Chow Tai Fook 2024Q1 Conservative Ending Management Still Optimistic in Face of High Base Pressure?

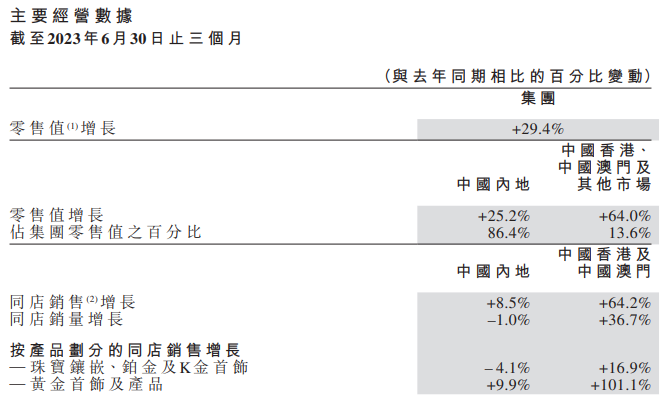

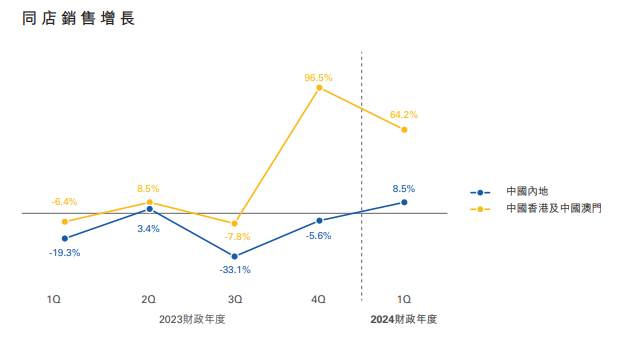

On July 10, Chow Tai Fook announced its first quarter fiscal 2024 results.。Performance data show that the overall retail value of Chow Tai Fook FY2024Q1 increased by 29.4%, the mainland retail value increased by 25.2%, same-store sales growth 8.5%, same-store sales fell 1.0%; retail value growth in Hong Kong, Macau and other markets 64.0%, same-store sales growth 64.2%, same-store sales growth of 36.7%。

On July 10, jeweler Chow Tai Fook announced its performance data for the three months ended June 30, 2023 (first quarter results report for fiscal 2024)。Data show that the overall retail value of Chow Tai Fook FY2024Q1 increased by 29.4%, the mainland retail value increased by 25.2%, same-store sales growth 8.5%, same-store sales fell 1.0%; retail value growth in Hong Kong, Macau and other markets 64.0%, same-store sales growth 64.2%, same-store sales growth of 36.7%。

Opening up after the epidemic to welcome income-generating gold jewelry mixed

According to the report, Chow Tai Fook's consumption recovery in the first quarter was in line with expectations, and the growth of store efficiency in mainland franchisees was encouraging, while the Hong Kong and Macao markets maintained a high growth momentum.。It is worth mentioning that the liberalization of the mainland's epidemic policy has boosted the mobility of people and the continued recovery of retail activity, thus stimulating Chow Tai Fook's same-store sales growth in the first quarter.。On this basis, the mainland same-store sales revenue of 8.5 percentage point rise and continued to rise from the first two quarters。The reopening of mainland border crossings is also directly conducive to a significant increase in same-store sales in Hong Kong and Macau。

