Hawkinsight Hong Kong Market Closing Roundup (1.30) | Hang Seng Index Lost Another Wanliu Semiconductor Sector

On January 30, all three major indexes of Hong Kong stocks opened sharply lower and weakened under pressure throughout the day.。Hang Seng Index closes down 2 at close.32%, reported 15703.45 points。

On January 30, all three major indexes of Hong Kong stocks opened sharply lower and weakened under pressure throughout the day.。Hang Seng Index closes down 2 at close.32%, reported 15703.45 points; Hang Seng SOE Index closes down 2.47%, at 5,275.37 points; Hang Seng Tech Index closes down 3.27%, reported 3098.87 points。

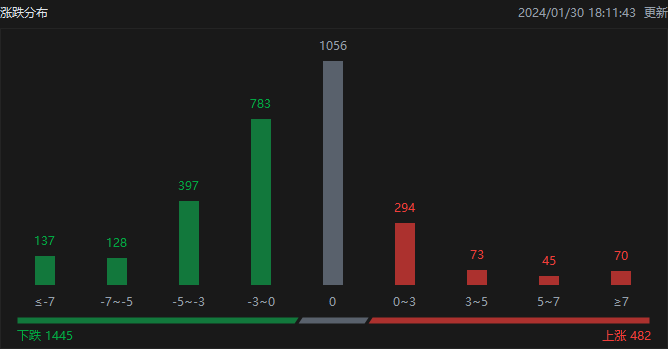

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 482, fell 1445, and closed flat at 1056.。

On the day of the Hong Kong stock market, North Water traded a net sell of 8.HK $600 million, of which HK Stock Connect (Shanghai) sold a net 1.3 billion..HK $4.5 billion, Hong Kong Stock Connect (Shenzhen) net sales of 12.HK $5.1 billion。

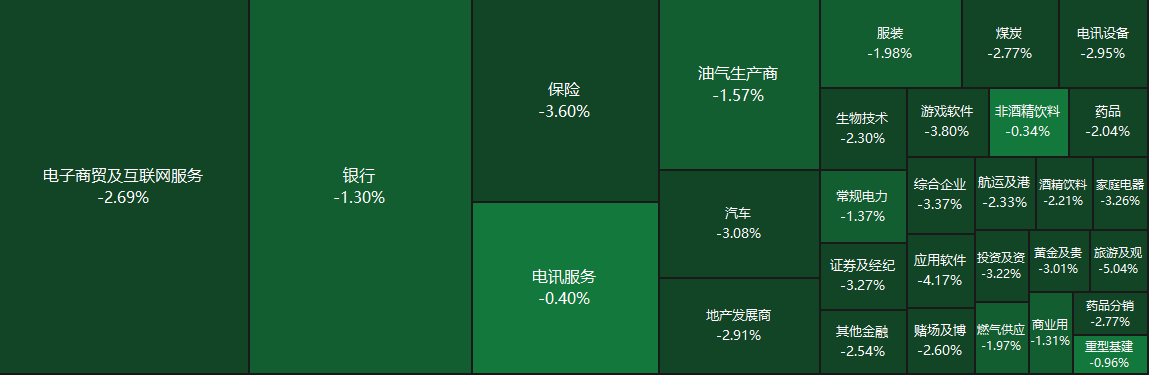

Sectors and Fundamentals

From the disk, the network stocks fell, fast hand, beep, Netease fell more than 4%, millet fell more than 3%, the United States, Tencent fell more than 2%, Baidu fell more than 1%;。On the other hand, Bitcoin price back at $43,000, Bitcoin concept stocks active; Nine Dragons Paper profit, paper stocks bucked the trend。

