Minshi Group's annual turnover rose 24% year-on-year..3% of major banks have maintained a "buy" rating.

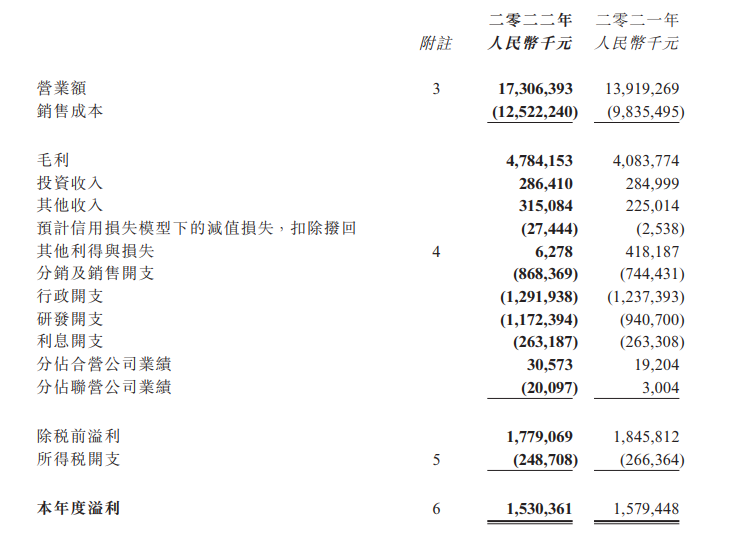

On March 22, Minshi Group released its 2022 annual results report。The results show that the company's turnover during the period increased by about 24.3%, reaching about 173.06 billion yuan。

On March 22, Minshi Group released its 2022 annual results report。Financial results show that the company's turnover during the period increased by 24% year-on-year to 173.06 billion yuan (RMB, the same below); gross profit increased by 17% year-on-year to 4.7.8.4 billion yuan; basic earnings per share 1.304 yuan, compared with 1 in the same period last year..299; proposed final dividend of 0 per share.HK $578。

In this regard, Minshi Group said that the significant increase in turnover was mainly due to the comprehensive mass production of its battery box products in multiple customers and the improvement of its own brand business.。Among them, the group's overseas turnover in 2022 increased by 36% year-on-year, and the outstanding performance of overseas turnover was mainly driven by the business of customers such as BMW, Mercedes-Benz, Volkswagen and GM, as well as the company's new overseas plant production support.。The company achieved a milestone in new business acquisitions in 2022, especially in the battery box business to achieve a major breakthrough, continuous cooperation with key customers。In addition to strong partnerships with existing key customers, the company is also actively capturing new energy vehicle upstarts such as Lucid, Xiaopeng and Ideal.。In addition, the company has expanded to varying degrees in battery box composites, body and chassis components, etc.。The company said it hopes to support sustainable growth with a diversified product portfolio and expanding customer coverage.。

In terms of production layout, Minshi Group continues to carry out forward-looking planning for the production layout of its main factories, and expands and optimizes production capacity in major factories around the world according to local conditions, so as to better respond to the needs of global customers for product development and mass production, while helping the company to further improve its overall operational efficiency.。By the end of last year, the company's newly completed production lines in many parts of the world had achieved full mass production, while continuing to improve existing products and expand capacity.。

It is worth noting that although Minshi Group's full-year results slightly beat expectations, its gross margin deteriorated to 26 in the second half of the year..6%, down 0.4%, down 2.6%。

In this regard, Minshi Group said that the decline in the company's overall gross profit margin was mainly dragged down by factors such as changes in product structure and the increase in the proportion of turnover of overseas companies during the climbing period.。Among them, the gross margin of battery box products has been significantly improved.。

After the earnings announcement, Daiwa released a research report saying that Minshi Group's revenue exceeded expectations last year, while making breakthrough progress in customer acquisition, but may be affected by the size of the battery box, gross margin fell to 26 in the second half of the year..6%。In addition, the bank believes that the increase in new chassis parts production has also dragged down gross margins.。In response, Daiwa maintained its "buy" rating, lowered its target price from HK $35 to HK $30, and lowered its earnings per share forecast for FY2023-2024 to 11% to 16% to reflect the decline in its gross margin.。

UBS said the decline in Minshi Group's gross margin was mainly due to short-term commodities remaining high, rising costs and new overseas plants still in the run-in phase.。The agency said that last year, Minshi received orders for battery boxes from Mercedes-Benz, BMW, Xiaopeng, Ideal Motors and other automakers, which is expected to drive business revenue from battery boxes to 3 billion yuan this year.。Although the acceleration of mass production and new projects to promote the scale effect, can bring support for the recovery of profit margins, but the short-term pressure from materials, energy, labor costs will not be significantly eased, the overall gross margin is expected to only rise to 28 this year and next..6% and 29.2%。Based on last year's performance, the bank lowered its 2023-2024 earnings forecast by 8% to 11%, lowering its target price from HK $31 to HK $29, with a "buy" rating.。

In addition, Citibank has released research reports。The bank lowered its gross margin forecast for Minshi Group from 2023 to 2025 to correspond to its lower gross margin performance。As a result of the company's effective cost control, Citi reduced the company's combined operating and research and development expenses to 18% of revenue from this year to the following year and adjusted its net profit forecast for 2023 to 2025 to 18%, respectively..700 million, 23.9 billion and 28.500 million yuan。The bank forecasts to maintain a price-to-earnings ratio of 15 times in 2023, corresponding to the target price from HK $30 to HK $26, and maintain a "buy" rating.。

By morning's close, Minshi Group was up 6.69%, now 20.HK $25。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.