U.S. April PMI data "burst" gold briefly fell to the 1980 mark debt problem is hotly debated.

On the evening of April 21, the U.S. Markit manufacturing and services PMI data for April were both released, with the manufacturing PMI recording an initial value of 50.4, breaking the 50 cut-off point。After the data was released, the dollar index pulled up 0 in the short term..29% at 101.98。

Things change again ahead of Fed's May policy meeting。

Purchasing managers' data to good manufacturing PMI initial value breakthrough 50 demarcation point dollar index short-term pull up

On the evening of April 21, the U.S. Markit Manufacturing and Services Purchasing Managers Index (PMI) preliminary data for April were both released, with the manufacturing PMI preliminary value recording 50.4, exceeding the expected value of 49.0 and previous value 49.2; initial service PMI recorded 53.7, also better than expected and previous values; composite PMI initial value announced at 53.5, also higher than the predicted value 51.2 and previous value 52.3。

The PMI data is published by market research firm Markit, also known as the Purchasing Managers Index, expressed as a percentage, often with 50% as the cut-off point for economic strength, and when the index is above 50%, it is often interpreted as a signal of economic expansion.。When the index is below 50%, especially when it is very close to 40%, there are worries of economic depression.。

Data show that the initial value of the manufacturing PMI exceeded the 50 cut-off point, representing the overall business environment and economic conditions in the United States to maintain resilience, the overall development of the U.S. manufacturing industry overall to the good。

After the data was released, the dollar index pulled up 0 in the short term..29% at 101.98。

Gold is short-term should fall 0..06%, comparable to the 1990 mark, reported 1990.$77 / oz, after briefly falling below the 1980 mark, at a low of 1971..62 USD / oz。

Before the silence period, Fed officials spoke out one after another, adding 25 basis points to the probability of nearly 90%.

As the May policy meeting approaches, Fed officials are increasingly vocal, and next week, the Fed will enter its regular silence period ahead of the rate meeting。

On April 12, FOMC Vote Committee, Chicago Fed Chairman Goolsbee (Austan Goolsbee) took the lead in saying that the Fed should remain cautious and avoid overly aggressive rate hikes。He said that the financial pressure caused by the collapse of two regional banks in the United States in mid-March has not subsided, may have a "substantial impact" on the real economy, the Fed needs to take this into account.。

A week later, Philadelphia Fed President Patrick Harker, who also has a vote, also said that the Fed's policy rate is close to the level it wants to reach and needs to be careful and cautious in times of uncertainty.。

On the other side, the Fed's famously hawkish St. Louis Fed Chairman Brad (James Bullard) said this week that the Fed should continue to raise interest rates, because recent data show that (anti) inflation has not made significant progress, and the overall U.S. economy seems to continue to grow, even if the growth rate will slow down.。He also called for the policy rate to rise by another 50 basis points to 5 basis points from its current level..50% -5.Between 75%。The comments undoubtedly startled the market in a cold sweat, with gold plunging more than $10 in the short term.。

Although Brad does not have the right to vote in this round of policy meetings, his hawkish colleagues, Fed Governor Christopher Waller (Christopher Waller), and New York Fed President Williams (John Williams) are expected to vote for a rate hike at the meeting.。Among other things, Waller said that recent data show that the Fed is not making much progress on its inflation target and that interest rates need to rise further.。Williams expressed the same view, saying that U.S. inflation remains too high and that the Federal Reserve will act to reduce inflation.。

