China Merchants Bank's total assets at the end of the year broke 10 trillion, executives said real estate risks may be cleared this year.

On March 24, China Merchants Bank released its 2022 annual results announcement。Last year, the bank's operating income was 3,447, according to earnings data..8.3 billion yuan, up 4.08%。

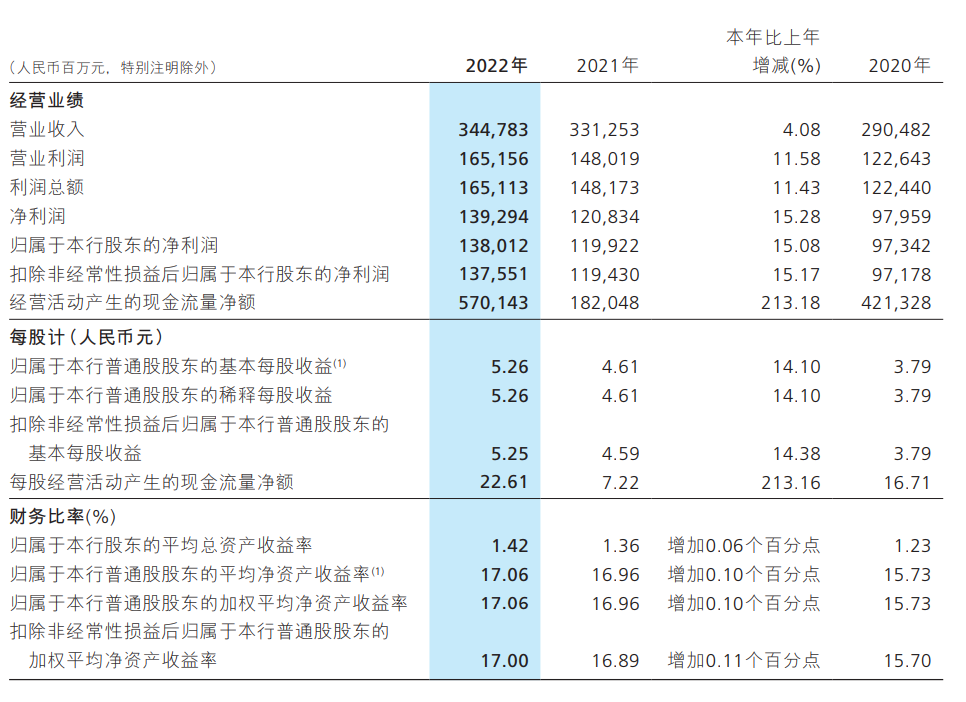

On March 24, China Merchants Bank released its 2022 annual results announcement。Last year, the bank's operating income was 3,447, according to earnings data..8.3 billion yuan (RMB, the same below), up 4.08%; net profit attributable to shareholders 1380.1.2 billion yuan, up 15% year-on-year.08%。As of the end of 2022, China Merchants Bank's total assets of 10.14 trillion yuan, an increase of 9.62%。

In this regard, China Merchants Bank said that in 2022, the company to build "innovation-driven, model-leading, distinctive characteristics of the best value creation bank" as its strategic vision, around the "incremental - revenue - efficiency - value-added" "four increase" value creation chain, and strive to enhance wealth management, risk management, financial technology three major capabilities, high-quality services to the real economy, to help people achieve a better life, committed to customers, employees, shareholders。

By business segment, wealth management business, China Merchants Bank said, the company will comply with the need for explosive growth in the demand for wealth management of residents and the long-term trend of narrowing net interest yield, accelerate the transformation of the model, actively promote the construction of wealth management capacity for the whole customer group, benchmark world-class banks, bigger and stronger wealth management business。As of the end of last year, the company's total retail customers reached 1..8.4 billion households, up 6.36%, total assets (AUM) balance of managed retail customers 12.12 trillion yuan, up 12 from the end of the previous year..68%; 4,312 clients with wealth product positions.930,000, up 14% year-on-year from the end of the previous year..14%; the number of private banking customers exceeded 130,000, and the total asset balance of private banking management customers reached 3.79 trillion yuan, up 11 percent from the end of the previous year..74%。

In terms of loan business, China Merchants Bank has effectively implemented the ESG concept, comprehensively improved the quality and efficiency of serving the real economy, focused on the green economy, manufacturing, scientific and technological innovation, inclusive finance and other directions, and continuously innovated in institutional mechanisms, product systems and service models.。At the end of last year, the company had 252 customers..610,000, up 9% year-on-year from the end of the previous year..02%; green loan balance 3,553.5.7 billion yuan, an increase of 915 from the end of the previous year..1.5 billion yuan, an increase of 34.69%; manufacturing loan balance 4,438.5.2 billion yuan, an increase of 1,237 from the end of the previous year..9.2 billion yuan, an increase of 38.68%, of which medium and long-term loans increased by 54.81%; balance of loans to technology enterprises 2,956.08 billion yuan, an increase of 915 from the end of the previous year..4.7 billion yuan, an increase of 44.86%; balance of loans to inclusive micro and small enterprises 6,783.4.9 billion yuan, an increase of 772 from the end of the previous year..4.9 billion yuan, an increase of 12.85 per cent; inclusive micro and small enterprises have loan balances of 99.070,000, up 7% year-on-year from the end of the previous year..740,000 households, an increase of 8.47%。

In terms of financial technology, the company proposed to build a "digital China Merchants Bank" macro vision, focusing on online, data, intelligent, platform, ecological goals, from customer service, risk management, management, internal operations and other aspects of continuous digital construction.。

In addition, China Merchants Bank also paid full attention to the key issues arising from the company's operations last year.

