Dida goes public today: HKEX's first travel stock

On June 28th, Dida Inc. landed on the Hong Kong Stock Exchange and began trading on the Hong Kong Stock Exchange at 9:00 am (Hong Kong time) on the same day.

On June 28th, Dida Inc. landed on the Hong Kong Stock Exchange and began trading on the Hong Kong Stock Exchange at 9:00 am (Hong Kong time) on the same day. After going public, Dida will become the first Chinese travel company to land on the Hong Kong Stock Exchange.

According to the documents, Dida plans to issue approximately 39.091 million shares, of which 3.9095 million shares (10%) will be issued in the Hong Kong Special Administrative Region and 35.1815 million shares (90%) will be issued internationally at an issue price of HKD 7 per share, with 500 shares per share.

CICC, Haitong Securities, and Nomura Securities are the joint sponsors of Dida.

Company Profile

Dida is a technology driven platform that mainly provides ride hailing platform services to share idle seats in private passenger cars, aiming to create more transportation capacity while reducing environmental impact. Dida also provides relatively small-scale smart taxi services, aiming to improve the efficiency and efficiency of relevant stakeholders in the Chinese taxi industry.

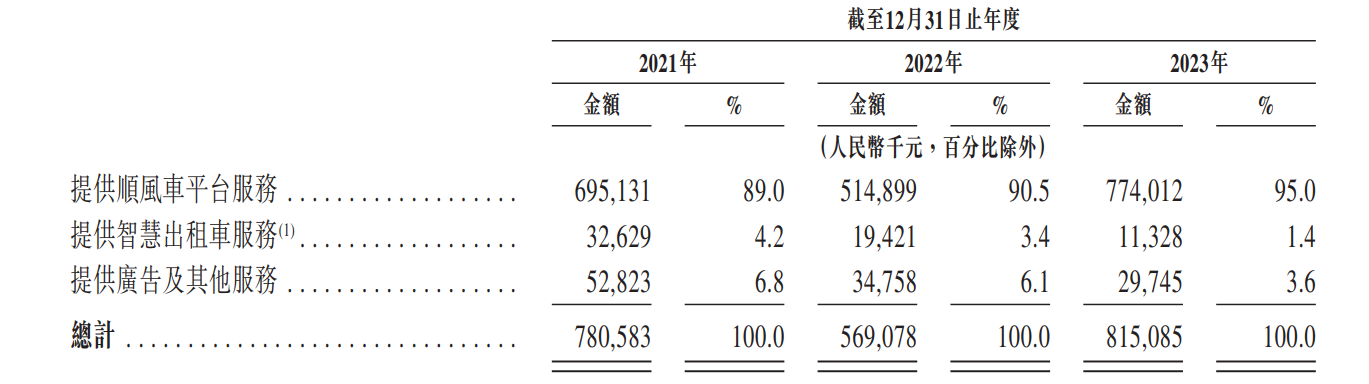

According to Dida, the company's business includes (1) providing ride hailing platform services; (2) Provide smart taxi services; (3) Provide advertising and other services (mainly including value-added services for automobiles). In 2023, the proportion of these three major businesses was 95%, 1.4%, and 3.6%, respectively.

Dida launched an App based ride hailing platform service in 2014. Private car owners can publish their itinerary through the Dida App, while ride hailing passengers can book a ride in advance. The revenue from ride hailing platform services mainly comes from service fees charged to private car owners who provide ride hailing services on the platform.

In addition to ride hailing services, Dida also launched a smart taxi service in 2017, with a focus on developing ride hailing solutions provided by Dida Taxi Driver App. All revenue from smart taxi services comes from taxi ride hailing services, mainly generated by charging service fees to taxi drivers for facilitated ride hailing services.

In terms of advertising and other services, it mainly provides advertising space to third-party merchants through its mobile app, and the revenue mainly comes from collecting advertising fees. Dida also charges commissions to third-party service providers for car value-added services based on the sales opportunities generated or the number of new customers obtained through their platforms.