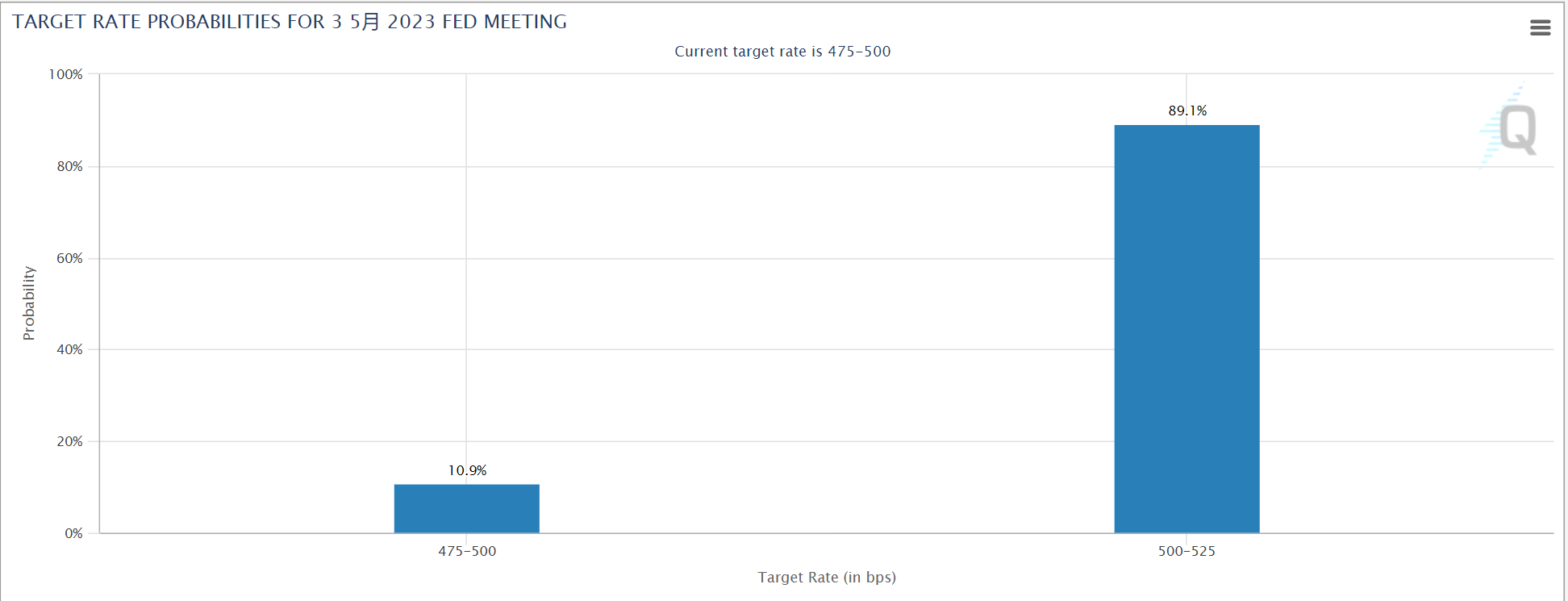

At 2: 00 a.m. Beijing time on May 4, the Federal Reserve will announce the U.S. to May 3 Fed interest rate decision (cap)。According to CME Fed Watch, the probability of the Fed raising interest rates by 25 basis points in May has reached 89 as of press time..1%。

Markets expect the Fed to raise interest rates by 25 basis points at its May policy meeting before pausing this unprecedented cycle of aggressive rate hikes。

Debt default doubts remain or affect the presidential election year debate.

On the eve of this meeting, the U.S. debt crisis is getting worse.。

This week, Goldman Sachs and JPMorgan Chase have warned investors that the U.S. could hit the debt ceiling sooner than expected as weak taxes overlaid with preannounced selling pressure on money market funds。Goldman Sachs expects the U.S. debt ceiling "X-day" will be reached as early as the first half of June; Xiao Mo said the U.S. will encounter the U.S. debt crisis as early as May, the bank also said that the U.S. Treasury Department is expected to run out of available resources by mid-August。

The debt ceiling is the maximum amount of money the U.S. government can borrow to meet its financial obligations.。Once the debt ceiling is reached, the U.S. Treasury can no longer issue any notes or bonds and can only pay for Treasury bills through tax revenues.。

U.S. debt problems continue to ferment, gradually attracting market attention。

On Wednesday, Bridgewater Fund founder Dalio (Ray Dalio) published an op-ed in LinkedIn that the current level of U.S. debt has reached unsustainable heights, laying a major risk to the financial system.。He said that while interest rates (and a tight enough monetary and credit policy) appear to be high enough to fight inflation and provide sufficient real returns for lenders / creditors, borrowers / debtors will suffer.。This means that the financial system is close to the brink of a 'great restructuring'。

In addition, Tesla CEO Elon Musk, who has recently become increasingly concerned about politics, also said on social media that a default is only a matter of time, given the federal government's spending.。

On the one hand, the Federal Reserve in May to raise interest rates by 25 basis points seems to have been basically a certainty; on the other hand, although the government debt default is defined as a "low-risk event," but the cumulative long-standing and huge debt ceiling like the sword of Damocles hanging over the U.S. economy, has caused more and more people's concerns.。

On Monday, House Speaker Kevin McCarthy warned that the U.S. debt is a time bomb that will explode unless we take serious and responsible action.。On Wednesday, he unveiled a 2023 bill called Limit, Save, and Grow, which plans to raise the federal government's debt ceiling by another 1.$5 trillion, or an extension of the debt ceiling moratorium until the end of March 2024, and calls on the Biden administration to negotiate。

If the two reach an agreement to extend the debt ceiling moratorium, it means that the U.S. government can continue to borrow indefinitely without the ceiling during this period.。This is undoubtedly a stopgap measure, the debt ceiling issue has not been effectively resolved, but postponed to the second quarter of next year。By then, in the middle of a presidential election year, the two parties are expected to erupt into a heated discussion on the issue。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.