Hawkinsight Hong Kong Market Closing Roundup (1.16) The Hang Seng Index fell sharply and lost a collective decline in the shares of Wanliu Science and Technology Network.

On January 16, the three major Hong Kong stock indices opened low and went low throughout the day.。Hang Seng Index closes down 2 at close.16%, at 15,865.92 points。

On January 16, the three major Hong Kong stock indices opened low and went low throughout the day.。Hang Seng Index closes down 2 at close.16%, at 15,865.92; Hang Seng SOE Index closes down 1.9%, at 5,343.3 points; Hang Seng Tech Index closes down 2.29% at 3325.93 points。

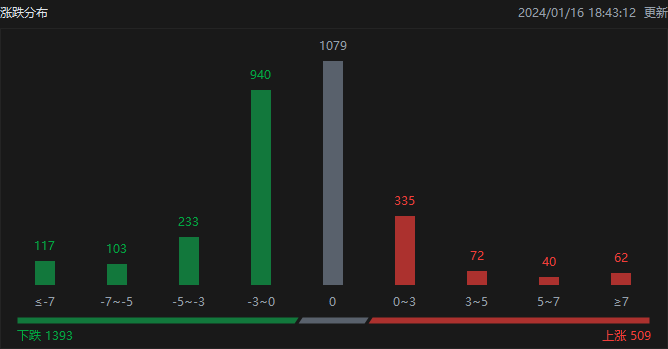

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 509, fell 1393, and closed flat at 1079.

On the day of the Hong Kong stock market, North Water traded net buy 29.HK $4.5 billion, of which HK Stock Connect (Shanghai) traded a net purchase of 24.HK $1.9 billion, Hong Kong Stock Connect (Shenzhen) traded net buy 5.HK $2.5 billion。

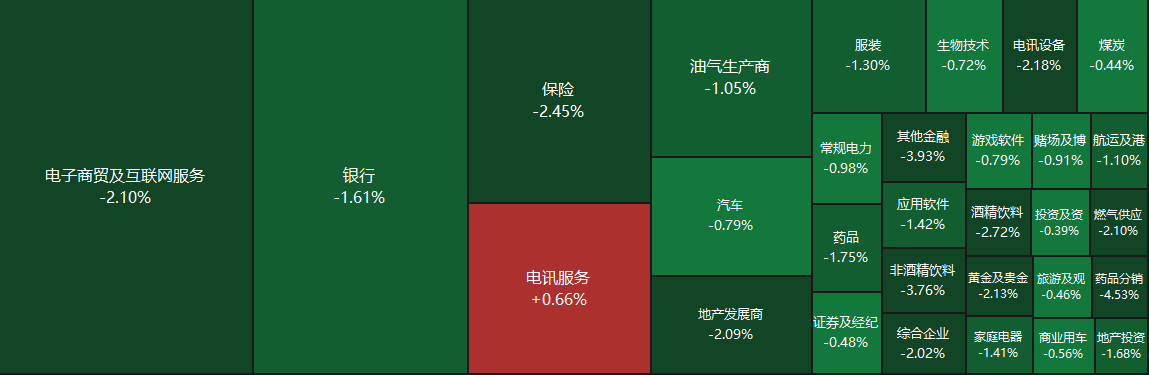

Sectors and Fundamentals

From the market point of view, the company's net stocks fell, Jingdong, millet, beery beery fell about 3%, Tencent, Meituan, Alibaba fell more than 2%, fast hands fell more than 1%

Fundamentally, Goldman Sachs previously pointed out that China's real estate exposure led to the rise in losses suffered by the Bank of Hong Kong, investors have expected, the stock price has also reflected the relevant negative factors, the current impairment of the Bank of Hong Kong's real estate business in Hong Kong is not too serious, but the Bank of Hong Kong-related exposure is much larger, many banks are expected to need to start making moderate provisions this year, but believe that its impact on bank earnings is。In terms of insurance stocks, AVIC Securities believes that the current asset side of the insurance sector is still under greater pressure, the market continues to be low volatility, the real estate market risk has not yet been fully resolved, urban investment bonds and corporate bonds still have the risk of default, resulting in increased difficulty in the allocation of insurance assets, increased volatility of investment income, overall profitability decline。

According to the China Index Research Institute, the property market as a whole rose last week, falling year-on-year, up or down 0.5%, 48.02%。All cities as a whole rose month-on-month, with first-tier cities rising the most.。Inventory as a whole fell slightly month-on-month.。The overall supply and demand of land fell month-on-month, homestead turnover fell by nearly half, the overall average price fell from last week, the average price of homestead fell by nearly 30%。China Merchants Bank International said it was cautiously optimistic about the real estate and property management sectors, with a weak year-end sales recovery.。December developer sales recovered slightly from November, but remained weaker than expected。The bank believes that sales of new homes in the first quarter may continue to be weak before the Spring Festival holiday.。

Increase or decrease in institutional holdings

According to the HKEx, on January 15, shareholder Liu Haiyan increased his holdings of 1.7 million shares of Financial Street property at a price of 2 per share..HK $32, with a total increase of approximately 394.HK $40,000。The latest number of shares held after the increase was approximately 6.85 million shares, and the shareholding ratio was changed to 6.61%。

On January 9, Always Blooming Holdings Limited increased its holdings in Xingda International 1.10,0369.16 billion shares, price per share 1.HK $52, total increase of approximately 1.HK $6.7 billion。The latest number of holdings after the increase is about 1..1 billion shares, shareholding ratio changed to 6.62%。

New Stock News

According to market sources, a person familiar with the matter disclosed that Star Charging, an electric vehicle charging pile manufacturer from Wujin, Changzhou, Jiangsu, plans to list in Hong Kong as soon as the second half of 2024。

Public information shows that Star Charging, as the leading unicorn in Asia's digital energy field, is one of the core brands of Wanbang Digital Energy, mainly providing equipment, platforms, users and data operation services for global customers, building a full life cycle platform for user charging with the help of vehicle sales, private charging, public charging, finance and insurance, and finally realizing the long-term dream of "promoting the electrification of human transportation and leading the digitization of global energy"。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.