Hawkinsight Hong Kong Market Closing Roundup (1.17) | The three major stock indexes opened lower and more than 60% of stocks closed lower.

On January 17, as last year's full-year GDP growth was slightly lower than market expectations, the three major indexes of Hong Kong stocks opened lower and went down, with volatility throughout the day.。Hang Seng Index closes down 3 at close.71%, reported 15276.9 o'clock。

On January 17, as last year's full-year GDP growth was slightly lower than market expectations, the three major indexes of Hong Kong stocks opened lower and went down, with volatility throughout the day.。Hang Seng Index closes down 3 at close.71%, reported 15276.9 points; Hang Seng SOE Index closes down 3.94%, at 5132.82 points; Hang Seng Tech Index closes down 4.99%, reported 3160

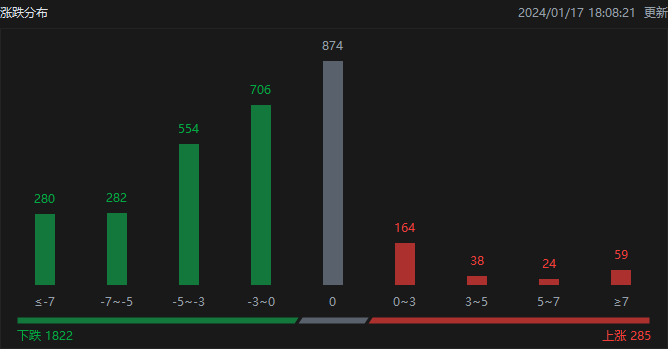

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 285, fell 1822, and closed flat 874.

On the day of the Hong Kong stock market, North Water traded net buy 59.HK $3.4 billion, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 40.HK $06 billion, Hong Kong Stock Connect (Shenzhen) traded net buy 19.27

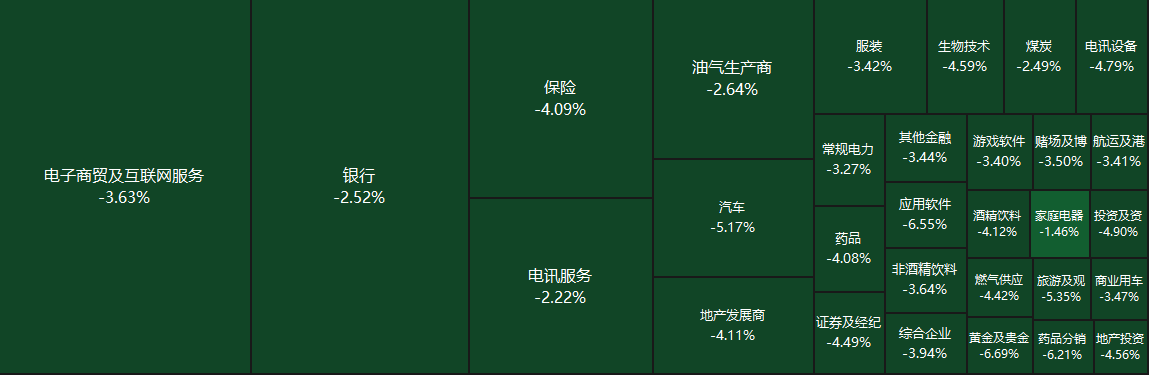

Sectors and Fundamentals

From the disk point of view, the vast majority of sectors have been down, the network stocks fell, the United States group, beep mile beep mile fell about 7%, fast hand, Jingdong fell more than 6%, millet fell nearly 5%, Alibaba fell more than 4%, Baidu, NetEase fell nearly 4%, Tencent fell nearly 3%;。On the other hand, penny stocks ushered in a carnival, nearly 80 stocks rose more than 5%, China's basic energy is soaring more than 80%。

Fundamentally, Fed Governor Waller played down expectations of a quick rate cut, saying there was no reason to cut rates as quickly as in the past and only if needed, and he was more confident that inflation could be sustainably reduced to 2 percent.。Its relatively hawkish speech pushed the dollar stronger, U.S. Treasury yields higher and precious metals prices under pressure。Spot Golden Week 2 closed down 1.28%, closed at 2028.$26 / oz, the lowest in the day had touched 2024.$16 an ounce, down about $30 from Monday's close。COMEX February gold futures closed down 1.04%, closed at 2030.$2 / oz。Societe Generale Futures sees lower probability of Fed rate cut in March。U.S. economic data and employment and labor data for the expected interest rate cut is still a big disturbance, the expected gap on the gold price to form a potential downward factor。

The National Bureau of Statistics announced in December 2023 70 large and medium-sized cities commercial residential sales price changes, 70 large and medium-sized cities, the line of cities commercial residential sales prices fell month-on-month, up and down year-on-year。From the ring, in December, the sales price of new commercial residential buildings in first-tier cities fell by 0.4%, the decline was 0.1 percentage point。Among them, Beijing was flat, Shanghai rose 0.2%, Guangzhou and Shenzhen were down 1.0% and 0.9%。In addition, the National Bureau of Statistics data show that in 2023, the national real estate development investment of 11091.3 billion yuan, down 9.6%; of which, residential investment of 8382 billion yuan, down 9..3%。In 2023, commercial housing sales area of 1117.35 million square meters, down 8.5%。Commercial housing sales of 1,166.22 billion yuan, down 6.5%。

Increase or decrease in institutional holdings

According to the HKEx, on January 11, Southeastern Asset Management reduced its stake in Melco International Development by 760,000 shares at a price of 5 per share..HK $2,436, total reduction of approximately 398.HK $510,000。The latest number of shares held after the reduction is about 7518..880,000 shares, with the shareholding ratio changed to 4.96%。

On January 11, Xiaomo reduced its holdings of Vanke's 130.85.79 million shares, price per share 6.HK $5,451, total reduction of approximately 856.HK $480,000。The latest number of shares held after the reduction is about 1..3.1 billion shares, with the shareholding ratio changed to 5.95%。

On January 10, Xiaomo increased its holdings by 25% in China..66.8 million shares, price per share 70.HK $8,968, total increase of approximately 1,819.HK $780,000。The latest number of shares held after the increase is about 840..290,000 shares, shareholding changed to 70,000.21%。

New Stock News

According to the Hong Kong Stock Exchange on January 16, small vegetable garden International Holdings Limited (hereinafter referred to as: small vegetable garden)

According to the prospectus, Xiaocaiyuan is a rapidly emerging leading brand of popular Chinese catering, both in terms of business scale and growth rate, are at the top level of the industry.。With a keen insight and in-depth understanding of the changing trend of China's catering industry, the path of modernization and industrialization of Chinese food, and the real needs of consumers, the company has decisively entered the field of popular Chinese catering with great potential with a forward-looking strategic vision, and is committed to meeting the growing long-term needs of the Chinese people for convenient catering.。

The company insists on consumer first, standardization as the basis, digitalization as the driving force, intelligence as the means, industrialization as the direction, the "small vegetable garden" to create a popular "family kitchen"。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.