Hawkinsight Hong Kong Market Closing Roundup (2.1) | The Hang Seng Index opened on the first day of February and the betting sector performed strongly.

On February 1, the three major indexes of Hong Kong stocks rebounded in early trading, ushering in a good start to February, but their afternoon gains narrowed.。Hang Seng closed up 0 at close.52%, reported 15,566.21 o'clock。

On February 1, the three major indexes of Hong Kong stocks rebounded in early trading, ushering in a good start to February, but their afternoon gains narrowed.。Hang Seng closed up 0 at close.52%, reported 15,566.21; Hang Seng SOE Index closes up 0.57%, at 5223.48 points; Hang Seng Technology Index closed up 2% at 3,065.95 points。

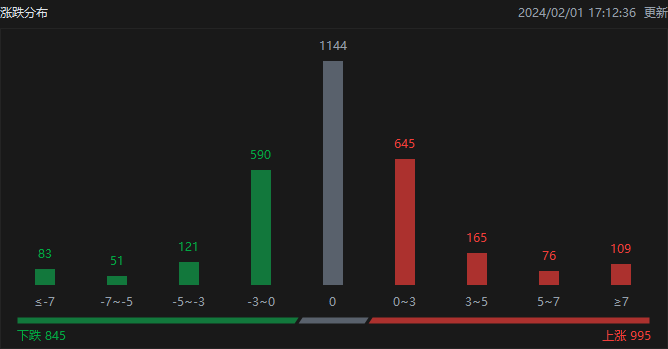

In terms of the distribution of ups and downs, as of the close of the day, Hong Kong stocks rose 995, fell 845, and closed flat 1144.。

On the day of the Hong Kong stock market, North Water traded a net sell of 13.HK $4.2 billion, of which HK Stock Connect (Shanghai) sold a net 1.HK $4.5 billion, Hong Kong Stock Connect (Shenzhen) net sales of 11.HK $9.7 billion。

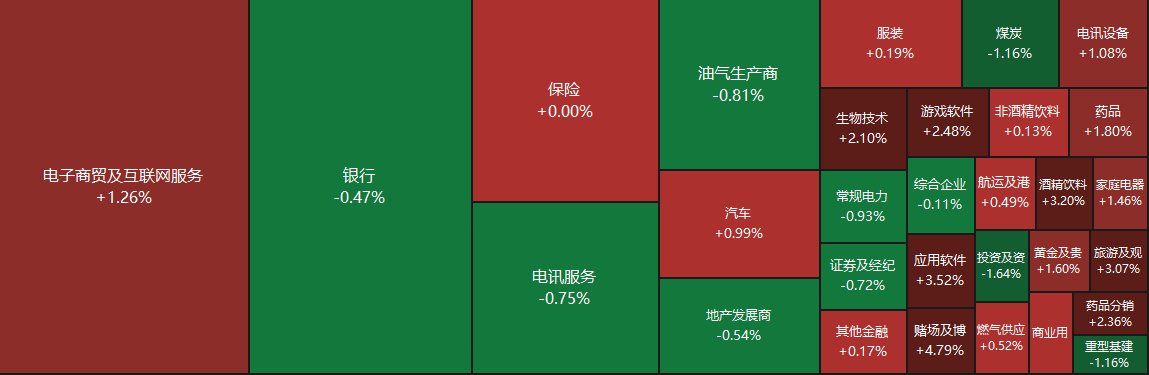

Sectors and Fundamentals

From the disk point of view, today's science and network stocks rose, beep, beep, fast hand rose more than 5%, Netease rose nearly 3%, Alibaba, the United States rose more than 2%, Baidu rose more than 1%, Jingdong rose nearly 1%;。On the other hand, power stocks led the decline as power companies' performance in the fourth quarter of last year was not favourable。

Fundamentally, according to the Macau Gaming Inspection and Coordination Bureau, Macau's January Lucky Gaming Gross Revenue 193.3.7 billion patacas, up 67% YoY, estimated at 63.3%, better than market expectations。The previous report of East Asia Securities Research Department pointed out that the current valuation of Macau gaming stocks is attractive, giving the Macau gaming industry an "overweight" rating, investors can prefer market share with growth potential, as well as valuation relative to the same industry discount gaming stocks.。With the gradual stabilization of the mainland economy, the steady demand for travel in the mainland and the gradual return to normal traffic, it is expected that Macau's gaming revenue may increase to 234 billion patacas this year, an increase of nearly 28% over last year and a return to the level of about 80% in 2019.。

The recent overseas early proposal caused the CXO sector share price short-term volatility, Minsheng Securities believes that this risk is small and controllable, the killing of market sentiment brings long-term allocation opportunities.。The proposal was very early, and many of its contents differed significantly from the facts, so the probability of passage was considered very small.。Morgan Stanley's latest report also argues that the market may be allergic to the introduction of the U.S. Biotech Restriction Act and that WuXi AppTec's share price has overreacted to this, providing potential opportunities。The report said that even if the bill becomes law, it would only restrict the outsourcing of projects that receive federal funds to overseas companies.。

Increase or decrease in institutional holdings

On January 25, RR (BVI) Limited reduced its holdings of 10 million shares of Yimei International Holdings at a price of 1 per share, according to HKEx..HK $62, total reduction of HK $16.2 million。The latest number of shares held after the reduction was approximately 55.5 million shares, and the shareholding ratio was changed to 8.89%。

On January 25, Xiaomo increased its holdings in China's 10.97.27 million shares, price per share 72.HK $2,719, with a total increase of approximately 793.HK $020,000。The latest number of shares held after the increase is about 818..110,000 shares, shareholding ratio changed to 7.02%。

New Stock News

According to the Hong Kong Stock Exchange on January 31, Lu Daopei Medical Group (hereinafter referred to as Lu Daopei Medical) submitted a listing application to the main board of the Hong Kong Stock Exchange, with CITIC Securities, China Merchants Bank International and Macquarie as its joint sponsors.。The company submitted its listing application to HKEx on January 3 and July 5, 2023.。

According to Frost & Sullivan, in terms of revenue in 2022, Lu Daopei Medical is China's largest provider of blood disease healthcare services, with a market share of 6.4%。As of December 31, 2022, the Company had the largest number of registered beds and HSCT (hematopoietic stem cell transplantation) positions for patients with hematological diseases。

According to the same source, the company is the second largest hematopoietic stem cell transplant participant in China based on the number of hematopoietic stem cell transplant cases in 2022, with a market share of 6.6%, and in China's hematopoietic stem cell transplantation services market, in 2022 the company is China's largest allogeneic hematopoietic stem cell transplantation participants, market share of 9.4%, the second most concomitant hematopoietic stem cell transplantation participants, with a market share of 10.2%。In terms of revenue generated by the blood disease screening service in 2022, the company is also the top three provider of the service in China, with a market share of 7.8%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.