1.Net interest margin declined

In its report, China Merchants Bank stated that in 2022, the Group's net interest margin of 2.40%, down 8 basis points year-over-year; the company's net interest margin of 2.44%, down 9 basis points YoY。In this regard, China Merchants Bank attributed to the poor performance of the company's asset and liability side.。In terms of asset-side segmentation, in terms of pricing, first, loan yields declined due to the repricing of the stock of floating-rate loans and insufficient financing demand, and second, market interest rates were running at a low level for a longer period of time, resulting in a decline in investment yields;。In terms of the breakdown of the liability side, due to the lack of activation of corporate funds, the growth of low-cost public demand deposits such as corporate settlement funds is restricted, and the conversion of residential investment to regular savings under the disturbance of the capital market, the proportion of demand has decreased.。

2.Non-interest net income slightly down

In 2022, China Merchants Bank achieved net non-interest income of 1,265.4.8 billion yuan, down 0.62%, 36% of operating income.70%, down 1.74%。Net fee and commission income of net non-interest income 942.7.5 billion yuan, down 0.18%, as a percentage of net non-interest income 74.50%; other net income 322.7.3 billion yuan, down 1.87%。Meanwhile, in 2022, China Merchants Bank's big wealth management revenue 491.5.1 billion yuan, down 6.10%。

In this regard, China Merchants Bank said that the decline in net fee and commission income was mainly affected by the performance of key projects, including the year-on-year increase in sales and rates of term insurance, the slowdown in the average daily balance of wealth management products, the decline in wealth management sales rates, the company's pressure-down financing trust products and other factors.。

3.Risk management and control in real estate field

China Merchants Bank adheres to the overall strategy of "clear positioning, stable scale, perfect access, focus on areas, adjust structure and strict management" in the real estate field。Describe business and manage risks in accordance with the principles of marketization and commercialization, taking into account the actual situation of customers and projects.。Rigorous review of cash flow, focusing on the selection of self-financing and commercially sustainable residential projects, supporting rigid and improved housing demand and increasing financial support for housing leasing, and further strengthening post-investment and loan management。In addition, as of the end of 2022, the Company's real estate-related real and contingent credit, proprietary bond investments, proprietary non-standard investments and other business balances that bear credit risk totaled 4,633.3.4 billion yuan, down 9% year-on-year from the end of the previous year..41%; the total balance of the company's business that does not bear credit risk, such as financial capital contributions, entrusted loans, agency trusts actively managed by cooperative institutions, and principal underwriting debt financing instruments, etc. 3,003.5.5 billion yuan, down 27% from the end of the previous year..11%。

At the 2022 annual results presentation meeting of China Merchants Bank, Zhu Jiangtao, vice president and chief risk officer of China Merchants Bank, said that overall, China Merchants Bank's real estate risks will be fully released in 2022, and it is expected that the real estate industry risks will probably be basically cleared in 2023.。

4.Financial products net value fluctuations

Since the full net worth, the net worth performance of financial products has gradually converged with the market.。In the first 10 months of 2022, the overall scale of China Merchants Bank's wealth management products remained stable, and in November 2022, the debt market experienced the biggest sharp decline in nearly two years, triggering fluctuations in the net value of bond funds and bank wealth management products, which had an impact on the overall banking wealth management business, with the net value of some products withdrawing significantly in the short term and the scale of industry wealth management declining to varying degrees.。The balance of wealth management products managed by China Merchants Bank decreased by 4% month-on-month at the end of November and December 2022, respectively..88% and 5.60%。In this regard, China Merchants Bank Wealth Management through the level of product provision, rich wealth management products series and strategies, strengthen product information disclosure and investor appropriateness sales management and other measures, smoothly through the debt market huge volatility period.。However, in 2022, CMB will fully meet its customers' redemption needs for all types of products without any payment risk。

After the announcement of the financial results, the major banks have different opinions on the market outlook of China Merchants Bank.。

Lyon published a research report saying that the development of banking depends entirely on the trust of customers, and the recent global banking turmoil shows that this trust has the potential to disappear quickly。However, China Merchants Bank's 2022 results demonstrated the bank's deep customer trust, as evidenced by strong growth in both its deposits and retail AUM.。At the same time, the bank's balance sheet performance was relatively solid, driven by a combination of improved capital position, reduced real estate exposure and increased reserve coverage.。In terms of profitability, China Merchants Bank's net profit rose 15% year-on-year last year, with shareholder returns rising to 17.06%。Looking ahead to this year, the bank will be a major beneficiary of lower real estate risks and a recovery in consumption.。As a result, Lyon gave China Merchants Bank a "buy" rating and reiterated that it was the industry's first choice, but lowered its target price from HK $75 to HK $67.。

In addition, Bank of America Securities and HSBC Research also gave China Merchants Bank a "buy" rating.。Among them, Bank of America raised its target price to 46.HK $85, HSBC cuts its price target to HK $58。

However, Macquarie published a research report saying that China Merchants Bank's net profit after tax was better than expected, but its loan loss coverage ratio was lower than consensus expectations。Quarterly AUM for the company's wealth management products fell 10% year-over-year due to massive redemptions, and fee income from the business is expected to decline further。The bank said it estimated its adjusted return on equity would be 13 if China Merchants Bank kept its coverage of broad non-performing loans at 2021 levels..1%, compared to 17% in 2022。The bank expects China Merchants Bank's adjusted return on equity to fall to 11 to 12 per cent this year and next, before recovering to 13 to 14 per cent in 2025.。As a result, Macquarie still maintains China Merchants Bank's "outperform" rating.。

As of press time, China Merchants Bank edged down 1.5% at 39.4 Hong Kong dollars。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.