Q2 Increase in Income and Increase in Profits What Worries Does Bank of America Have?

On July 18, local time, Bank of America (hereinafter referred to as "Bank of America") released its second quarter 2023 results report, revenue and profit exceeded expectations, customer loans, investment banking and other business units also performed better than expected.。

On July 18, local time, Bank of America (hereinafter referred to as "Bank of America") released its second quarter 2023 results report, revenue and profit exceeded expectations, customer loans, investment banking and other business units also performed better than expected.。

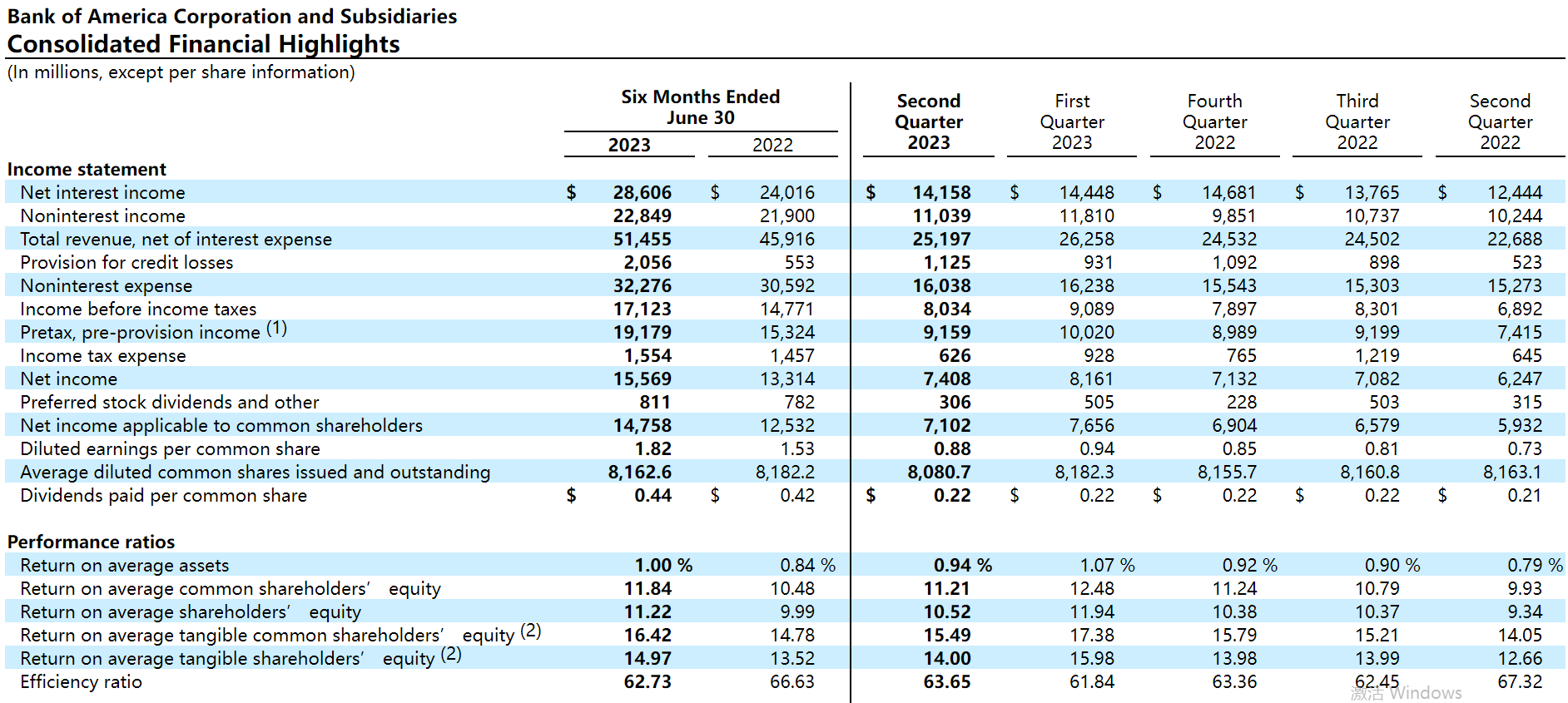

Specifically, Bank of America's second-quarter revenue was 253.$300 million, up 11% YoY, with market expectations of 250.500 million dollars。Profit of $7.4 billion, up 19%。Earnings per share 88 cents against market expectations of 84 cents。

