China Ping An Q1 handed over satisfactory "answer sheet" net profit increased by nearly 50% year-on-year!

On April 27, China Ping An AH shares rose.。On the news, Ping An of China announced its first quarter 2023 results late yesterday (April 26), with solid operating results.。

On April 27, China Ping An AH shares rose.。The company's A-shares hit the daily limit several times from 14: 00 p.m. to 15: 00 p.m. for the first time in eight years, with turnover of more than 12.6 billion yuan, closing at 50.37 yuan; H shares also all the way higher today, once approaching 10% in midday, after a slight correction to close at 56.2 Hong Kong dollars。

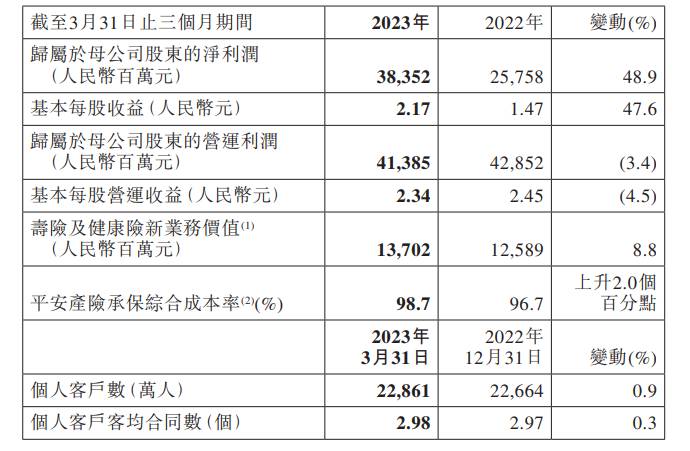

On the news, Ping An of China announced its first quarter 2023 results late yesterday (April 26), with solid operating results.。Financial data show that the company achieved a first-quarter operating profit of 413.8.5 billion yuan (RMB, the same below); net profit attributable to the parent increased by 48% year-on-year..9% to 383.$5.2 billion; basic earnings per share 2.17 yuan, up 47.6%; annualized operating ROE of 18.8%。

Ping An of China performs well on several major business lines。Among them, the value of new business in life and health insurance increased by 8.8%, the agent channel turned positive year-on-year, and the bancassurance channel grew significantly year-on-year; property insurance service revenue 763.1.2 billion yuan, up 7.1%, and the overall underwriting combined cost ratio remained at 98.7% healthy level; Ping An Bank, on the other hand, made a net profit of 146.02 billion yuan, up 1.3.6%, as of the end of March 2023, the non-performing loan ratio of 1.05%, provision coverage 290.40%, risk offset capacity to maintain good。

In response, a number of major banks have issued research reports on their ratings and target prices.。

Among them, Guotai Junan released a research report saying that the value of Ping An's new business in the first quarter increased by 8.8%, greatly exceeding expectations。Among them, the value of new insurance business increased by 2.2%, bancassurance and multi-channel new business value increased 59.9%, life insurance reform brings multiple channels (bancassurance, community grid and other) to increase the contribution of new business value 5.4% to 16.9%。Thanks to the same supply and demand, Ping An raised its full-year new business value growth forecast to 15.6%。

HSBC, for its part, released a research report saying Ping An's first-quarter results showed it was back on track。However, as strong growth in the property and banking sectors was offset by declines in life and health insurance, asset management and technology, the company's first-quarter after-tax operating profit fell 3% year-on-year。The bank expects Ping An's new business value to grow by 13% this year, so it maintains its "buy" rating and target price of HK $73.。

CICC believes that Ping An's new business value has achieved positive growth for the first time in a single quarter after three consecutive years of decline, up 8.8%, exceeding the bank's expectations 1.7%。In addition, net profit increased 48% year-over-year, driven by better-than-expected elasticity on the investment side..9%, exceeding the bank's expectations 2.8%。As Ping An's actual sales momentum is better than CICC's expectations, it raised its new business value growth rate to 14%, maintaining the "outperform industry" rating and target price of 86.3 Hong Kong dollars。

At the same time, CICC once again suggested that Ping An's share price has been significantly weaker than the fundamentals over the past period of time, and believes that the current market for Ping An to hold more negative expectations of the suppression of the share price, is expected to continue to improve after the data gradually improve, the first quarter earnings of the over-expected performance will also provide repair catalysis。

Xiaomo said in the report that after Ping An announced last year's results on March 15, although the company gave positive guidance on the value of new business in the first quarter of this year, its share price did not respond, which may be due to investors' more cautious views on the company's reforms and the uncertainty of financial data under IFRS-17.。However, after the first quarter results, the bank believes that its risk return has improved, the first quarter life insurance new business value growth is very strong, the expected financial impact under IFRS-17 is limited.。

Xiaomo believes that Ping An Life Insurance and Property Insurance in the first quarter of this year, the core solvency adequacy ratio of 120% -172% level, to maintain a stable, taking into account the strong business recovery and flexible earnings performance, the bank believes that the company's current price valuation is not high, so maintain the "overweight" rating, the target price of HK $85。

Citi, for its part, sees Ping An's performance in the first quarter of this year as mixed, with net book value up 9% year-on-year, but after-tax operating profit unexpectedly down 3%。New business value rose 9% YoY to RMB13.7 billion in Q1 2023, supported by 28% first-year premium growth, higher than expected。The bank has a target price of HK $72 and a "buy" rating.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.