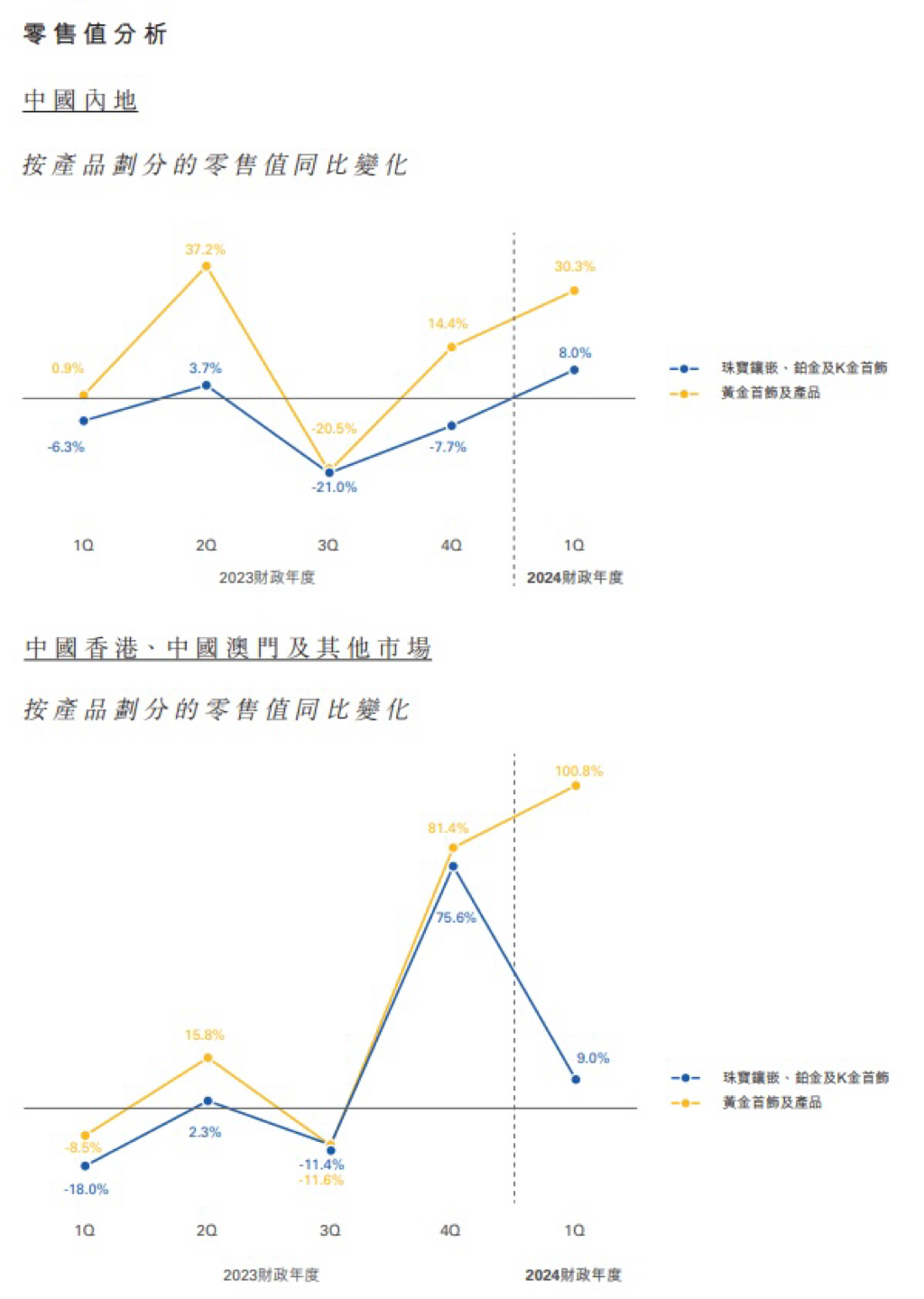

According to product data, same-store sales in the Mainland jewelry inlay, platinum and K-gold jewelry categories fell 4% in the quarter..1%, an increase of 16% over the same period in Hong Kong and Macao..9% is not satisfactory.。In terms of retail value, similar stores in the Mainland increased by 8.Hong Kong and Macao, on the other hand, maintained a strong growth trend, mainly due to a steady increase in sales and prices of such commodities.。As for gold jewelry and products, same-store sales in the Mainland rose by 9% during the quarter..9%, while similar same-store sales in Hong Kong and Macau more than doubled significantly to 101.1%。

According to statistics, the average selling price of similar stores in Chow Tai Fook Mainland remained at HK $5,500 (HK $5,300 for the same period in FY2023) during the quarter, while similar stores in Hong Kong and Macau increased the proportion of gold products sold by weight and the average international gold price during the quarter was 5% higher than the same period last year..6%, resulting in its average selling price rising to HK $8,300 (HK $6,100 for the same period in FY2023), higher than that of priced gold products, and sales of priced gold products are limited by the high base problems left over from the previous quarter, Hong Kong and Macao gold jewelry and products overall look strong momentum.。

In addition, Chow Tai Fook published an analysis of retail values by product in the Mainland, Hong Kong and Macau.。Mainland Jewelry Inlay, Platinum and K-Gold Jewelry and Gold Jewelry and Accessories Contributed Retail Value respectively 19.1% and 76.4%, up 8% year-on-year with 30.3%。Among them, diamond jewelry contributed 55% of the retail value of jewelry inlay, platinum and K-gold jewelry..0% (same period FY2023 59.0%)。Hong Kong and Macao jewelry inlay, platinum and K-gold jewelry and gold jewelry and accessories contributed to retail value 18.1% and 75.7%, up 9.0% and 100.8%。Among them, diamond jewelry contributed 66% of the retail value of jewelry inlay, platinum and K-gold jewelry..1% (same period FY2023 70.3%)。

Five Strategies Focus on Profitability Recovery Management Confidence Undiminished

It has been revealed that Chow Tai Fook's management said that the mainland business will continue to face high base pressure in the second quarter of fiscal 2024 due to better same-store sales growth in April-June and excellent performance in the gold jewelry category.。However, in view of the company's next focus on profitability, Chow Tai Fook Group will continue to promote five strategies (enhance brand, optimize products, digital upgrades, optimize operational efficiency, strengthen personnel training), strengthen cost control, and commit to the continued improvement of core business operating margins.。

