Hawkinsight Hong Kong Market Closing Roundup (2.22) | Hang Seng Index Continuously Higher Energy Sector Strong All Day

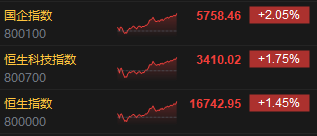

On February 22, the three major indexes of Hong Kong stocks weakened in early trading, while in the afternoon they quickly pulled up and continued to strengthen.。Hang Seng Index closes up 1 at close.45%, at 16,742.95 points。

On February 22, the three major indexes of Hong Kong stocks weakened in early trading, while in the afternoon they quickly pulled up and continued to strengthen.。Hang Seng Index closes up 1 at close.45%, at 16,742.95; Hang Seng SOE Index closes up 2.05% at 5758.46 points; Hang Seng Tech Index closes up 1.75% at 3410.02 points。

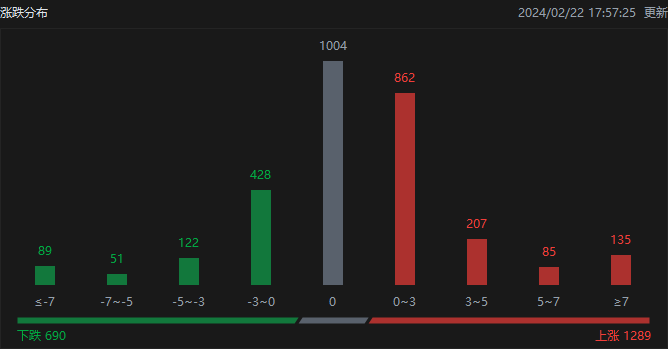

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 1289, fell 690, and closed flat at 1004.。

On the day of the Hong Kong stock market, North Water traded net buy 47.HK $7.7 billion, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 22.HK $1.4 billion, Hong Kong Stock Connect (Shenzhen) traded net buy 25.HK $6.3 billion。

Sectors and Fundamentals

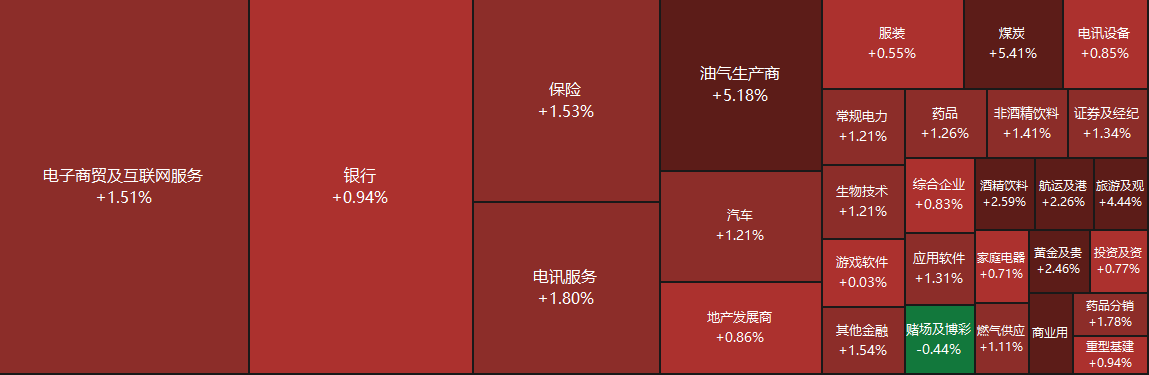

From the disk point of view, today's multi-plate floating red, the majority of science and network stocks in the afternoon pulled up, including the United States group rose more than 3%, Alibaba rose nearly 3%, fast hand, Jingdong, Baidu rose more than 1%, Tencent rose nearly 1%。Strong momentum in coal, oil and power exchange sectors。On the other hand, the entertainment and gaming sector is weaker than the market.。

Fundamentals: Coal stocks rose strongly。The Shanxi Provincial Emergency Management Department, the Shanxi Bureau of the State Mine Safety Supervision Bureau, and the Shanxi Provincial Energy Bureau recently issued the Notice on Carrying out the "Three Super" and Concealed Working Face Special Remediation of Coal Mines, and decided to immediately carry out the "Three Super" and Concealed Working Face Special Remediation of Coal Mines throughout the province.。Everbright Securities believes that the event will affect the supply of coal in Shanxi in the short term, especially the supply of coking coal, coking coal prices constitute a positive。At the same time, the bank expects the global coal supply and demand to be basically balanced in 2024-2026, under the protection of the long association policy, the earnings of domestic coal enterprises are expected to maintain high and stable, high dividends, central enterprises and other characteristics are expected to catalyze the valuation of coal stocks to continue to improve.。

Oil Stocks Stronger, Three Barrels Up。Oil prices rose 1 percent on Wednesday amid geopolitical tensions in the Middle East。WTI crude futures up 87 cents, or 1.1%, closed at 77 per barrel.$91; Brent up 69 cents, or 0.8%, closed at 83 per barrel.03 USD。UBS issued a report saying that the average price of Brent oil futures rose 3 per week last week..3% to 82 per barrel.$5, mainly driven by geopolitical factors, including rising tensions in the Middle East and the ongoing conflict between Russia and Ukraine.。With geopolitical factors boosting oil prices, it is believed that three barrels of oil, namely PetroChina, Sinopec and CNOOC, will benefit。CICC, for its part, notes that oil may remain a fundamentally better bulk asset this year。

Power Stocks Stronger in Afternoon。Tianfeng Securities said most thermal power companies' earnings improved significantly in '23, with Q4 alone mostly the lowest quarter of the year。Bank sees further improvement in thermal power profitability in 2024。Specifically, affected by the coal price base, etc., the degree of performance improvement in the first half of the year may be more significant than in the second half of the year.。Along with the improvement of thermal power profitability, the level of dividends of each company may increase, thus driving the attractiveness of thermal power in dividends.。Debang Securities pointed out that the Development and Reform Commission, the Energy Bureau clear auxiliary services market price mechanism, to stimulate the power system flexible adjustment capacity to play a better role, auxiliary services market is expected to usher in rapid development, the bank believes that thermal power operators and flexible transformation technology providers will be the first to benefit。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on February 15, Xiaomo reduced its holdings of Shenzhou International 269.86.66 million shares, price per share 67.HK $0991, total reduction of approximately 1.HK $8.1 billion。The latest number of shares held after the reduction is about 8911..210,000 shares, with the shareholding ratio changed to 5.92%。

On February 15, Komo reduced its holdings of Follett Glass 620.38.29 million shares, price per share 14.HK $0339, total reduction of approximately 8,706.HK $390,000。The latest number of shares held after the reduction is about 4857..760,000 shares, with a change in shareholding to 100,000.79%。

New Stock News

None

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.