Hawkinsight Hong Kong Market Closing Roundup (2.2) The Hang Seng Index has fallen 2 this week..62% of gaming stocks remain active

On February 2, the three major indexes of Hong Kong stocks opened high and went low, the whole day's shock weakened, the afternoon decline accelerated to expand, the end of the collective closed down。Hang Seng Index closes down 0 at close.21%, down 2 this week..62%, now 15533.56 points。

On February 2, the three major indexes of Hong Kong stocks opened high and went low, the whole day's shock weakened, the afternoon decline accelerated to expand, the end of the collective closed down。Hang Seng Index closes down 0 at close.21%, down 2 this week..62%, now 15533.56; Hang Seng SOE Index closes down 0.09% at 5218.99 points; Hang Seng Tech Index closes down 0.72%, reported 3043.9 o'clock。

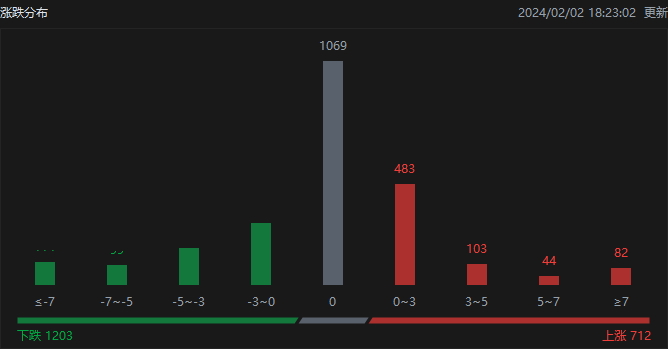

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 712, fell 1203, and closed flat at 1069.。

On the day of the Hong Kong stock market, North Water traded a net sell of 39.HK $8.7 billion, of which HK Stock Connect (Shanghai) sold a net 1.3 billion..HK $1.8 billion, net sales of Hong Kong Stock Connect (Shenzhen) transactions 26.HK $6.8 billion。

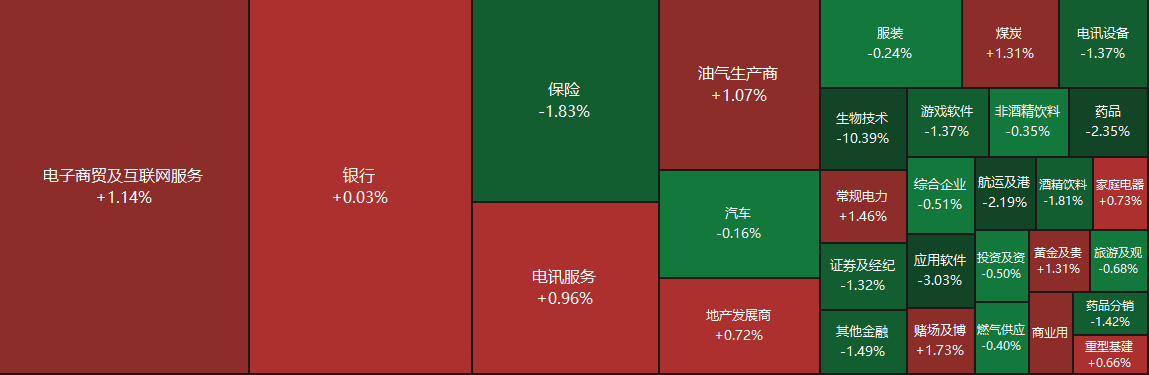

Sectors and Fundamentals

From the disk point of view, most of today's science and network stocks lower, fast hand fell more than 3%, Jingdong fell nearly 2%, millet, the United States group fell more than 1%, Baidu fell nearly 1%, Alibaba, beep mile beep mile slightly down, Tencent bucked the trend rose nearly 3%; internal housing stocks, property management stocks and auto stocks were mixed, pharmaceutical stocks were sluggish throughout the day; large financial stocks, Chinese prefix stocks and other。On the other hand, gaming stocks continued to perform actively, while gold stocks strengthened。

Fundamentally, from January 27 to January 30, Guangzhou, Suzhou and Shanghai further relaxed their real estate control policies, increasing easing in improving corporate financing and supporting reasonable housing demand to ensure the smooth development of the real estate industry.。In addition, the recent market attention of the real estate project "white list" has new progress。As of January 31, Nanning, Chongqing, Kunming and many other real estate projects "white list" landed。Industry insiders believe that with more real estate project loan support landing, the policy effect of supporting project financing will gradually appear, help improve the liquidity of real estate enterprises, ease the tightening of real estate loans and expand real estate investment, and promote a virtuous circle of real estate and finance.。

Macau Gaming Inspection and Coordination Bureau Announces Gross Gaming Revenue in January 2024 193.3.7 billion patacas, up 67% year-on-year, higher than market expectations of 18 billion patacas。Macau's January gaming revenues at 193, says Citi.3.7 billion patacas, 6.2.4 billion patacas, reaching 78% of the same period in 2019, significantly better than the bank and market expectations。The bank raised its February gaming revenue forecast from 18.5 billion patacas to 19.5 billion patacas.。Taking into account the latest trends in Macau, the bank raised its forecast for gaming revenue growth in fiscal 2024 from 18% to 26%, with gaming revenue expected to reach 231.3 billion patacas, equivalent to about 79% of the 2019 level.。

The continued weakness of the dollar helped push international gold prices up further to nearly a month's high on Thursday, and has been up for four days this week.。As of the close, the most actively traded April gold futures on the NYSE gold futures market closed at 2071 per ounce.$1, up 0.18%。In addition, the performance of major gold listed companies have been unveiled, gold corporate profits generally high。Shandong gold, CICC gold, Chifeng gold, Sichuan gold and Caibai shares and other gold and retail enterprises generally achieved good profit growth in 2023。Among them, Shandong Gold is expected to achieve net profit attributable to 2 billion yuan to 2.5 billion yuan in 2023, up 60% year-on-year..53% to 100.66%。

Increase or decrease in institutional holdings

According to the HKEx, on January 29, BlackRock reduced its holdings of CNOOC Oilfield Services 73.40,000 shares, price per share 7.HK $3,675, total reduction of approximately 540.HK $770,000。The latest number of shares held after the reduction is about 1..6.3 billion shares, shareholding changed to 8.98%。

On January 29, Invesco Asset Management Limited increased its stake in Beijing Capital Airport by 84.40,000 shares, price per share 2.HK $4,089, total increase of approximately 203.HK $310,000。The latest number of shares held after the increase is 1.1.3 billion shares, the shareholding ratio changed to 6.03%。

New Stock News

According to the disclosure of the Hong Kong Stock Exchange on February 1, Fujing China Holdings Limited ("Fujing China") submitted a listing application to the main board of the Hong Kong Stock Exchange, and Quanfu Financing is its exclusive sponsor.。

The prospectus shows that Fujing China is the largest producer of potted vegetable agricultural products in Shandong Province, with a market share of 14% in 2022 based on sales proceeds..8%。In 2022, the company's sales revenue was 1.26.7 billion yuan, accounting for about 3% of the total sales revenue of Chinese potted vegetable producers..1%, and less than 0% of the total sales revenue of Chinese vegetable producers.01%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.