Market size

Dida mainly provides ride hailing services.

According to the prospectus, Dida operates China's second largest ride hailing platform in 2023, with a total ride hailing transaction amount of RMB 8.6 billion and a total of 130.3 million rides. Its market share is 31.8% based on the total transaction amount and 31.0% based on the number of rides.

As of December 31, 2023, Dida has provided App based ride hailing platform services in 366 cities across the country, with approximately 15.6 million certified private car owners, of which 5.0 million or 32.0% were active certified private car owners in 2023.

The company believes that there is still a lot of room for development in China's ride hailing business. Based on the total transaction volume in 2023, the market shares of taxis, ride hailing services, and ride hailing services in China are 54.2%, 41.4%, and 4.4%, respectively. The total transaction volume of China's ride hailing market is expected to increase from 37.1 billion yuan in 2024 to 103.9 billion yuan in 2028, accounting for 8.4% of the market share in China's automotive passenger transportation market. The compound annual growth rate from 2024 to 2028 is 29.4%.

In terms of smart taxi services, Dida stated that as of the final feasible date, the company has provided taxi ride hailing services in 91 cities in China. In 2023, the company's market share based on completed rides was 0.09%, while its market share based on the total transaction volume of the entire Chinese taxi market was 0.07%. Dida is expected to gradually charge service fees in other cities after achieving a daily completion of about 1000 rides and a response rate of about 50%.

Financial Profile

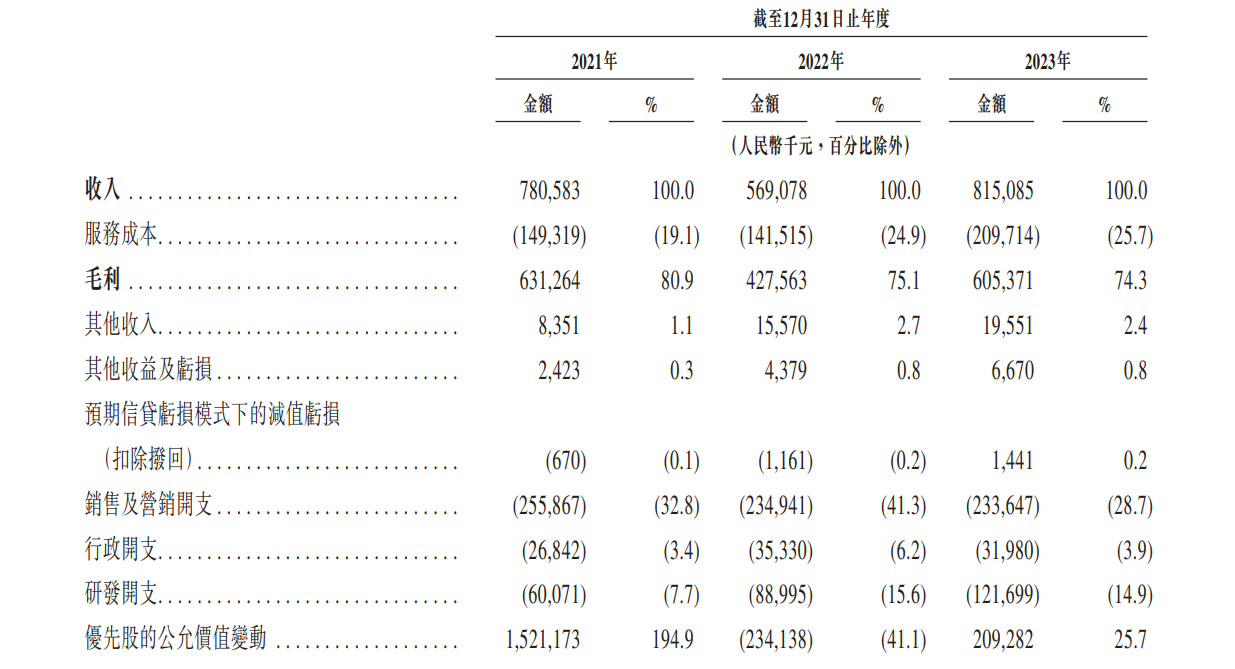

From 2021 to 2023, Dida recorded revenue of 781 million yuan, 569 million yuan, and 815 million yuan, respectively. The gross profit was 631 million yuan, 428 million yuan, and 605 million yuan respectively, with gross profit margins of 80.9%, 75.1%, and 74.3% for the same year.

