Well deserved! Pharmaceutical Mingkang 2022 revenue "record" increased by more than 70%

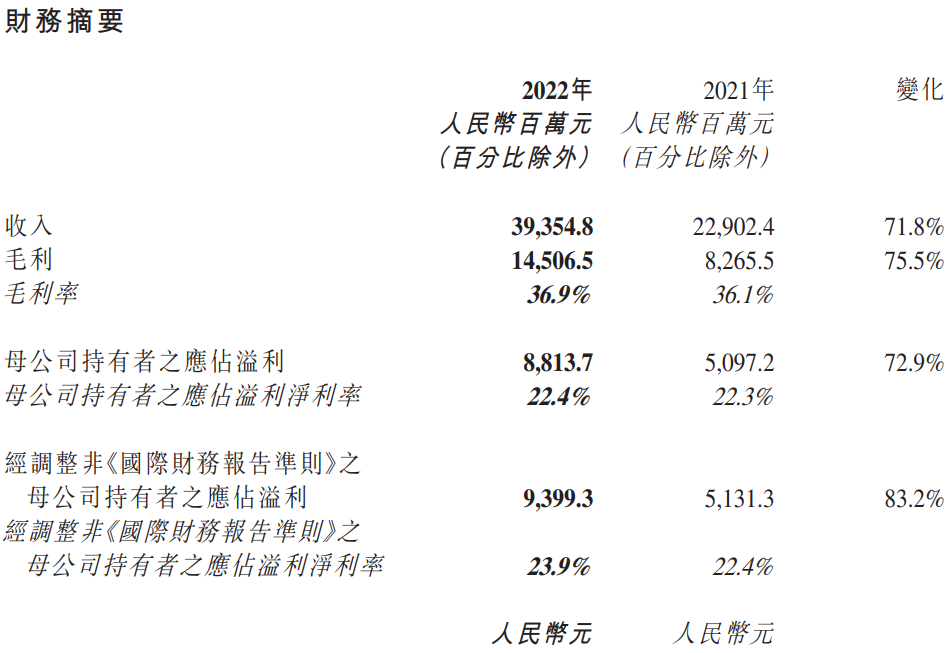

On March 20, WuXi AppTec released its annual report, achieving revenue in 2022 393.5.5 billion yuan (RMB, same below), up 71% YoY.84%; net profit attributable to parent 88.1.4 billion yuan, up 72.91%。

On Monday (March 20), WuXi AppTec released its 2022 results report.。Financial data show that WuXi AppTec achieved operating income in 2022 393.5.5 billion yuan (RMB, same below), up 71% YoY.84%; net profit attributable to parent 88.1.4 billion yuan, up 72.91%; to pay a cash dividend to all shareholders for every 10 shares 8.93 yuan (including tax), the total amount of the expected dividend 26..4.4 billion yuan (including tax), accounting for 30% of net profit。

As for the "record" increase in the company's revenue, WuXi AppTec said that in 2022, the company will give full play to the advantages of global layout and full industrial chain coverage, and link up with each region to jointly ensure business continuity, seize new business opportunities and continue to empower customers.。At the same time, the company is constantly adjusting and exploring business synergies across sectors to better serve customers around the world, continuously strengthening the company's unique integrated CRDMO (contract research, development and production) and CTDMO (contract testing, research and development and production) business models, and providing a true one-stop service to meet customers' service needs from drug discovery, development to production.。

According to financial reports, the company added more than 1,400 new customers in 2022, serving more than 5,950 active customers from more than 30 countries through 32 operations and branches around the world.。By region, in 2022, the company's revenue from U.S. customers reached 258.8.4 billion yuan, up 113% year-on-year; revenue from Chinese customers reached RMB 75.2.6 billion yuan, up 30% year-on-year; customer revenue from Europe was 44..3.2 billion yuan, up 19% year-on-year, while customer revenue from other regions was 15%..1.2 billion yuan, up 23% year-on-year。Faced with a significant increase in the number of new customers in 2022, WuXi AppTec said that this is due to its excellent service record and comprehensive intellectual property protection system, which has earned it a recognized reputation for excellence in the global pharmaceutical R & D industry.。In addition, the company said that the service data it generates is highly recognized and credible in the industry.。

For the bright performance of WuXi AppTec, various institutions have given full attention in the latest research report.。

Daiwa published a research report saying that WuXi AppTec's fourth-quarter revenue rose 72% year-on-year last year, driven by its chemical business, and its overall gross margin improved to 36.9%。Excluding foreign exchange gains and changes in fair value, the company's operating profit reached RMB2.6 billion, 6% lower than the bank's expectations.。The bank also noted that the company's revenue is expected to grow by 5 to 7 per cent year-on-year this year, with the chemical business estimated to grow by 36 to 38 per cent after excluding revenue from the new crown project.。At the same time, the company's management is focused on improving operating efficiency this year, so Daiwa expects adjusted non-IAS gross profit to grow 12% to 14% year-on-year, free cash flow to grow 6 to 8 times, and capital expenditure to fall to RMB8 billion to RMB9 billion.。As a result, Daiwa raised its earnings forecast for this year by 0.6%, but cut its earnings forecast for next year by 2.6% and slightly reduced its target price from HK $110 to HK $105, maintaining a "buy" rating.。

Bank of America, for its part, said it expects revenue to grow by 5 to 7 per cent this year, following a strong performance last year and benefiting from a recent backlog of business, and estimates that adjusted non-IFRS gross profit will grow by 12 to 14 per cent this year.。In addition, management maintains its earlier forecast of a CAGR of approximately 34% in revenue from 2021 to 2024.。The agency said it would lower its revenue forecast for the company in 2022-2024 accordingly, but that it expects the company's operating expenditure efficiency to improve given the economies of scale.。As a result, the bank increased its target price from 120.2 HK $slashed to 97.HK $8, but still maintain "buy" rating。

UBS also released a research report saying that WuXi AppTec earned $39.4 billion last year, up 71.8%, in line with expectations。The fly in the ointment is that as the company faded out of the new crown project, the agency then lowered the company's 2023-25 earnings per share forecast, from the original 3..59 yuan, 4.$5 and 5.Rmb6, down to 3.34 yuan, 4.$1 and 4.9 yuan。At the same time, the bank lowered its target price from HK $112 to HK $109 and maintained its "buy" rating.。

As of press time, WuXi AppTec edged down 0 on the day.36%, now HK $82。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.