China Resources Power 2022 net profit soared more than 2 times! Announced the proposed spin-off of China Resources New Energy to return to A-share listing.

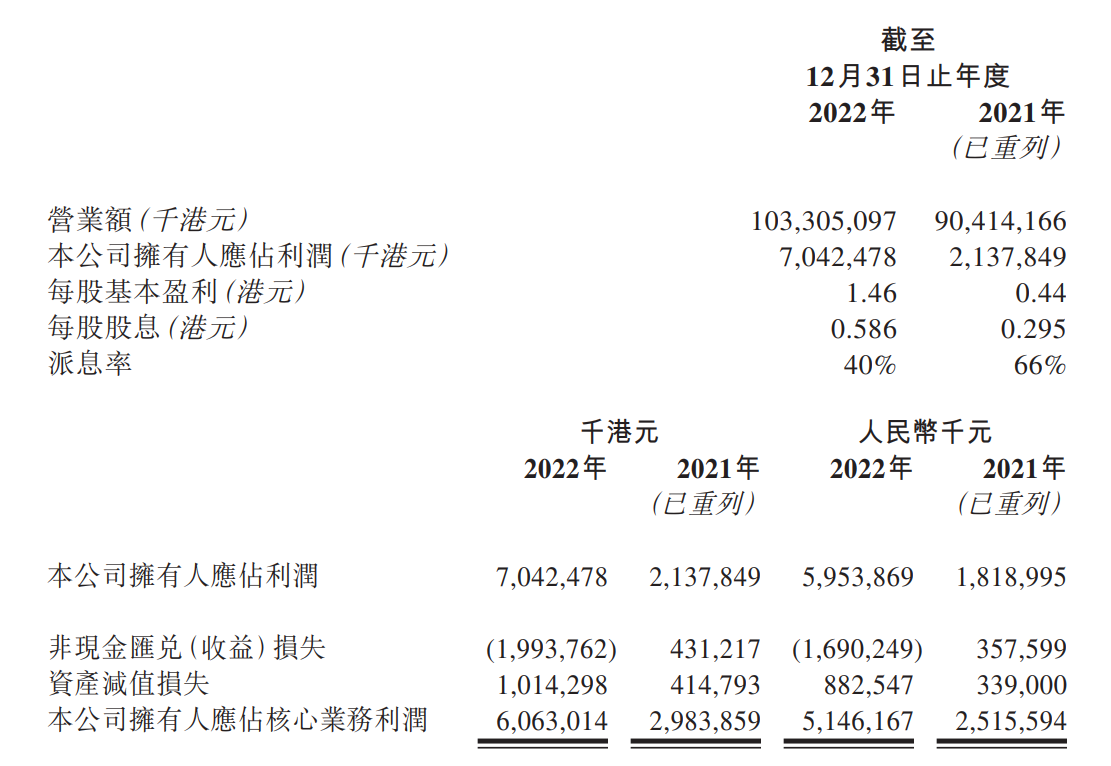

March 22 (Wednesday), China Resources Power released 2022 annual results announcement。The company's operating income in 2022 reached HK $103.3 billion, up 14.26%; net profit of 70.HK $4.2 billion, up 229% YoY.4%。

March 22 (Wednesday), China Resources Power released 2022 annual results announcement。The company's operating income in 2022 reached HK $103.3 billion, up 14.26%; net profit of 70.HK $4.2 billion, up 229% YoY.4%。

Rising electricity prices drive profits to skyrocket Renewable energy projects help again

China Resources Power said the company's operating profit in 2022 was 135.HK $5.1 billion, up 75% from a year earlier.HK $2.2 billion, up 124% YoY.8%。The company said the rise in operating profit was mainly influenced by five factors.。First, the average feed-in tariff of the company's affiliated coal-fired power plants, excluding taxes, increased year-on-year;。

To split China Resources New Energy to return to A-share listing path clear to help achieve dual-carbon targets

China Resources Power announced that the board of directors is planning to spin off China Resources New Energy in the domestic stock exchange initial public offering of A shares and listing.。China Resources New Energy mainly invests, develops, operates and manages wind farms and photovoltaic power plants in China.。

China Resources Power also said that the company has developed a carbon-neutral action plan to provide path guidance for achieving its carbon-neutral and carbon-neutral goals.。The ways to reduce carbon emissions include: vigorously developing renewable energy; strictly controlling new coal-fired power units; reducing coal consumption by increasing heating, biomass coupling and technological transformation; and actively trying carbon capture, application and storage technologies.。In addition, the company will actively assist industrial and commercial users and government agencies to improve energy efficiency, accelerate the expansion of rooftop photovoltaic construction, help users and the whole society to use renewable energy, reduce carbon emissions, and cooperate with users to try low-carbon, zero-carbon project construction.。

Net profit far exceeds CICC's expectations. Investment banks are optimistic about Rundian's future.

Before China Resources Power disclosed its results, CICC released a research report saying that it maintained China Resources Power's "outperform industry" rating, but took into account higher-than-expected fuel costs and weaker-than-expected wind conditions in 2022, so it significantly lowered the company's 2022 net profit of 38.7% to 52.HK $6.2 billion with a target price of 22.HK $5, 38% upside from current share price。It is worth noting that China Resources Power reported a net profit of 70% after its performance..HK $4.2 billion, well ahead of CICC expectations。

Daiwa, on the other hand, released a research report saying that at the analyst meeting, China Resources Power was confident about the recovery in subsidies because it did not receive any information from the government about cutting electricity prices or subsidies.。The bank believes that this was the only positive surprise in the analyst meeting, but the company's optimistic comments may only be more beneficial to its renewable energy independent power plants, rather than Runpower itself.。

In addition, the bank also said that at the meeting, China Resources Power only said that the current task is to maintain a stable dividend, and did not mention the spin-off of China Resources New Energy in the A-share listing details.。As a result, Daiwa maintained China Resources Power's "hold" rating unchanged and lowered its 2023-24 earnings per share forecast by 8% to 11%, lowering its target price from 18.HK $5 lowered by 2.7% to HK $18。

Bank of America Securities, on the other hand, compared China Resources Power to Huaneng International Power, another energy stock listed in Hong Kong, and said it was more optimistic about the former because of its lower perpetual bond size, lower debt level, higher return on invested capital, lower asset impairment cost burden and lower carbon transaction costs.。As a result, the bank raised its target price for China Resources Power slightly from HK $18 to HK $18..HK $6 and reiterates its "Buy" rating。

Changjiang Securities said that in the electricity price increase superimposed on the improvement of the implementation of the long-term association of electricity and coal is expected, thermal power is expected to usher in a performance reversal in 2023, in addition to the photovoltaic industry chain in all aspects of the obvious price decline, constraints on new energy installed capacity and yield factors can also be improved。In the long term, the company's ambitious renewable energy plan will be a core driver of long-term growth, with current valuation levels offering room for upside。Under the dual beta market of thermal power and green power, China Resources Power, which has high assets, is also expected to usher in better market performance.。

By morning close, China Resources Power edged up 1.32% at 16.HK $94。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.