Hawkinsight Hong Kong Market Closing Roundup (2.27) Automotive stocks all day strong pharmaceuticals, semiconductors collective strength.

On February 27, the three major indexes of Hong Kong stocks opened higher and lower in early trading, picked up in the afternoon, and further expanded their gains in late trading.。Hang Seng closed up 0 at close.94%, at 16,790.80 points。

On February 27, the three major indexes of Hong Kong stocks opened higher and lower in early trading, picked up in the afternoon, and further expanded their gains in late trading.。Hang Seng closed up 0 at close.94%, at 16,790.80 points; Hang Seng SOE Index closes up 1.46%, at 5806.90; Hang Seng Tech Index closes up 3.24%, at 3503.17 points。

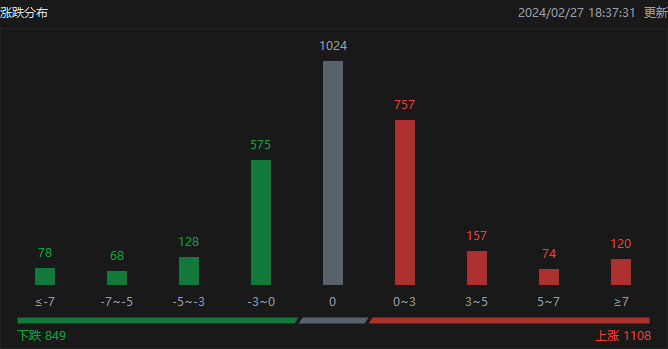

In terms of the distribution of ups and downs, as of the close of the day, Hong Kong stocks rose 1108, fell 849, and closed flat 1024.。

On the day of the Hong Kong stock market, North Water traded net buy 13.HK $2.9 billion, of which HK Stock Connect (Shanghai) traded a net purchase of 11.HK $8.2 billion, Hong Kong Stock Connect (Shenzhen) net buy 1.HK $4.8 billion。

Sectors and Fundamentals

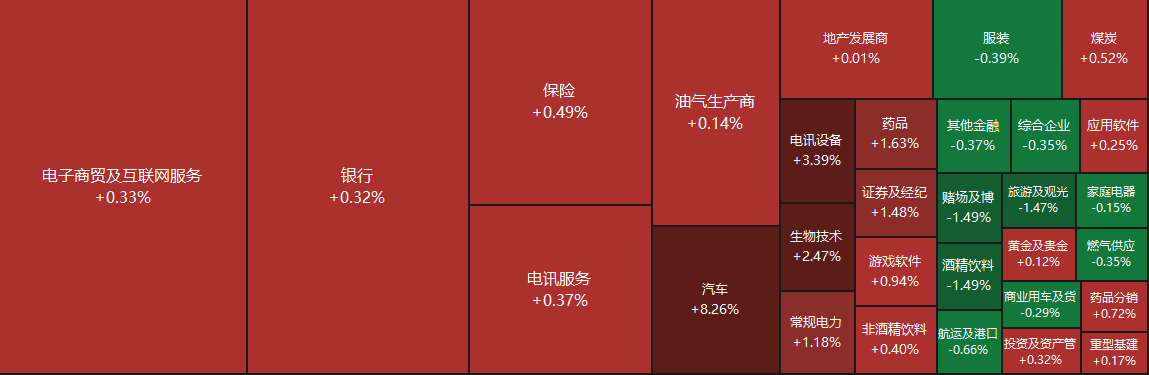

From the disk point of view, today's science and network stocks rose, of which millet rose nearly 3%, Alibaba, Bilibili rose nearly 2%, Baidu, Jingdong rose nearly 1%, fast hand, Tencent fell nearly 1%; auto stocks throughout the day strong, ideal cars rose more than 25% led the rise, zero run cars rose more than 6%, Xiaopeng Motors, BYD shares rose more than 5%, Great Wall Motors rose more than 4%。On the other hand, gaming stocks were sluggish throughout the day, with dairy stocks, heavy machinery stocks, interior housing stocks and property management stocks bucking the trend.。

Fundamentals: auto stocks strong throughout the day。The fourth meeting of the Central Finance and Economics Commission pointed out that it is necessary to promote the renewal and technological transformation of various types of production equipment and service equipment, encourage traditional consumer goods such as automobiles and home appliances to trade in old ones, and promote the trade-in of durable consumer goods.。Cinda Securities pointed out that if a new round of trade-in policy landing, is expected to promote the proportion of purchase, is expected to 15-300,000 prices with a larger space, multi-purpose model layout of the car companies are expected to benefit。

Semiconductor Stocks Rise。The State-owned Assets Supervision and Administration Commission of the State Council recently held a special promotion meeting on artificial intelligence for central enterprises "AI Empowerment Industry Rejuvenation"。The meeting called for AI + special actions to strengthen demand traction, speed up the empowerment of key industries, build a batch of industrial multi-modal high-quality data sets, and create a large model enabling industrial ecology from infrastructure, algorithm tools, intelligent platforms to solutions.。

Increase or decrease in institutional holdings

According to the HKEx, on February 20, UBS Group AG reduced its holdings of China Soft International 67.02.41 million shares, price per share 4.HK $5,121, total reduction of 302.HK $420,000。The latest number of shares held after the reduction is about 2..3.2 billion shares, shareholding changed to 7.99%。

On February 20, Xiaomo increased its stake in BYD 137.79.65 million shares, price per share 181.HK $1,877, total increase of approximately 2.HK $500 million。The number of shares held after the increase is about 5555..650,000 shares, with the shareholding ratio changed to 5.05%。

On February 21, BlackRock increased its stake in ENN Energy 18.1.92 million shares, price per share 61.HK $3,469, total increase of approximately 1116.HK $020,000。The latest number of shares held after the increase is about 5663..290,000 shares, with the shareholding ratio changed to 50,000.01%。

On February 22, GIC Private Limited increased its holdings of 4 million shares of Longyuan Power at a price of 5 per share..HK $3,789, with a total increase of approximately 2,151.HK $560,000。The latest number of holdings after the increase is about 2..03 billion shares, with the shareholding ratio changed to 6.07%。

New Stock News

According to the HKEx's February 27 disclosure, Les Group Limited passed the HKEx Main Board Listing Hearing, with Huasheng Capital as its sole sponsor.。

According to the prospectus, Lexus Group is a mobile advertising service provider in China that provides comprehensive mobile advertising services to customers to market its brands, products and / or services on the media platforms operated by the company's media partners.。Based on total 2022 billing, the company has approximately 0% of the advertising industry in China..1% market share。The company's services include mobile marketing planning, traffic acquisition, advertising material production, advertising delivery, advertising optimization, advertising campaign management and advertising distribution.。The Company intends to optimize the effectiveness of mobile advertising and maximize its exposure to target mobile users in order to achieve customers' marketing objectives and improve their return on investment.。The company is able to provide customers with comprehensive mobile advertising solution services and one or more of these services, such as ad creation, ad optimization and ad distribution, to meet different needs。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.