Hawkinsight Hong Kong Market Closing Roundup (1.25) | The Hang Seng Index rose three times in a row, and the reduction in crude oil inventories boosted the oil sector.

On January 25, the three major indexes of Hong Kong stocks continued to rebound again, and the whole day was volatile and strong, ushering in three consecutive gains.。Hang Seng Index closes up 1 at close.96%, reported 16211.96 points。

On January 25, the three major indexes of Hong Kong stocks continued to rebound again, and the whole day was volatile and strong, ushering in three consecutive gains.。Hang Seng Index closes up 1 at close.96%, reported 16211.96; Hang Seng SOE Index closes up 2.16%, at 5468.71 points; Hang Seng Tech Index closes up 0.9%, at 3310.69 points。

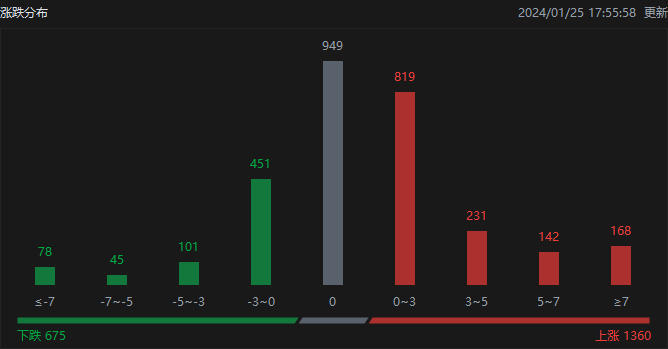

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 1,360, fell 675, and closed flat at 949.。

On the day of the Hong Kong stock market, North Water traded a net buy of 18.HK $1.7 billion, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 5.HK $5.3 billion, Hong Kong Stock Connect (Shenzhen) net buy 12.HK $6.4 billion。

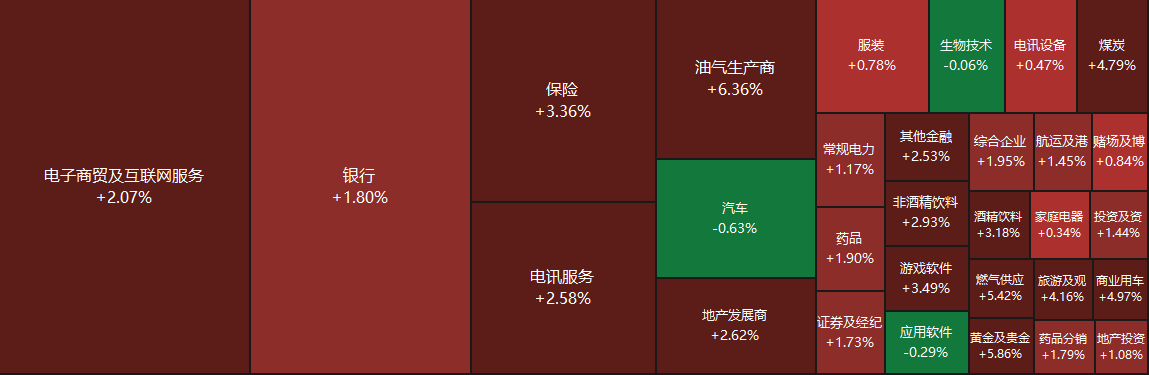

Sectors and Fundamentals

From the disk point of view, the network stocks mixed, NetEase rose nearly 4%, Jingdong, Tencent rose more than 3%, Baidu rose nearly 2%, Alibaba rose more than 1%, beep mile beep mile fell nearly 3%, the United States group fell more than 1%;。On the other hand, due to the poor performance of Tesla Q4 triggered market concerns, new energy vehicle stocks are generally under pressure;。

Fundamentally, data released on Wednesday showed that US EIA crude oil inventories fell 923 in the week ending January 19..30,000 barrels, far exceeding market expectations of a reduction of 2.15 million barrels。On the same day, the People's Bank of China said it would cut the reserve requirement ratio by 0 on February 5..5 percentage points to provide long-term liquidity to the market of about 1 trillion yuan.。Analysts point out that China is taking measures to support the economy and oil prices are expected to be supported。In intraday trading on Wednesday, WTI crude oil prices rose to their highest level since December 26 last year to above $75 a barrel, while Brent crude oil prices remained above $80 a barrel.。

The Central Bank and the General Administration of Financial Supervision jointly issued the Notice on Doing a Good Job in the Management of Business Property Loans (hereinafter referred to as the Notice), detailing the requirements for the management caliber, term, amount and purpose of commercial banks' business property loans.。Guotai Junan believes that in the short term, the policy intensive introduction can be expected, is expected to bring good to the development sector, at the same time, the promotion of restructuring will also get more favorable conditions.。

On Wednesday (January 24) after the U.S. stock market, Tesla announced its full-year earnings for the fourth quarter of 2023.。Financial data show that in the fourth quarter, Tesla achieved revenue of 251.$6.7 billion, below market expectations of 256.$200 million, up 3% year-over-year, Tesla's slowest pace of growth in more than three years。In terms of earnings, Tesla reported adjusted earnings per share of 0.71 dollars, the market expected 0.73 美元。Adjusted net profit was 24.$8.5 billion, against Wall Street expectations of 26.100 million dollars。The market's most concerned gross margin fell further in the fourth quarter to 17..6%, below Wall Street expectations of 18.1%, the lowest level since 2019。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on January 19, Xiaomo increased its holdings of Ganfeng Lithium 131.89.24 million shares, price per share 24.HK $6,817, with a total increase of approximately 3,255.HK $330,000。The latest number of shares held after the increase is about 4509..460,000 shares, with a change in shareholding to 11.17%。

On January 19, Xiaomo increased its holdings of mobile cards 125.13.97 million shares, price per share 13.HK $8,122, with a total increase of approximately 1,728.HK $450,000。The latest number of shares held after the increase is about 4581..540,000 shares, with the shareholding ratio changed to 100,000.27%。

On January 19, Xiaomo reduced its holdings of Samsonite 254.03.49 million shares, price per share 22.HK $5,797, total reduction of approximately 5,736.HK $0.03 million。The latest number of shares held after the reduction is about 8553..480,000 shares, with the shareholding ratio changed to 50,000.90%。

On January 19, BlackRock increased its stake in Conch Venture 1473.350,000 shares, price per share 5.HK $8,215, total increase of approximately 8,577.HK $110,000。The latest number of shares held after the increase is about 9,132..580,000 shares, with the shareholding ratio changed to 5.04%。

On January 19, BlackRock reduced its holdings of WuXi AppTec 111.69.27 million shares, price per share 78.HK $3,646, total reduction of approximately 8,752.HK $750,000。The latest number of shares held after the reduction is about 2676..07 million shares, with the shareholding ratio changed to 6.91%。

New Stock News

Star Charge, a Chinese electric vehicle charging equipment provider, is reportedly considering an initial public offering in Hong Kong to raise about $500 million (about HK $3.9 billion).。The company, registered as Wanbang Digital Energy, is arranging a listing with CICC and CMB International, which could take place as soon as this year, with Guotai Junan International and JPMorgan Chase also involved.。Reports indicate that the company may seek a $5 billion valuation when it goes public。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.