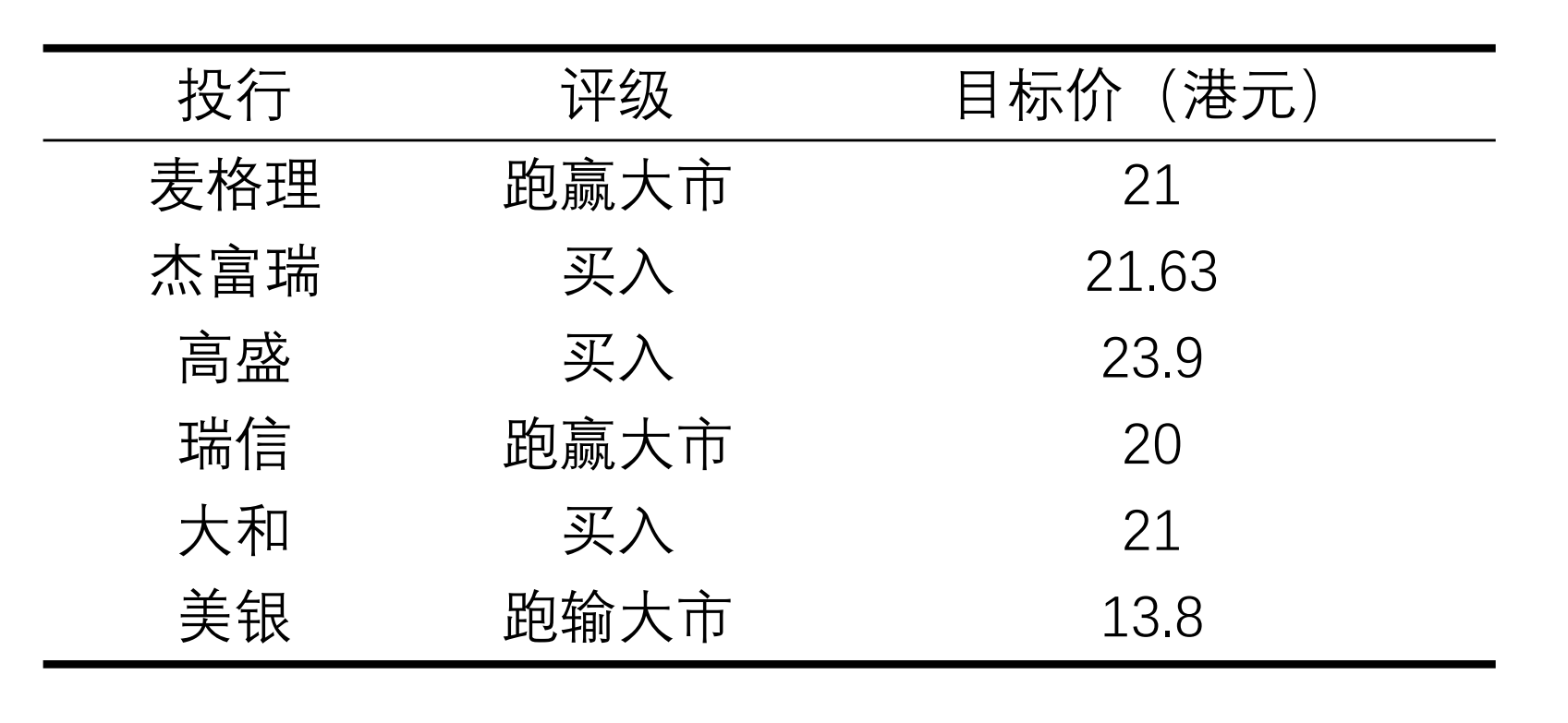

After the disagreement, Macquarie raised its target price sharply, Bank of America still maintained its "outperform" rating.

After the earnings report, a number of major banks released research reports on the performance of Ruisheng Technology.。Among them, Macquarie published a research report saying that the bank expects Ruisheng Technology's earnings in the second half of this year will increase due to iPhone all-category device touch (Haptics) and Android acoustic upgrades after its fourth quarter results fell short of expectations last year.。Macquarie believes that the company's diversification process, although slow, is in progress, and the value of designated projects is expected to triple this year as the company finds its niche in automotive acoustics.。

Macquarie also said that based on the expected ED (electromagnetic transmission) and PM (precision structural parts) and camera lens module revenue improvement, and acoustic gross profit rise, the bank will be the company's 2024 earnings forecast by 4%, while its rating from "lose the market" to "win the market," the target price from 10.HK $56 raised sharply to HK $21。

In addition, Goldman Sachs also released a research report that Ruisheng mobile phone lens shipments continued to grow in the fourth quarter of last year, resulting in full-year shipments in the case of a decline in the smartphone market can rise by the number of units.。Given the fierce competition and low demand for high-end cameras, the company's average product price and gross margin are in a downward trend.。Nonetheless, with brand manufacturers vying to get home, the bank expects Rising to launch better camera specifications and drive the smartphone market next season.。As a result, the bank lowered its net income forecast for 2023-25 by 45%, 30% and 17%, respectively, with a target price of HK $28 to HK $23..HK $9, Maintain "Buy" Rating。

Credit Suisse also said in a research report that the fourth quarter results of Ruisheng Technology last year exceeded the bank's expectations, but the company's optical business gross profit pressure, and the expected first half of this year for the iPhone off-season and weak demand for Android, will bring short-term pressure.。As a result, the bank will be Ruisheng this year and next year earnings per share by 9% and 8%, while the company's target price from 21.HK $9 down slightly to HK $20, Maintain OUTPERFORM rating。

Bank of America Securities, on the other hand, said in a report that Ruisheng Technology did not perform well in the fourth quarter。Bank of America said the company's management is optimistic about future growth and said it will expand through high-end products, targeting double-digit growth in the average selling price of optical products this year, a move that does not mean easing price competition, but rather means increased competition in the high-end segment.。For company inventory levels down to 4 to 5 months。Bank of America believes this remains relatively high and could create uncertainty about its operations。Therefore, the bank will maintain Ruisheng Technology "outperform" rating, and its 2023-24 earnings forecast down 3% to 6%, but the target price from 12..3 HK $raised to 13.HK $8。

In addition, Jefferies and Daiwa also gave the latest ratings and price targets for Ruisheng Technology's earnings report.。Among them, the target price of Ruisheng Technology will be 19..HK $6 raised 7% to HK $21, and Jefferies raised its target price to HK $21..HK $63, both big banks maintain "buy" ratings。

As of March 28, Hong Kong stocks closed slightly higher than 0.21%, reported 18.HK $84。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.