Hawkinsight Hong Kong Market Closing Roundup (1.12) | The three major stock indexes closed down. A new round of price war caused auto stocks to weaken throughout the day.

On January 12, the three major indexes of Hong Kong stocks fell back, and the afternoon decline widened further.。Hang Seng Index closes down 0 at close.35%, at 16,244.58 points。

On January 12, the three major indexes of Hong Kong stocks fell back, and the afternoon decline widened further.。Hang Seng Index closes down 0 at close.35%, at 16,244.58 points; Hang Seng SOE Index closes up 0.23%, at 5481.94; Hang Seng Tech Index closes up 0.92%, reported 3470.64 points。

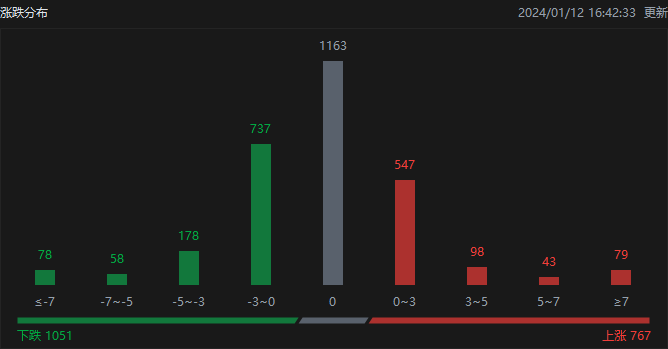

In terms of the distribution of ups and downs, as of the close of the day, Hong Kong stocks rose 767, down 1051, closing flat 1163。

On the day of the Hong Kong stock market, North Water traded net buy 14.HK $6.8 billion, of which HK Stock Connect (Shanghai) traded a net purchase of 8.HK $7.5 billion, net sale of Hong Kong Stock Connect (Shenzhen) transactions 5.HK $9.3 billion。

Sectors and Fundamentals

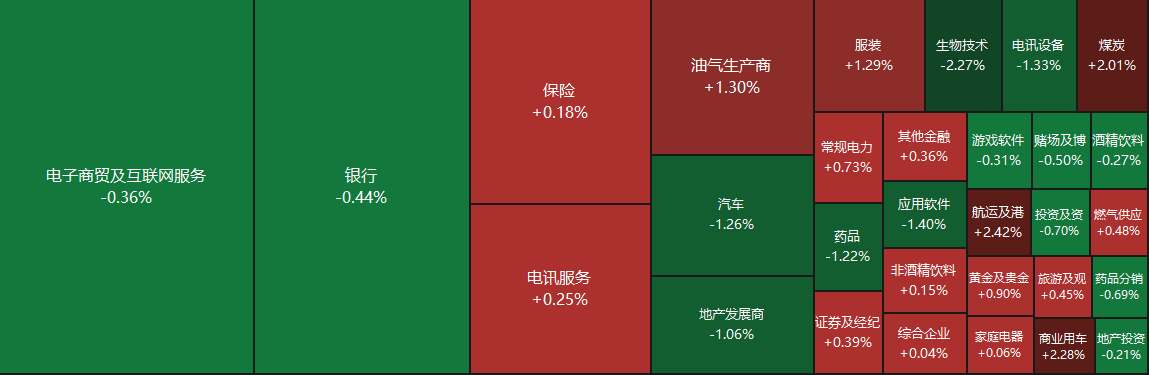

From the disk point of view, the network stocks collectively fell, beep beep fell more than 2%, Jingdong fell nearly 2%, fast hand, millet fell more than 1%, Baidu fell nearly 1%, Alibaba, Meituan, Netease slightly down; pharmaceutical stocks have been down, auto stocks in the experience of yesterday's general rise and began to go down。On the other hand, shipping stocks bucked the trend today, with oil and coal stocks trending, and power and water stocks also moving higher.。

