Geely's total annual revenue increased 46% year-on-year to a new high, but major banks are still worried about its gross profit margin.

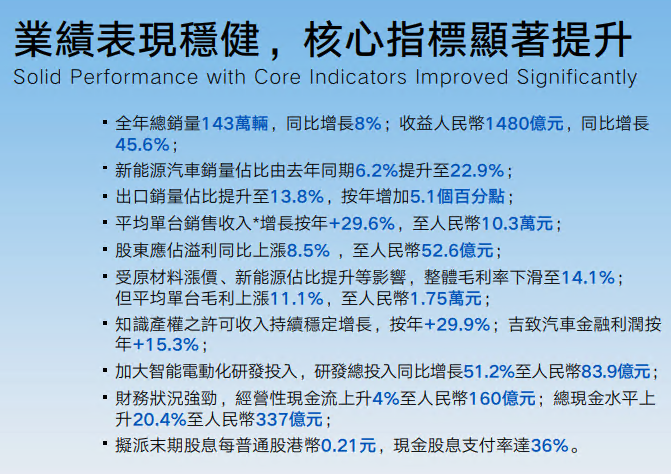

On March 21, Geely announced its 2022 annual results report。According to the financial report data, Geely's total revenue for 2022 increased 46% year-on-year to 148 billion yuan (RMB, the same below), a record high.。

On March 21, Geely announced its 2022 annual results report。According to the financial report data, Geely's total revenue for 2022 increased 46% year-on-year to 148 billion yuan (RMB, the same below), a record high;.5% up to 52.600 million yuan, overall higher than market expectations。Due to external factors such as raw material price increases, Geely's overall gross margin will also be impacted in 2022, falling to 14.1%。

In terms of products, Geely's total annual cumulative sales in 2022 will reach approximately 143.30,000 vehicles, up about 8% year-on-year; new energy vehicle sales accounted for 6.2% to 22.9%; export sales increased to 13%.8%, up 5.1 percentage point; average bicycle sales revenue increased by 29.6% to 10.30,000 yuan。Company's average bike gross margin up 11.1% to 1.750,000 yuan。

The report also mentioned that Geely Automobile's product structure continued to be optimized and adjusted for the whole of last year, with a significant increase in bicycle sales revenue, but due to the increase in raw material prices and a significant increase in the proportion of new energy vehicles, the company's gross profit margin in the second half of the year was lower than expected, down 3.2% to 13.8%。In this regard, Geely Automobile said that in 2022, the group will be the focus of new energy transformation as a business focus, geometric and polar krypton brands in sales to achieve rapid growth.。However, due to the significant increase in the cost of batteries, chips and other components, as well as the impact of a large amount of investment in the early development of the new business of polar krypton, profitability was under pressure during the period.。

At the earnings meeting, Geely CEO and Executive Director Gui Shengyue also said that the auto industry needs scale, and only scale can generate profits.。Geely in the process of comprehensive transformation to new energy, scale will gradually show great advantages。Once the formation of scale effect, will constitute a lot of peers do not have the advantage of differentiation, which is Geely is confident in the new energy track "catch up" of the bottom line.。

However, Daiwa released a research report saying that Geely's results in the second half of last year were in line with expectations and that its gross margins are expected to continue to be under pressure this year and continue to face fierce price competition.。Therefore, the bank lowered Geely's net profit for fiscal year 2023-24 by 7% / 10% respectively.。and set its target price from 11.HK $5 to 10.3 Hong Kong dollars。

In addition, Credit Suisse also released a research report saying that Geely's only shortcoming is that its gross profit margin fell 3% year-on-year in the second half of last year..2% to 13.8%, less than expected。Therefore, the company's target price is 13..HK $8 down to HK $13, but rating remains "OUTPERFORM."。

It is worth noting that, as of press time, Geely Automobile rose nearly 3.16%, now 9.HK $8。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.