Fundamentally, recently, market news shows that the global mainstream wafer foundry manufacturers have opened a new round of various types or disguised or direct price reduction competition behavior.。According to research, the main range of current wafer generation industry price cuts is over 28nm processes。In the range of processes above 28nm, the average price of a 12-inch foundry in the first quarter of 2024 was approximately 11% lower than the same period last year..1%, the average price of the 8-inch foundry for the same period was about 25% lower than the same period last year..2%。The price reduction is larger than that of the same period in previous years.。Tianfeng Securities believes that TSMC's fourth-quarter revenue exceeded guidance。At the same time, taking into account Huawei's mobile phone support for local chip suppliers, with the increase in the stock of Huawei mobile phones, it is believed that the relevant IC design companies in the fab is expected to increase the investment, driving the recovery of local wafer foundry capacity utilization.。Under the background of pro-cyclical, domestic industrial development or let local wafer foundry recovery is better than the industry average.。

On January 29, China Evergrande's liquidation case was arraigned in the High Court of Hong Kong, where the judge formally ordered China Evergrande to liquidate the company, citing the lack of progress in China Evergrande's debt restructuring plan and the company's insolvency.。Daiwa expects Evergrande to be ordered to liquidate, which will cause other defaulting developers' creditors to pay close attention to and follow suit, or attract a new wave of liquidation applications, putting pressure on the share price of the distressed property.。In addition, UBS pointed out that Guangzhou relaxed the restrictions on the purchase of units of more than 120 square meters, is the first first-tier cities announced the relaxation of the same type of unit restrictions, with the Ministry of Housing and Construction recently stated that real estate can be self-regulated, I believe other first-tier cities or follow suit。The bank mentioned that in communication with Guangzhou Centaline Real Estate on the 28th, it found that the flow of people in the sales center increased slightly, but the transaction was still basically weak.。The bank noted that previous easing of restrictions on mortgage lending or home purchases often led to a recovery that lasted about four weeks, but narrowed in magnitude and duration.。In terms of share price, despite the positive policy easing, the bank is expected to have a limited impact on the share price of the house.。

On Monday, the price of Bitcoin returned to above $43,000, resuming its recent rally.。Bitcoin has seen a sharp decline this year after the long-awaited approval of the Bitcoin Spot ETF, but has recently resumed its rally.。Bitcoin closes at around $42,000 in 2023。So far in 2024, the cryptocurrency has risen by about 1.25%。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on January 23, Xiaomo reduced its holdings of Weichai Power 389.34.54 million shares, price per share 12.HK $5,171, total reduction of approximately 4,873.HK $480,000。The latest number of shares held after the reduction is about 1..1.5 billion shares, shareholding changed to 5.91%。

On January 24, BlackRock reduced its holdings of China Shenhua 221.70,000 shares, price per share 27.HK $5,811, total reduction of approximately 6,114.HK $730,000。The latest number of shares held after the reduction is about 1..6.7 billion shares, with the shareholding ratio changed to 4.94%。

On January 24, BlackRock reduced its stake in Beijing Capital Airport by 2.63 million shares at a price of 2 per share..HK $1,202, total reduction of approximately 557.HK $61。The latest number of shares held after the reduction is about 1..1.1 billion shares, the shareholding ratio changed to 5.88%。

On January 24, BlackRock reduced its holdings of Shanghai Pharmaceuticals 57.550,000 shares, price per share 10.HK $569, total reduction of approximately 608.HK $250,000。The latest number of shares held after the reduction is about 6408..760,000 shares, with a change in shareholding to 6.97%。

New Stock News

According to the Hong Kong Stock Exchange disclosed on January 29, Star Reading Holdings Limited (hereinafter referred to as: Star Reading Holdings) to table the main board of the Hong Kong Stock Exchange, Huatai International and Dongxing Securities (Hong Kong) as its joint sponsors.。

According to the prospectus, Star Reading Holdings is one of the leading IP operators of online literature in China, with strong full-chain IP development, operation and commercialization capabilities.。According to the Frost Sullivan report, in 2022, the company ranked fourth in China's online literature IP licensing and IP transfer market by revenue from online literature IP licensing and IP transfer, with a market share of 2.1%; and in terms of revenue, the Company ranked first among Chinese online literature IP operators primarily engaged in the Chinese online fantasy literature IP licensing and IP transfer market, with a market share of 11.3%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.