Hawkinsight Hong Kong Market Closing Roundup (2.7) | Hang Seng Index Secures Wanliu Pass Semiconductor Stocks Underperform

On February 7, the three major indexes of Hong Kong stocks collectively rushed higher and fell back in early trading, and the afternoon decline widened further.。Hang Seng Index closes down 0 at close.34%, at 16081.89 points。

On February 7, the three major indexes of Hong Kong stocks collectively rushed higher and fell back in early trading, and the afternoon decline widened further.。Hang Seng Index closes down 0 at close.34%, at 16081.89; Hang Seng SOE Index closes down 0.95% at 5421.53 points; Hang Seng Tech Index closes down 1.64%, at 3190.68 points。

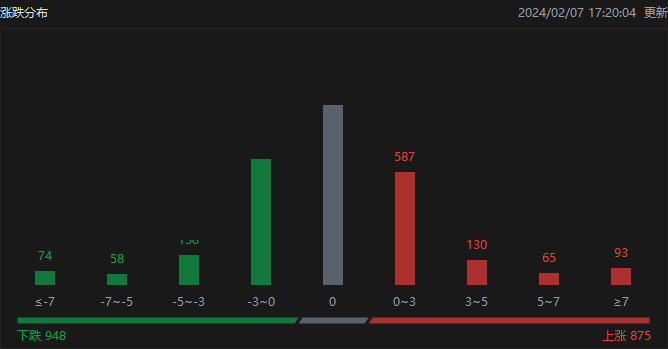

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 875, fell 948, and closed flat at 1160.。

On the day of the Hong Kong stock market, North Water traded net buy 23.HK $5.4 billion, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 26.HK $03 billion, net sale of Hong Kong Stock Connect (Shenzhen) transactions 2.HK $4.8 billion。

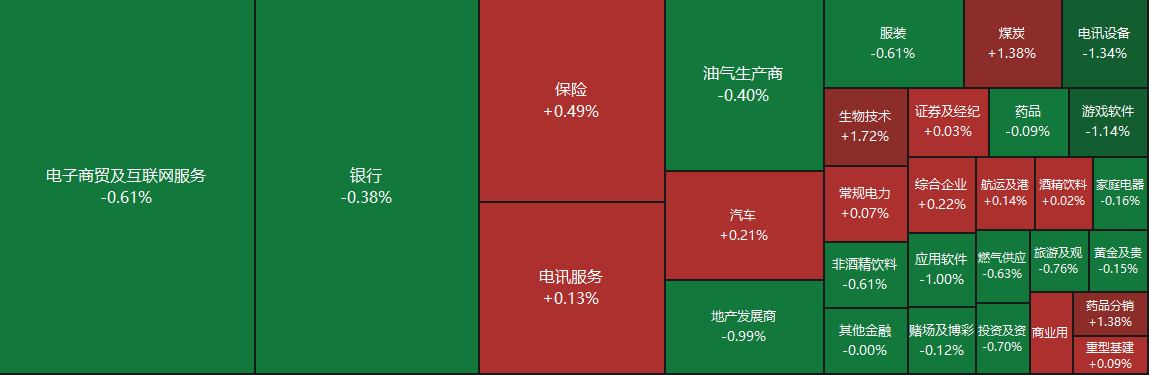

Sectors and Fundamentals

From the disk point of view, most of the technology network stocks weakened, Jingdong fell more than 2%, Xiaomi, Ali, Meituan, fast hand fell more than 1%, Tencent slightly higher。Internal housing stocks, property management stocks and semiconductor stocks fell, while education stocks, film and television stocks also fell.。On the other hand, Yum China's fourth-quarter results beat expectations, driving restaurant stocks higher and coal stocks bucking the trend。

Fundamentally, on the evening of February 6, SMIC and Huahong Semiconductor disclosed their fourth-quarter results.。In the fourth quarter alone, both companies' profitability declined, with single-quarter gross margins falling on a year-over-year basis.。The announcement shows that SMIC's fourth quarter 2023 sales revenue was 16.$7.8 billion, up 3.6%, YoY growth of 3.5%。Its single-quarter gross margin was 16.4%, down 3.4 percentage points, down 15.6 percentage points。However, SMIC's fourth-quarter net profit was 1.$7.5 billion, compared with a previous estimate of 1.$4.9 billion。And Huahong Semiconductor's sales revenue in the fourth quarter of last year was 4..$5.5 billion, down 27.7%, down 19.9%。Its single-quarter gross margin was 4%, down 34.2 percentage points, down 12.1 percentage point。Huahong Semiconductor's fourth-quarter net profit was only $35.4 million, down 77.8%。

Internal housing stocks continue to weaken。Huatai Securities believes that in January, the new housing transaction area was partly affected by the supply side of the housing enterprises to reduce the impact of pushing goods; second-hand housing transaction area to maintain resilience, indicating that the demand side still has some support。In terms of shell leading indicators, January leading indicators showed that property sales were still bottoming out and house price declines continued to narrow in signs。Since January, with the strengthening of regulatory support for real estate, local governments are also actively cooperating: first, for the supply side of the project financing "white list" quickly landed;。Expect a top-down package of policies to drive confidence recovery in the real estate sector, bringing valuation repair space to the sector。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on February 1, Brandes Investment Partners, L.P.Increase in 100 Fortune Global 100.16.91 million shares, price per share 5.HK $46, with a total increase of approximately 546.HK $920,000。The latest number of holdings after the increase is about 1..2.9 billion shares, shareholding changed to 12.06%。

New Stock News

According to the Hong Kong Stock Exchange on February 6, Auto Street Development Limited submitted a listing application to the main board of the Hong Kong Stock Exchange, with CITIC Securities and Haitong International as its joint sponsors.。It is understood that the Company submitted its listing application to the HKEx on 30 June 2023.。

Auto Street Development is a one-stop solution provider for used car buyers and sellers, and the company provides a full set of value-added services and other services for used car buyers and sellers throughout the entire used car trading cycle to improve the company's online and offline integrated auction services.。As of December 31, 2023, more than 6,900 4S stores had disposed of used cars through the platform.。During the Track Record Period, approximately 16,000 buyers were professional buyers (i.e., those who purchased three or more used vehicles on the trading platform in any given year).。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.