Hawkinsight Hong Kong Market Closing Roundup (1.31) | Apple concept led decliners Coal stocks bucked the trend

On January 31, as the last trading day of January, the three major indexes of Hong Kong stocks opened lower again in early trading today, with volatility weakening throughout the day.。Hang Seng Index closes down 1 at close.39%, reported 15,485.07: 00。

On January 31, as the last trading day of January, the three major indexes of Hong Kong stocks opened lower again in early trading today, with volatility weakening throughout the day.。Hang Seng Index closes down 1 at close.39%, reported 15,485.07; Hang Seng SOE Index closes down 1.54%, at 5194.04; Hang Seng Tech Index closes down 3% at 3005.8 o'clock。

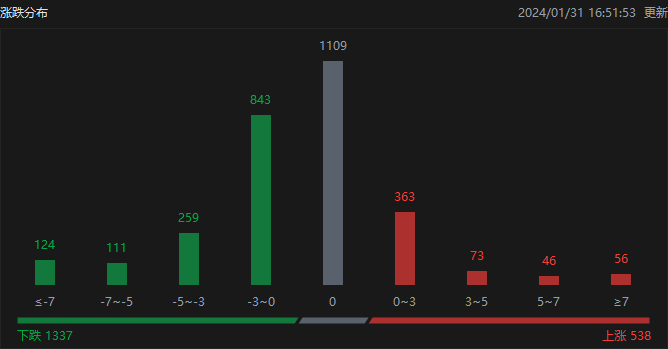

In terms of the distribution of ups and downs, as of the close of the day, Hong Kong stocks rose 538, fell 1337, and closed flat at 1054.。

On the day of the Hong Kong stock market, North Water traded a net sell of 6.HK $3.2 billion, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 2.HK $9.8 billion, Hong Kong Stock Connect (Shenzhen) net sales of 9.HK $300 million。

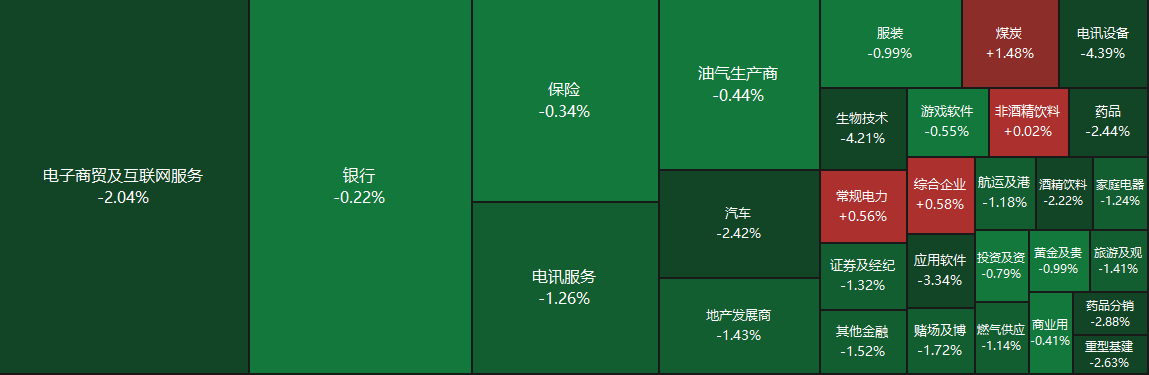

Sectors and Fundamentals

From the disk, the network stocks fell, millet, the United States group fell more than 4%, beep mile beep mile fell nearly 4%, Jingdong, fast hand fell more than 3%, Alibaba fell more than 2%, Baidu fell nearly 2%, Tencent fell more than 1%;。On the other hand, some coal stocks bucked the trend, while online education stocks strengthened individually。

Fundamentally, Tianfeng International analyst Guo Mingxuan's latest research report says Apple has lowered its 2024 iPhone shipment estimate for key upstream semiconductor components to about 200 million units (15% year-on-year decline)。He believes that among the world's major mobile phone brands in 2024, Apple may be the one with the largest recession, especially the continued decline in shipments in the Chinese market.。In addition, Apple will announce its first-quarter results after the U.S. stock market on February 1, EST。It is understood that Apple has previously had four consecutive quarters of revenue decline, and at the beginning of the year it was downgraded by major banks.。UBS Research notes that Apple's weak demand trend in the first quarter to the end of December last year, the potential accumulation of iPhone inventory, or will become a headwind in the second quarter to the end of March this year。

The current price war in the automotive industry continues。According to incomplete statistics, about 10 car companies have recently announced preferential policies for car purchases, with Tesla, Ideal, and Xiaopeng all on the list.。Daiwa pointed out that Tesla asked upstream component suppliers to reduce prices by up to 10%。It believes that Tesla's price reduction will put pressure on the profit margins of other new energy vehicle companies, while negatively affecting the overall atmosphere of the Chinese auto industry.。Bank of Communications International also said that the new energy passenger car market in 2024 will be a year of more intense competition.。If terminal orders do not improve significantly after the Spring Festival, it is believed that independent brands with supply chain and cost advantages will stimulate sales with price cuts, and other car companies will follow suit.。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on January 24, Xiaomo reduced its holdings of Ganfeng Lithium 75.35.59 million shares, price per share 23.HK $8,015, with a total reduction of approximately 1,793.HK $580,000。The latest number of shares held after the reduction is about 4372..410,000 shares, with the shareholding ratio changed to 100,000.83%。

On January 25, Xiaomo reduced its holdings of China Merchants Bank by 145.50.82 million shares, price per share 27.HK $8,605, total reduction of approximately 4,053.HK $930,000。The latest number of shares held after the reduction is about 2..7.4 billion shares, with the shareholding ratio changed to 5.98%。

On January 26, U.S. Capital Group increased its holdings of AIA 254.42.12 million shares, price per share 64.HK $9,316, total reduction of approximately 1.HK $6.5 billion。The latest number of holdings after the increase is about 9..09 million shares, with the shareholding ratio changed to 8.00%。

New Stock News

According to the Hong Kong Stock Exchange on January 30, Jiaxin International Resources Investment Co., Ltd. (hereinafter referred to as: Jiaxin International) presented the main board of the Hong Kong Stock Exchange, with CICC as its sole sponsor.。

According to the prospectus, Jiaxin International, a tungsten mining company rooted in Kazakhstan, has been focusing on the development of the company's Bakuta Tungsten Mine (Bakuta Tungsten Project), which, according to Frost Sullivan, as of September 30, 2023, is one of the world's largest tungsten trioxide (WO3) mineral resources reserves open-pit tungsten mines.。According to Frost Sullivan, as of the same date, the company's Bakuta tungsten mine is also the world's fourth largest WO3 mineral resource tungsten mine, with the world's largest designed tungsten production capacity in a single tungsten mine.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.