Fundamentally, on January 10, the China Automobile Dealers Association released the results of the "Automobile Dealer Inventory" survey for December 2023: the comprehensive inventory coefficient of automobile dealers in December was 1.20, down 16 month-on-month.1%, up 12.1%, inventory levels below the warning line, auto distribution industry boom upward。According to the survey, some dealers are ready to adjust their brands and increase their efforts to clear their warehouses.。It is expected that brand adjustments such as dealer withdrawal and card flipping will continue until the end of the first quarter.。High-end luxury and imported brand inventory factor of 0.97, down 11 month-on-month.8%; joint venture brand inventory factor of 1.18, down 24 month-on-month.8%; self-owned brand inventory factor of 1.39, down 0 month-on-month.7%。

On January 12, Tesla China once again opened a new round of price war, its official website shows, Model 3 Huan new version of the new model price reduction, Model 3 rear-drive version price reduction 1.550,000 Yuan, Long Endurance Huan New Edition Price Reduction 1.150,000 yuan; Model Y rear-drive version price reduction of 7500 yuan, long life price reduction of 6500 yuan。It is reported that as of January 10, about 20 car companies have announced New Year promotions.。The first is still Tesla, announced the launch of the New Year's low-interest financial policy and limited-time insurance subsidies, which car announced the decision which AYA / which X / which S / which GT, can enjoy 5000 yuan New Year exclusive red envelope gift。Rating agency Fitch said competition in China's auto market will continue to intensify in 2024 as domestic auto brands accelerate the promotion of high levels of autonomous driving and global auto brands accelerate the electrification process。Fitch believes that the intensification of competition may put pressure on the market share and profitability of car companies in the short term, resulting in their ability to generate cash while facing higher investment demand.。

As the conflict between the Houthis in Yemen and the United States intensifies, the Middle East tensions again, the container transport index (European line) today closed up more than 19%, the intraday once touched the 20% range of the daily limit。On Wednesday, the United Nations Security Council passed a resolution unequivocally calling for an immediate halt to attacks by the Houthis on commercial shipping in the Red Sea and stressing the right of member states to "protect their ships from attacks, including those that undermine the right and freedom of navigation," in accordance with international law.。The United States and Britain begin strikes against Houthi-linked targets in Yemen。In addition, Maersk CEO Ke Wensheng told the media that the closure of container ships in the Red Sea after a series of attacks by the Houthis in Yemen was "bad."。He noted that it could take months to reopen the Red Sea trade routes, which could deliver an economic and inflation blow to the global economy, businesses and consumers.。

Increase or decrease in institutional holdings

According to the HKEx, on January 8, FIDELITY FUNDS reduced its holdings of Zhaoyan New Drugs 9.035 million shares, price per share 12.HK $3,063, total reduction of approximately 111.HK $190,000。The latest number of shares held after the reduction is about 832..330,000 shares, with a change in shareholding to 6.99%。

On January 8, Hermes Investment Management Ltd increased its holdings of CNOOC Chemical 913.96.55 million shares, price per share 2.06 Hong Kong dollars, the total increase of about 1882.HK $770,000。The latest number of holdings after the increase is about 2..1.9 billion shares, shareholding changed to 12.17%。

From January 9 to 11, Zhu Yiwen, Chairman and Executive Director of the Company, increased his holdings of Hagia Medical 3.060,000 shares, 130,000 shares.340,000 shares, 11.340,000 shares, with prices per share of 300,000 by date of increase.HK $65, 30.HK $67, 31.41 Hong Kong dollars, the total increase in three days is about 859.HK $120,000。The latest number of holdings after the increase is 2..8.2 billion shares, shareholding changed to 44.73%。

New Stock News

Jingwei Tiandi this IPO issue 1..2.5 billion shares, priced at HK $1 each, 4,000 shares per lot, net proceeds of HK $62.67 million。Jingwei Tiandi is China Telecom's network support and information and communication technology (ICT) integration service provider and software developer.。The Group launched its business in 2003 with a focus on the development of telecommunications network performance analysis software and subsequently expanded its business scope to provide telecommunications network support services and ICT integration services.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.