China's first-half net profit or 2% year-on-year decline in major banks have lowered their target prices.

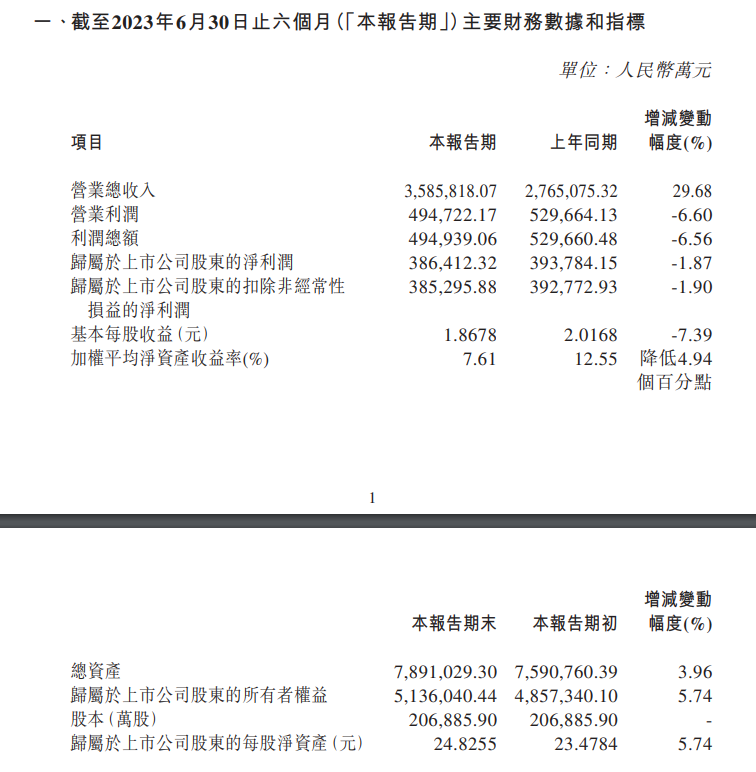

According to HKEx disclosure documents, China China Exemption announced its 2023 semi-annual results on July 7.。Express data show that China's total revenue is expected to be 358 in the first half of the year..5.8 billion yuan (RMB, the same below); operating profit was 49.4.7 billion yuan; net profit attributable to the parent was 38.$6.4 billion; EPS of 1.87 yuan。

According to HKEx disclosure documents, China Tourism Group China Exemption Co., Ltd. (hereinafter referred to as China China Exemption) announced its 2023 half-year results on July 7.。Express data show that for the six months ended June 30, 2023, China's total revenue is expected to be 358.5.8 billion yuan (RMB, the same below), up 29.68%; operating profit was 49.4.7 billion yuan, down 6.6%; net profit attributable to the parent was 38.6.4 billion yuan, down 1.87%; EPS of 1.87 yuan, compared with 2 in the same period last year.01 yuan。

In response, Citigroup released a research report saying that China Zhongfu announced its preliminary results for the first half of the year, with revenue expected to grow 30% year-on-year to 35.8 billion yuan, which means that revenue in the second quarter rose 39% year-on-year to 15.1 billion yuan, while also saying that the company's revenue recovery was slower than expected.。

Citi says China's gross margin is on track, with revenue up 3% in the second quarter.67 percentage points to 30%, and the company's recent change to a point incentive program to reduce member benefits also indicates the company's focus on balancing profitability and size, which is expected to support a sustained recovery in margins in the second half of the year.。As a result, Citi has significantly lowered its target price for China Zhongfu from HK $243 to HK $183, maintaining its "buy" rating.。

In addition, CCB International also released a research report saying that China's China Free Results Express showed that first-half net profit fell about 2% year-on-year to 38.$6.4 billion, only about 37 per cent and 40 per cent of the bank's and the market's expected full-year net profit, but revenue growth of 39 per cent in the second quarter led to a 14 per cent increase in net profit, an improvement over the first quarter's revenue growth of 24 per cent and a 10 per cent decline in net profit.。

CCB International expects a better performance in the second quarter due to a pick-up in passenger flow following the reopening of the epidemic and a lower base in the second quarter of 2022。The bank reviewed China's forecast of accelerated sales in the second half of the year, and said that the number of tourists to Hainan and domestic airport passenger traffic increased, so the bank expects that as sales continue to recover, the company will shift its development center to improve profitability, and expects profit margins to improve in the second half of the year.。Finally, CCB International lowered its China China Waiver target price from HK $197 to HK $155 to reflect exchange rate effects, but maintained its "outperform" rating.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.