Hawkinsight Hong Kong Market Closing Roundup (2.21) Hong Kong stocks rose throughout the day, the semiconductor sector is strong.

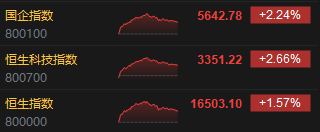

On February 21, the three major indexes of Hong Kong stocks opened lower again in early trading, the difference is that the three major indexes rose unilaterally after the opening, and the afternoon gains narrowed but still gained a large gain.。Hang Seng Index closes up 1 at close.57%, reported 16503.1 point。

On February 21, the three major indexes of Hong Kong stocks opened lower again in early trading, the difference is that the three major indexes rose unilaterally after the opening, and the afternoon gains narrowed but still gained a large gain.。Hang Seng Index closes up 1 at close.57%, reported 16503.1 point; Hang Seng SOE Index closes up 2.24%, at 5642.78 points; Hang Seng Tech Index closes up 2.66%, at 3351.22 points。

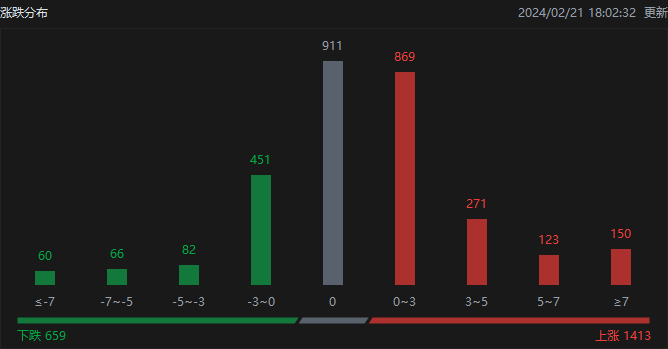

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 1,413, fell 659, and closed flat at 911.。

On the day of the Hong Kong stock market, North Water traded net buy 10.HK $8.2 billion, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 6.HK $5.7 billion, Hong Kong Stock Connect (Shenzhen) net buy 4.HK $2.6 billion。

Sectors and Fundamentals

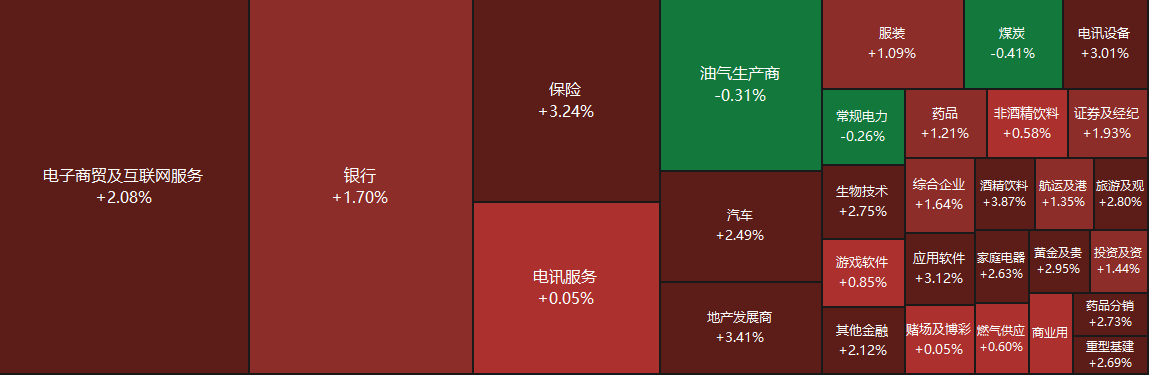

From the disk point of view, today's science and network stocks trend is strong, in which the United States group rose nearly 5%, beep mile, fast hand rose more than 3%, millet, Jingdong rose more than 2%, Baidu, Ali, Tencent rose more than 1%, Netease followed the rise.。In addition, the semiconductor sector strengthened, auto stocks also turned down, while insurance stocks were strong all day.。On the other hand, the coal and power sectors were slightly weaker today, with retail stocks also performing weakly.。

Fundamentals: semiconductor stocks strengthen collectively。According to media reports, the wholesale price of the index product DDR4 8Gb rose 9% month-on-month and the price of 4Gb products rose 8% month-on-month in January as Chinese customers accepted price increases from memory chip manufacturers.。In addition, the three major original manufacturers of memory chips Samsung Electronics, SK Hynix, Micron Technology are controlling the supply, the price attitude is firm.。Industry insiders also pointed out that the first quarter of 2024 storage market price increases have become a trend, superimposed on the emerging smart cars, AI models and other scenarios will also give birth to more storage needs。In addition, Guoxin Securities pointed out that due to the continued strong demand for advanced packaging of AI chips, it is expected that the CAGR of advanced packaging will exceed 50% in the next few years.。The bank believes that the semiconductor cycle resonates with the growth of innovation.。

Auto Stocks Rebound。On February 19, BYD announced that the Qin PLUS Glory Edition of Dynasty Network was officially listed, with an official guide price of 7.From 980,000 yuan。At the same time, Wuling, Changan Automobile, Nezha Automobile, Beijing Hyundai, SAIC-GM and other car companies have joined the price war, collectively announced a number of models of large price cuts。According to incomplete statistics, as of now, the number of car companies that have started a new round of price cuts has exceeded 20.。Dongguan Securities pointed out that due to the impact of the Spring Festival holiday, the car market sales are expected to be flat in February。After the Spring Festival holiday, car companies have opened price reduction promotions, is expected to drive the new energy vehicle market gradually pick up。With the decline in battery costs, the continued abundance of supply, and the accelerated application of new technologies such as fast charging and intelligent driving, sales of new energy vehicles are expected to maintain rapid growth throughout the year.。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on February 14, Xiaomo reduced its holdings by ninety-nine 565.19.32 million shares, price per share 4.HK $6,184, with a total reduction of approximately 2,610.HK $290,000。The latest number of shares held after the reduction is about 1..1.1 billion shares, change in shareholding to 7.69%。

On February 15, BlackRock reduced its stake in ENN Energy 34.270,000 shares, price per share 55.HK $4,893, total reduction of approximately 1901.HK $620,000。The latest number of shares held after the reduction is about 5645..360,000 shares, with the shareholding ratio changed to 4.99%。

On February 15, BlackRock increased its holdings of China Civil Aviation Information Network 53.70,000 shares, price per share 7.HK $9,936, with a total increase of approximately 429.HK $260,000。The latest number of shares held after the increase is about 4699..060,000 shares, with the shareholding ratio changed to 5.04%。

New Stock News

None

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.