Hawkinsight Hong Kong Market Closing Roundup (1.19) The Hang Seng Index has fallen nearly 6% this week, and game stocks have bucked the trend.

On January 19, the three major indexes of Hong Kong stocks opened higher in early trading and began to fall back in the afternoon.。Hang Seng Index closes down 0 at close.54% at 15,308.69 points, this week's cumulative decline of 5.76%。

On January 19, the three major indexes of Hong Kong stocks opened higher in early trading and began to fall back in the afternoon.。Hang Seng Index closes down 0 at close.54% at 15,308.69 points, this week's cumulative decline of 5.76%; Hang Seng SOE Index closes down 0.87% at 5127.24; Hang Seng Tech Index closes down 1.45%, at 3129.92

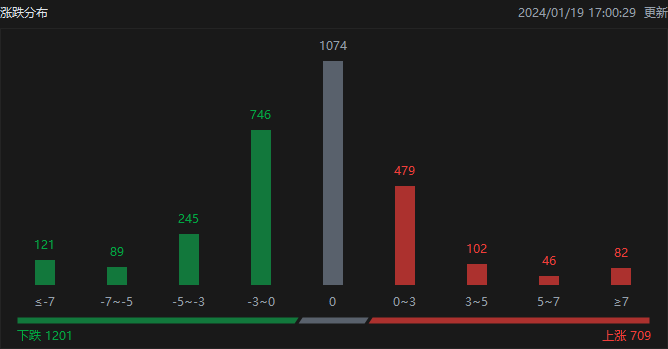

In terms of the distribution of ups and downs, as of the close of the day, Hong Kong stocks rose 709, fell 1201, closing flat 1074

On the day of the Hong Kong stock market, North Water traded net buy 10.HK $3.1 billion, of which HK Stock Connect (Shanghai) traded a net purchase of 11.HK $1.5 billion, net sale of Hong Kong Stock Connect (Shenzhen) transactions 0.HK $8.4 billion。

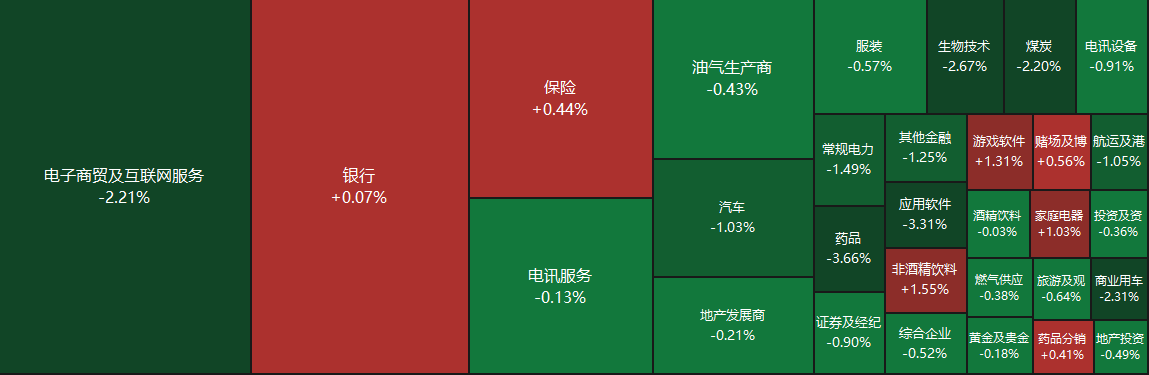

Sectors and Fundamentals

From the disk point of view, the network stocks fell, beep, fast hand fell more than 3%, Tencent, Jingdong fell more than 2%, Alibaba, Meituan fell nearly 2%, millet fell more than 1%, Netease rose more than 1%;。On the other hand, institutions pointed out that the game industry is moving towards a new round of development cycle, game stocks against the trend, Zhongxu future up more than 3%

Fundamentally, according to the China Game Industry Report 2023 released by the Game Working Committee of the China Audiovisual and Digital Publishing Association, China's overseas sales revenue of self-developed products in 2023 163.6.6 billion U.S. dollars, with a scale of over 100 billion yuan for four consecutive years。Everbright Securities pointed out that, looking forward to the follow-up "online game management measures" official draft, the regulatory level for the domestic game market to realize the standardization, the game to sea actively encourage is expected to be further clarified.。Under the policy support, the overseas market will continue to become an important direction for the development and expansion of the game industry, followed by the penetration of overseas market segments, the sea space is still large.。Considering the deep adjustment of the game sector, has more fully reflected the pessimistic expectations, the overall valuation is low, it is recommended to pay attention to the high proportion of overseas revenue, continued research and development of new products and overseas product distribution capacity of the game company.。

According to the preliminary calculation of the passenger car Federation, the narrow passenger car retail market this month is about 220.About 0 million vehicles, month-on-month -6.5%; new energy retail is expected to 80.About 0 million vehicles, month-on-month -15.3%, the penetration rate fell back to 36.4%。The passenger association said that the winter weather is colder, consumers' perception of battery life is more obvious, which is not conducive to the potential passenger savings of the new energy car market.。Terminal performance is less than expected triggered by a new round of new energy head manufacturers price cuts have been opened, a new round of new energy mainstream market segments of the price volume is ready to go。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on January 15, BlackRock reduced its stake in Tsingtao Brewery by 15%..180,000 shares, price per share 50.HK $8,536, total reduction of approximately 771.HK $960,000。The latest number of shares held after the reduction is about 3929..180,000 shares, with the shareholding ratio changed to 5.99%。

January 16, Mitsubishi UFJ Financial Group, Inc.Reduction of Jiangsu Ninghu Expressway 632.60,000 shares, price per share 7.HK $6,261, total reduction of approximately 4,824.HK $270,000。The latest number of shares held after the reduction is about 6741..080,000 shares, with the shareholding ratio changed to 5.51%。

New Stock News

On January 18, Jiashida, the holding company of BenQ Hospital Group, announced that in order to expand the Group's medical services business and enhance revenue and profit growth, the Board of Directors has approved BenQ BM Holding Cayman Corp (BenQ BM Holding Cayman Corp).., BBHC) Hong Kong listing application and will be submitted to the first interim shareholders' meeting on March 14 for resolution。It is understood that BenQ Hospital Group currently has Nanjing BenQ Hospital, Suzhou BenQ Hospital two teaching center-level large general hospitals, and investment in Guangxi Guigang Donghui Hospital.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.