Hawkinsight Hong Kong Market Closing Roundup (2.20) | The Hang Seng Index rose slightly. A new round of price war has started. Auto stocks continue to be under pressure.

On February 20, the three major indexes of Hong Kong stocks opened higher and lower in early trading, and began to pick up in the afternoon.。By the close, the three major indexes had turned red, with the Hang Seng index closing up 0.57%, reported 16247.51 points。

On February 20, the three major indexes of Hong Kong stocks opened higher and lower in early trading, and began to pick up in the afternoon.。By the close, the three major indexes had turned red, with the Hang Seng index closing up 0.57%, reported 16247.51 points; Hang Seng SOE Index closes up 0.63%, reported 5519.23 points; Hang Seng Tech up 0.35%, at 3264.4 points。

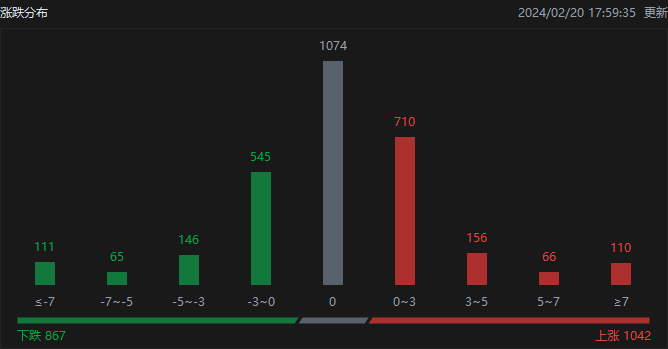

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 1042, fell 867, and closed flat at 1074.。

On the day of the Hong Kong stock market, North Water traded net buy 34.HK $7.1 billion, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 29.HK $800 million, Hong Kong Stock Connect (Shenzhen) net buy 4.HK $9.2 billion。

Sectors and Fundamentals

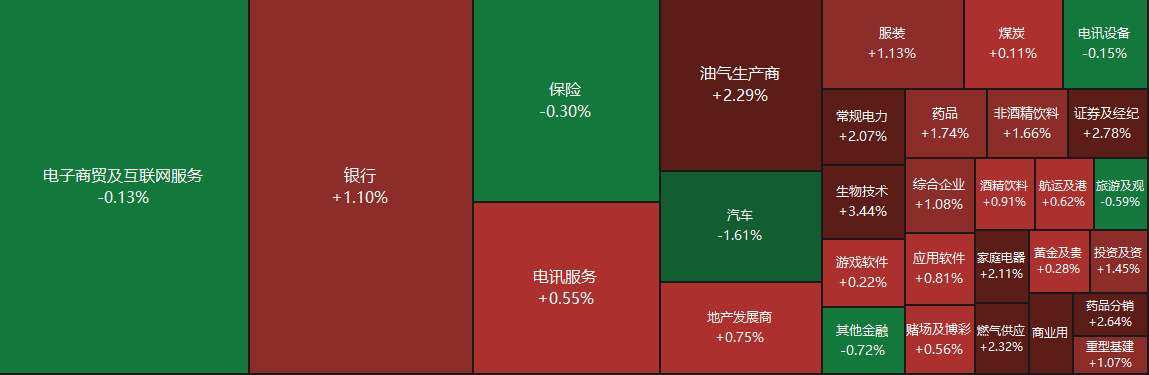

From the disk point of view, today's science and network stocks mixed, fast hand, beep mile up more than 1%, the United States, Ali, Netease, Baidu rose slightly, Jingdong, Tencent fell slightly;。On the other hand, pharmaceutical stocks today's performance is strong, in which the drug Ming United rose more than 17%, the drug Ming Kant rose nearly 8%, the drug Ming biological rose nearly 4%, oil stocks rally continued, power stocks strengthened again。

Fundamentals: pharmaceutical stocks strong throughout the day。It is reported that WuXi AppTec recently issued a clarification announcement again in response to the previous "four U.S. lawmakers sent a letter to the U.S. government department requesting sanctions on the drug system," reiterating that "WuXi AppTec has not in the past, is and will not pose a national security risk to the United States, even if the U.S. government again reviews the company will come to the same conclusion."。In addition, WuXi AppTec mentioned that the company does not have a human genomics business, and existing businesses do not collect human genome data.。Citicorp pointed out that both houses have similar bills in progress, but are in the early stages, follow-up progress and potential impact still need to continue to observe, the major companies involved in the bill are also to clarify the inaccuracies.。

Power stocks strengthen again。The National Development and Reform Commission and the Energy Administration recently jointly issued the Notice on Establishing and Improving the Market Price Mechanism for Power Auxiliary Services, and the relevant policies will be implemented from March 1, 2024.。The Notice mainly includes: optimizing the trading and price mechanism of peak shaving, FM, standby and other ancillary services; regulating the price transmission of ancillary services; and strengthening policy support.。In addition, Tianfeng Securities noted that thermal power profitability will continue to improve further in 2024.。Specifically, affected by the coal price base, etc., the degree of performance improvement in the first half of the year may be more significant than in the second half of the year.。Along with the improvement of thermal power profitability, the level of dividends of each company may increase, thus driving the attractiveness of thermal power in dividends.。

A new round of price war forces auto stocks to remain under pressure。On February 19, BYD announced that the Qin PLUS Glory Edition of Dynasty Network was officially listed, with an official guide price of 7.From 980,000 yuan。At the same time, Wuling, Changan Automobile, Nezha Automobile, Beijing Hyundai, SAIC-GM and other car companies have joined the price war, collectively announced a number of models of large price cuts。Cui Dongshu, secretary-general of the Federation of Passenger Cars, said that in 2023, the national new energy passenger car market sales reached 8.88 million units, which has exceeded the overall sales scale of the national passenger car market in 2009, while the national passenger car sales in 2017 peaked at 24.2 million units in stages.。In the next few years of rapid growth, 2024 is a key year for new energy vehicle companies to gain a foothold, and competition is destined to be very fierce.。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on February 9, UBS reduced its holdings of Far East Hongxin 1160.50,000 shares, price per share.HK $94, with a total reduction of approximately 6,893.HK $370,000。The latest number of shares held after the reduction is about 5..1.6 billion shares, shareholding changed to 11.96%。

On February 15, U.S. Capital Group increased its holdings of WuXi AppTec 97.550,000 shares, price per share 38.HK $4,330, with a total increase of approximately 3,749.HK $140,000。The latest number of shares held after the increase is about 3509..510,000 shares, with the shareholding ratio changed to 90,000.07%。

New Stock News

None

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.