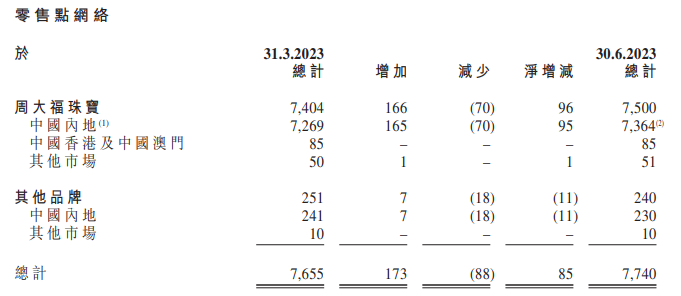

The report also showed that during the quarter, Chow Tai Fook's national retail outlets network added a net 85 to a total of 7,740 by the end of the quarter.。Its steady pace of opening stores and the rise in store efficiency stimulated the increase in the contribution of retail value of its franchisees during the quarter.。

In addition, Chow Tai Fook management also claimed that the company remains focused on profitability, despite the poor product mix, but through active price control, fee control, is expected to continue to improve profit margins.。And stressed that based on the grim situation from July to the present, the plan will have a negative impact on same-store sales growth in the second fiscal quarter ending September.。However, due to the company's strategic shift to improve the quality of operations, the continued recovery of end consumption, which will not hinder Chow Tai Fook to achieve fiscal 2024 same-store sales growth, full-year retail point network net increase to 600 to 800 and core operating margin expansion of 50% to 80% of the pace.。In this regard, the management expressed confidence。

Q1 performance conservative major banks tend to maintain stability

In response to Chow Tai Fook FY2024Q1 performance data, major banks have made adjustments to their target prices and ratings。

Among them, Citi released a research report saying that Chow Tai Fook's same-store sales in the mainland increased by 8% in the first fiscal quarter to the end of June..5%, less than the bank's expectations, mainly due to the high base in June last year, while the same-store sales in Hong Kong and Macau increased by 64 percentage points, meeting the bank's expectations.。In addition, in the face of Chow Tai Fook management's full confidence in the performance of the climb, Citi said it is willing to maintain the company's earnings recovery expectations, recognized its 5% dividend return and current valuation level, to its "buy" rating, target price of 18.HK $1。

Daiwa released a report saying that Chow Tai Fook had a net increase of 85 retail outlets in the first quarter of 2024.。In the face of the company's high base in the second quarter of fiscal 2024, as well as the market's psychological expectations of management's conservative planning, Daiwa still believes that Chow Tai Fook's potential for market share growth in the fiscal year and the long term is "solid," and predicts that pent-up demand will be released in the second half of the year.。

However, through careful consideration of retail store network expansion and product mix changes, Daiwa lowered its forecast for Chow Tai Fook's FY2024-26 earnings per share and slightly lowered its price target from HK $18 to HK $17..HK $4, Reiterates Its "Buy" Rating。

Goldman Sachs noted that Chow Tai Fook's same-store sales in Hong Kong and Macau in the first quarter of fiscal 2024 exceeded the bank's expectations of 60% year-on-year growth and equaled 71% of the same period in 2018, comparable to the previous fiscal quarter and April-May, thanks to same-store sales growth of 36.7%。The year-on-year growth in mainland same-store sales was also higher than the bank's expectation of 5%, equivalent to 11% of the same period in 2019, but same-store sales fell 1%.。

The bank believes that Chow Tai Fook's net growth in retail outlets in the mainland in the first quarter was lower than the bank's half-year forecast of 260, while the company's management still believes it is on track to achieve its full-year net growth target。As such, while Goldman Sachs is bullish on Chow Tai Fook's strong momentum in June and the effectiveness of year-to-date cost controls, it has decided to maintain its price target of 14 in view of adverse factors such as increased competition, a higher base and weakening consumer spending power in the second quarter and holidays, and has decided to be conservative about the company's same-store sales recovery and store expansion..HK $3, rated "Neutral"。

Lyon also reported that Chow Tai Fook's first quarter same-store sales growth in the Mainland and Hong Kong and Macau were in line with the bank's full-year expectations, even under the adverse impact of a high base; the company's downward trend in mainland same-store sales growth in June is expected to continue into the next quarter, also in line with its expectations。As a result, Lyon said it would maintain its forecast for 4% and 45% growth in same-store sales in the Mainland, Hong Kong and Macau, and forecast a dividend return of 4% for Chow Tai Fook in fiscal 2024..6%, while maintaining its "buy" rating with a target price of 16.HK $7。

Boosted by the company's business strategy cautious and market heat recovery and other positive factors, Chow Tai Fook opened high today, as of press time, Chow Tai Fook rose nearly 5%, now reported 13.4 Hong Kong dollars。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.