Strong recovery in order demand BOE Jingdian 2022 full-year revenue increased 39% year-on-year to a new high.

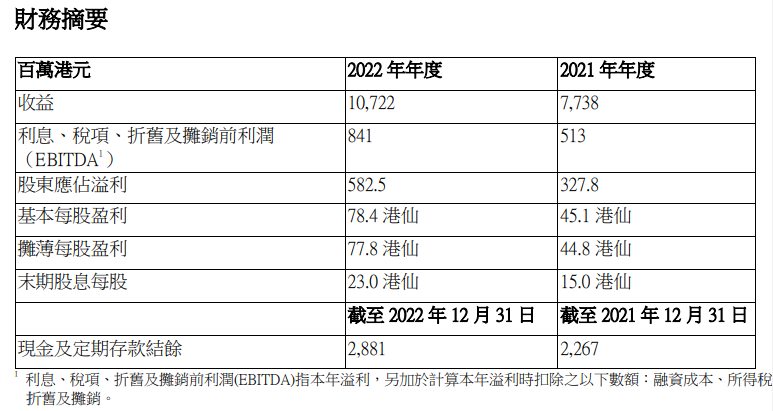

March 21, 2023, BOE Jingdian Co., Ltd. issued 2022 results announcement。The company's operating income in 2022 was HK $10.7 billion, up 39% year-on-year, with net profit attributable to 5.HK $800 million, up 77% year on year。

On Tuesday (March 21), BOE Jingdian released its 2022 annual results announcement.。According to the financial report data, BOE's full-year revenue in 2022 reached HK $10.7 billion, up 39% year-on-year, of which revenue in the second half of 2022 was HK $5.9 billion, up 28% year-on-year;.HK $800 million; underlying earnings per share of 78.4 Hong Kong cents, compared with 45 in the same period last year..1 Hong Kong Sin。

In response, BOE said that the company's revenue and net profit attributable to its parent company both hit new highs in 2022。The company's revenue in all regions increased compared to the past due to increased sales of thin film transistors (TFTs) and touch screen display modules during the fiscal year.。Among them, the company's sales in the Chinese market increased significantly, the data increased by 48% compared to 2021, mainly due to the mass production of thin-film transistors (TFTs), the launch of the touch screen display module project and the increase in overall demand in the Chinese automotive market.。In addition, the company's sales in Europe, the United States and South Korea also achieved overall growth.。BOE also said that with the growth of sales and the implementation of cost control measures, the group's overall profitability is constantly improving through the continuous realization of economies of scale.。

By business, in the automotive display business, the company achieved significant growth in 2022。With the company's continued efforts in the TFT display business, the market share of its vehicle TFT display products and medium and large-size display modules is now the world's leading market share.。At the same time, thanks to government tax incentives and the vigorous promotion of new energy vehicles, the demand for new energy vehicle displays will continue to increase in 2022, which will also drive its product sales.。In addition, in addition to the increase in the selling price of some products due to higher material costs, the Group's product portfolio gradually shifted to products with higher average selling prices, driving its sales growth in 2022.。

In the industrial display business, according to the results announcement, revenue from this business decreased by 7% year-on-year compared to 2021.。In this regard, BOE Jingdian attributed it to the special demand for educational products in 2022 and the reduced demand for a globally renowned high-end appliance brand.。At the same time, the company predicts that the market demand for education-related products in China will slow down and the future revenue contribution of the business will continue to decrease.。However, due to relatively stable demand in industrial instrumentation, medical and other products, the company's monochrome display products will continue to play an important role in the non-automotive business.。

After the earnings announcement, Citi released a research report saying that BOE's revenue rose 30% year-on-year in the second half of last year, 10% higher than the bank's previous forecast, but slightly 3% lower than the market forecast.。The company's net profit rose 42% year-on-year in the second half of last year, in line with expectations.。The bank predicts that the potential global automotive display market will grow by more than 10% this year.。In addition, benefiting from the company's continued increase in the market share of its display models and its support for the development of its system products, it is believed that BOEVx's sales platform will grow revenue by 30% this year.。The bank slightly lowered the company's net profit forecast for this year and next year by 2% each to reflect its profit margin pressure, and lowered its target price from HK $25 to HK $24 and maintained its "buy" rating.。

Credit Suisse also said in its latest research report that BOE's revenue and earnings in the second half of last year were in line with the bank's expectations, but gross margins fell 1 year-on-year due to a drag from Chengdu fab expansion and subsystem investment..6% to 14.8%, 2 lower than the bank expected.2%。As a result, Credit Suisse lowered the company's earnings per share forecast for this year by 2% and lowered its target price for BOE from 22.HK $2 to 21.HK $6, maintains rating of OUTPERFORM。

In addition, China Merchants Bank International released a research report saying that the company's revenue and net profit will grow in 2022, respectively, driven by strong demand for automotive displays, a better product portfolio and economies of scale.。Looking ahead to 2023, the bank expects the rapid expansion of the Chengdu plant, the electronic exterior mirror CMS and the U.S. market to be the main growth drivers, and considering the recent automotive OEM price war and new business expansion, the company is expected to be in the first half of 2023 ASP / gross margin will be under pressure。The bank reiterated BOE's "buy" rating with a price target of 23.HK $69。

BOE Jingdian down 0 as of press time.54%, now reported 14.HK $74。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.