Hawkinsight Hong Kong Market Closing Roundup (2.23) The Hang Seng Index rose 2 this week..36% of film and television stocks led the strong rise

On February 23, the three major indexes of Hong Kong stocks rose rapidly in early trading and fell back quickly soon after, after which they were in a narrow range throughout the day.。Hang Seng Index closes down 0 at close.1%, at 16,725.86 points, this week's cumulative increase of 2.36%。

On February 23, the three major indexes of Hong Kong stocks rose rapidly in early trading and fell back quickly soon after, after which they were in a narrow range throughout the day.。Hang Seng Index closes down 0 at close.1%, at 16,725.86 points, this week's cumulative increase of 2.36%; Hang Seng SOE Index closed up 0.12%, at 5765.1 point; Hang Seng Tech Index closes down 0.3%, at 3399.84 points。

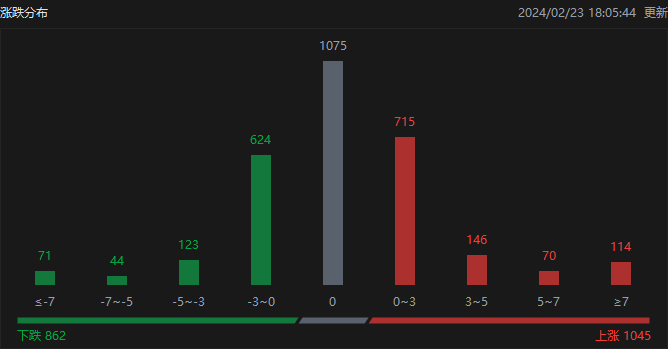

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 1045, fell 862, and closed flat at 1075.。

On the day of the Hong Kong stock market, North Water traded net buy 64.HK $4.5 billion, of which HK Stock Connect (Shanghai) traded net purchases of 38.HK $4.7 billion, Hong Kong Stock Connect (Shenzhen) traded net buy 25.HK $9.8 billion。

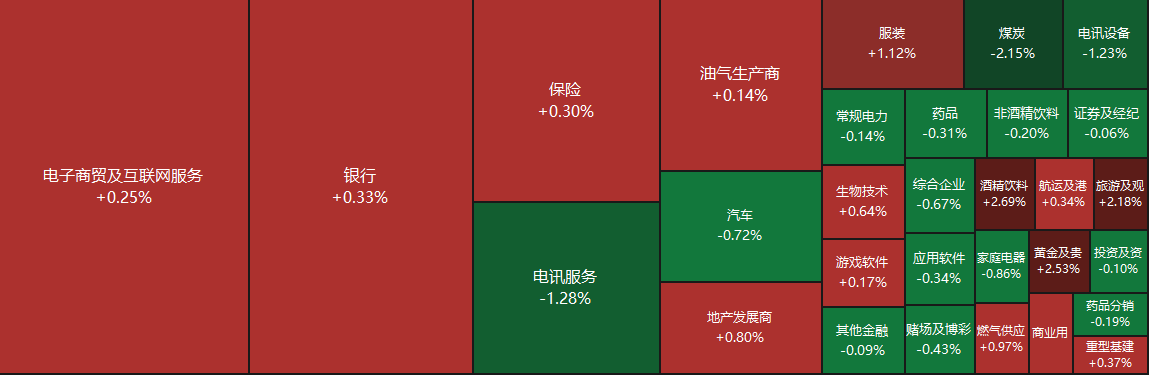

Sectors and Fundamentals

From the disk point of view, today's science and network stocks mixed, Baidu rose nearly 3%, the United States group rose more than 2%, beep mile beep mile fell more than 2%, Jingdong, millet fell more than 1%, Ali, fast hand, Tencent fell slightly;。On the other hand, auto stocks were mostly lower today due to the price war, in addition, heavy machinery, semiconductors, Apple concept stocks have been lower。

Fundamentals: strong film and television sector led the rise。According to Lighthouse Pro data, as of 10: 27 on February 23, the total box office (including pre-sales) in February 2024 broke 10 billion。Centaline Securities pointed out that from the overall performance of the film market during the 2024 Spring Festival holiday, although there are certain holiday duration factors, but can break the same period box office and movie attendance records still reflect the current domestic film market there is a relatively strong demand, the end of the Spring Festival holiday 2 to 3 weeks after the Spring Festival film will continue to release long-term box office, but also to provide good support for the annual box office。

Inner room, property management stocks rose.。The National Bureau of Statistics released statistics on the changes in the sales price of commercial residential buildings in January 2024.。Wang Zhonghua, a statistician at the City Department of the National Bureau of Statistics, explained that in January 2024, the number of cities in 70 large and medium-sized cities where the sales price of commercial residential buildings fell month-on-month decreased, and the overall decline in the sales price of commercial residential buildings narrowed month-on-month and continued year-on-year.。In addition, since the beginning of the year, multiple policies have helped real estate stabilize, and the real estate financing coordination mechanism has continued to make positive progress; while the 5-year LPR has experienced the largest decline in history, many places have also adjusted their CPF loan policies.。Ping An Securities pointed out that with the policy of positive factors continue to ferment, superimposed on the plate and individual stock valuation fell sharply, market expectations and institutional positions fell to a low point, the current plate configuration can be moderately positive。

Auto stocks weak again。The Federation of Passengers recently issued a document saying that the initial projection of the narrow passenger car retail market in February is about 115.About 0 million vehicles, month-on-month -43.5%。New energy retail forecast 38.About 0 million vehicles, month-on-month -43.0%, permeability of about 33.0%, slightly recovered from January。The Federation of Passengers pointed out that at the beginning of the Year of the Dragon, the economic plug-in hybrid market took the lead in price exploration, 100,000 or less car market price competition further intensified, and then many brands quickly followed up, for their respective models launched a different strength of preferential measures.。A new wave of price war intensified, the market wait-and-see sentiment increased, in the short term is not conducive to the release of terminal demand。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on February 16, Xiaomo reduced its holdings of Ganfeng Lithium 175.23.2 million shares, price per share 21.HK $2,349, total reduction of approximately 3,721.HK $0.03 million。The latest number of shares held after the reduction is about 4762..290,000 shares, shareholding changed to 11.80%。

On February 19, FMR LLC reduced its holdings of Samsonite 35.130,000 shares, price per share 23.HK $3,956, total reduction of approximately 821.HK $890,000。The latest number of shares held after the reduction is about 8677..320,000 shares, with the shareholding ratio changed to 50,000.98%。

On February 19, Schroders PLC reduced its stake in Zoomlion 182..620,000 shares, price per share 4.HK $8,038, total reduction of approximately 877.HK $270,000。The latest number of shares held after the reduction is 7844..940,000 shares, with the shareholding ratio changed to 4.96%。

On February 19, Schroders PLC reduced its holdings of Gloria British 1.930,000 shares, price per share 62.HK $5,262, total reduction of approximately 120.HK $680,000。The latest number of shares held after the reduction is about 136.190,000 shares, with the shareholding ratio changed to 4.94%。

New Stock News

According to the Hong Kong Stock Exchange on February 22, Hongji Group (Holdings) Limited ("Hongji Group") passed the listing hearing on the main board of the Hong Kong Stock Exchange, with Grande Capital Limited as its sole sponsor.。

According to the prospectus, Hongji Group is a steel structure contractor focused on supplying, manufacturing and installing structural steel for construction projects in Hong Kong.。The company was established in 1999, as a subcontractor to undertake steel structure engineering。According to the industry report, the Group ranked third in the steel structure engineering industry in Hong Kong by revenue in 2022, with a market share of approximately 3% in 2022..4%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.