In terms of R&D investment, from 2021 to 2023, Dida's R&D expenses were 60.071 million yuan, 88.995 million yuan, and 122 million yuan, respectively.

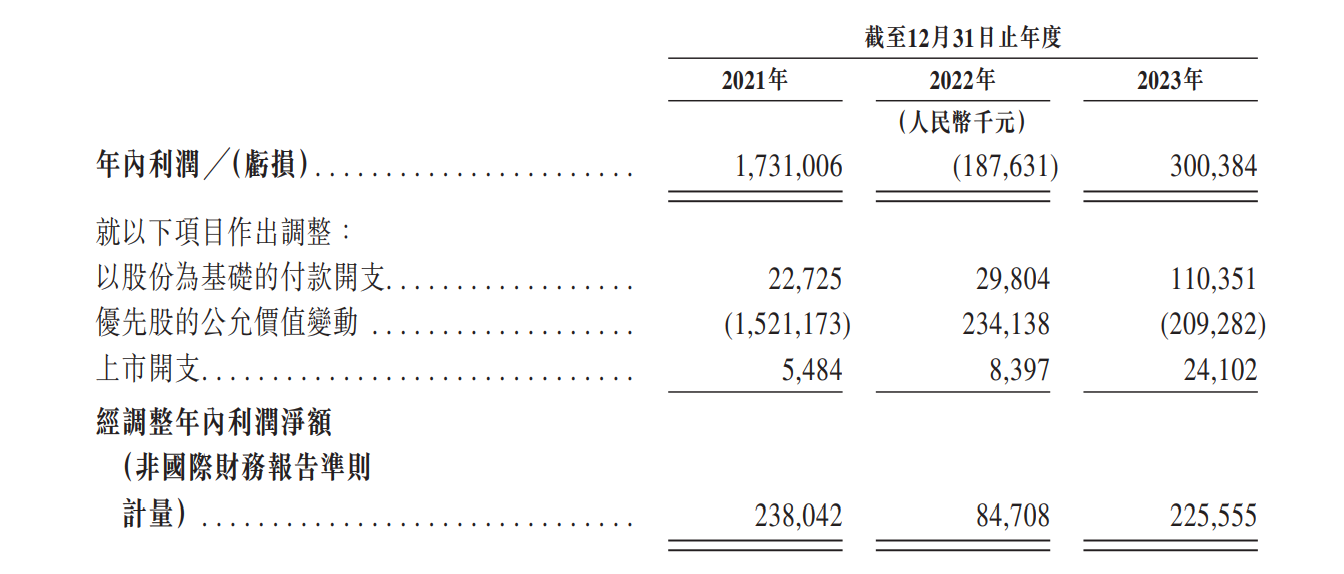

From 2021 to 2023, the company's adjusted net profit (measured under non International Financial Reporting Standards) was 238 million yuan, 84.7 million yuan, and 226 million yuan, respectively, while the adjusted net profit margin for the same year was 30.5%, 14.9%, and 27.7%, respectively.

Use of funds

Assuming the offering price is HKD 6 per share (i.e. the median of the indicative offering price range of HKD 5 to HKD 7 per share), and assuming that the over allotment rights have not been exercised, the company estimates that the net proceeds from the global offering will be approximately HKD 147.2 million.

The company stated that approximately 50.0% is expected to be used primarily to expand user base and strengthen marketing and promotion plans through user rewards and subsidies, online advertising activities, and offline promotion and publicity activities; (2) Approximately 35.0% will be used to enhance technical capabilities and upgrade security mechanisms; (3) Approximately 15.0% will be used to enhance liquidity.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.