Hawkinsight Hong Kong Market Closing Roundup (2.19) Hong Kong stocks languished throughout the day Coal stocks bucked the trend.

On February 19, the three major indexes of Hong Kong stocks opened lower and fell sharply in early trading, and weakened throughout the day.。Hang Seng Index closes down 1 at close.13%, at 16,155.61 points。

On February 19, the three major indexes of Hong Kong stocks opened lower and fell sharply in early trading, and weakened throughout the day.。Hang Seng Index closes down 1 at close.13%, at 16,155.61; Hang Seng SOE Index closes down 1.33%, at 5,484.88 points; Hang Seng Tech index closes down 2.68%, at 3,253.09: 00。

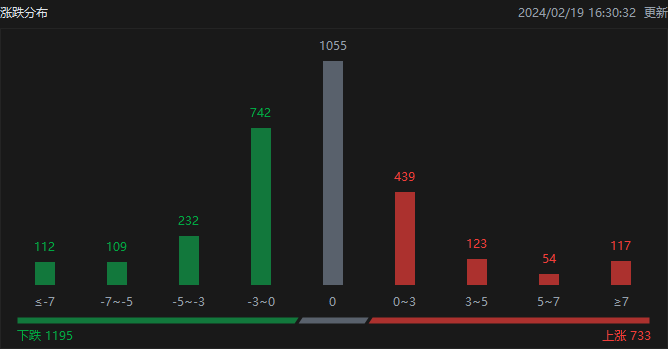

In terms of the distribution of ups and downs, as of the close of the day, Hong Kong stocks rose 733, fell 1195, and closed flat at 1055.。

On the day of the Hong Kong stock market, North Water traded a net buy of 42.HK $6.6 billion, of which HK Stock Connect (Shanghai) traded net purchases of 34.HK $6.3 billion, Hong Kong Stock Connect (Shenzhen) turnover net buy 8.HK $0.3 billion。

Sectors and Fundamentals

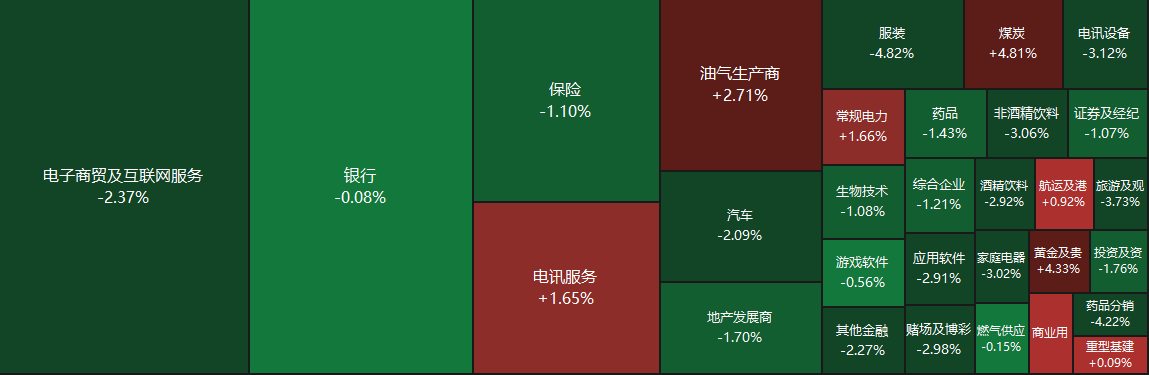

From the disk point of view, the network stocks collectively weakened, beep beep, Jingdong, millet fell about 4%, Baidu, fast hand fell more than 3%, Ali, Meituan, Tencent fell more than 2%, Netease followed the decline; property management stocks, sporting goods stocks collectively weakened, Internet pharmaceutical stocks fell first, of which Jingdong Health fell nearly 7%, ZhongAn Online fell more than 6%, Ali Health fell nearly 3%, Ping An Good Doctor。On the other hand, coal stocks were strong throughout the day today, as were power stocks。

Fundamentals: internal housing, property management stocks collectively lower。Open Source Securities points out that the sales market is flat during the Spring Festival.。The bank tracked 64 cities of new homes and 17 cities of second-hand housing bi-weekly transaction area decreased year-on-year.。Land transaction area turned from positive to negative year-on-year, and the transaction premium increased in week 7.。During the Spring Festival, new and second-hand housing transactions are sluggish, but the steady growth policy to speed up the landing。It is expected that the future real estate policy will continue the loose tone, the demand for housing still has room to release。Mega-megacities are actively and steadily promoting the transformation of urban villages, and more counter-cyclical adjustment measures are expected to accelerate the landing.。

Coal stocks bucked the trend and strengthened。Minsheng Securities pointed out that the 2024 Spring Festival private and state-owned coal mines generally holiday to bring the supply side of the more obvious contraction, superimposed on the lower enthusiasm of traders, the holiday Daqin line daily traffic volume than before the holiday reduced by about 20-300,000 tons, resulting in a continuous decline in port inventories; and after the holiday coal mines to fully resume production still need time, the supply side is expected to recover slowly.。Before the festival, the decline in demand for thermal coal is more obvious, but due to the long-term coal protection, power plant daily consumption on spot coal prices less impact, thermal coal off-season will be near and does not constitute a factor of concern about the decline in coal prices; and non-coal demand holidays run smoothly, after the festival with the arrival of non-coal peak season, downstream replenishment opened, the bank believes that the rise in coal prices in March is more certain。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on February 5, SEAVI Advent Investments Ltd reduced its holdings of 15 million shares of Trainer Industries at a price of 0 per share..HK $36, total reduction of approximately HK $5.4 million。The latest number of shares held after the reduction is about 6113..220,000 shares, with the shareholding ratio changed to 90,000.32%。

On February 9, Ketto Inform Limited increased its holdings of Chantang Holdings by approximately 1.600 million shares, price per share 0.HK $2,628, total increase of approximately HK $42 million。The latest number of holdings after the increase is about 1..6 billion shares, shareholding changed to 23.53%。

New Stock News

None

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.