Bright performance in investment banking, significant year-on-year increase in credit loss reserves

By business, investment banking performed well, with net profit soaring 76% to $2.7 billion。The company said earnings growth was driven by higher interest payments and rental income.。

Another strong performer was the bank's sales and trading revenue, which rose 3 percent to $4.3 billion, beating expectations.。Revenue from fixed income, currency and commodities trading rose 7% from a year earlier to $2.7 billion.。"We have a very strong and resilient deposit base and we do a lot of money transfers around the world for corporate clients," said Alastair Borthwick, chief financial officer, of the company's trading business.。"

BofA's consumer banking division revenue rose 15 percent to $10.5 billion, supported by consumers' financial health.。But BofA's global M & A activity fell 36% year-over-year in the second quarter.。

Since the Silicon Valley banking incident, deposits at major U.S. banks have become the focus of analysts and investors。

Bank of America's deposits fell 1 month-on-month in the second quarter..7% to 1.$88 trillion, with market expectations of a 3% decline。Its average deposit balance fell $18 billion, or 1%, from the previous year to 1.9 trillion dollars。In addition to Bank of America, the credit loss reserve is 11..300 million U.S. dollars, compared with 5 in the same period last year..$2.3 billion increase, a sign that Bank of America is preparing for bad credit card loans。

In terms of expenses, the bank's total expenses for the quarter were $16 billion, including about 2.$7.6 billion in litigation costs。The biggest of these is the 2 paid by Bank of America last week..$500 million in fines and compensation。The spending was used to resolve allegations the bank faced, including double-charging customers, withholding promised credit card benefits and opening accounts without customer authorization.。

Strong capital position。Common stock Tier 1 capital ratio of 13.2%, up from 12% in the same period last year..2%。As of June 30, 2023, the book value per share was 32.$05, compared to $29 a year ago.$87; tangible book value per share of 23.$23, up from $21 a year earlier.13美元。

Bank of America's net interest income is under pressure.

Banks like Bank of America benefit by charging customers higher rates as Fed raises rates to curb stubborn inflation。Bank of America's net interest income (NII), the difference between the interest paid by banks to depositors and the interest earned by banks on loans and investments, rose 14 percent to $14.2 billion in the second quarter from a year earlier, slightly below analysts' expectations.。Bank of America expects full-year NII to grow 8% to about $57 billion。

In a statement, CEO Brian Moynihan said, "We continue to see a healthy U.S. economy with slower growth and a resilient job market.。Customer growth and customer activity across our businesses continued to increase, amplifying the positive impact of higher interest rates。"

However, the cost of bank deposits in the U.S. is rising as customers move cash from interest-free accounts to accounts with higher interest rates and higher yields。

And the data disclosed by Bank of America is also supporting this trend.。In the first half of this year, Bank of America's interest expense (that is, the amount paid to customers) grew twice as fast as interest income.。It is reported that Bank of America's corporate customers now deposit 60% of their cash in interest-bearing accounts, up from 30% a year ago。

David Fanger, senior vice president of Moody's Financial Institutions Group, said: "Bank of America's second-quarter results continue to benefit from higher interest rates, but the bank's net interest margin will come under increasing pressure as customers continue to seek higher yields.。"

In addition, Bank of America's large bond portfolio (including government debt and mortgage bonds) is dragging down its ability to grow net interest income。

Three years ago, Bank of America invested about $625 billion in deposits in the bond market at historically high bond prices and low yields。In the second quarter of this year, unrealized losses on its bond portfolio were $110 billion, up from $103 billion in the first quarter.。Bank of America's level of unrealized losses is by far the highest among U.S. banks, as well as compared to JPMorgan Chase and other large competitors.。

As a result, Bank of America's interest income is still not growing as fast as its peers such as JPMorgan Chase, despite a significant increase in high-yield loans such as credit cards.。Data released by JPMorgan last week showed a 44% jump in net interest income in the second quarter, driving profits to soar 67%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.