"Load ahead, return to growth" Tencent Q4 results beat expectations

As the most heavily weighted stock in the Hang Seng Technology Index, the domestic Internet giant Tencent is expected to announce every earnings report.。

As the most heavily weighted stock in the Hang Seng Technology Index, the domestic Internet giant Tencent is expected to announce every earnings report.。

Tencent still delivers satisfactory results in the fourth quarter under macro adversity.

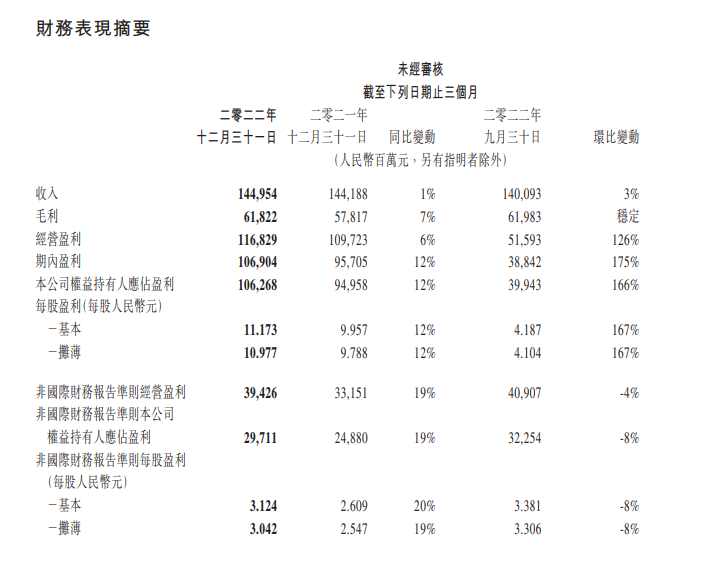

After the Hong Kong stock market on March 22, Tencent Holdings disclosed its fourth-quarter and full-year results for fiscal 2022 on the Hong Kong Stock Exchange.。First, let's look at Tencent's Q4 results, with earnings data showing that Tencent's Q4 revenue was 1449.5.4 billion yuan (RMB, the same below), up 1% YoY; net profit was 1062.6.8 billion yuan, up 12% year-on-year; adjusted net profit 297.1.1 billion yuan, up 19% year-on-year。

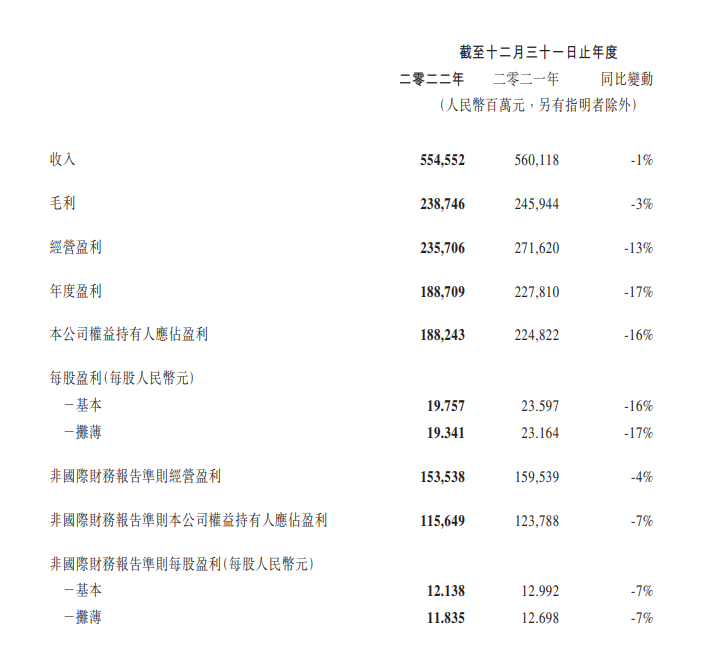

On the other hand, Tencent's 2022 full-year results。Financial data show that Tencent's total revenue for the full year 2022 is 5545.5.2 billion yuan, down 1% YoY; net profit 1882.4.3 billion yuan, down 16% YoY; adjusted net profit 1156.4.9 billion yuan, down 7% year-on-year。

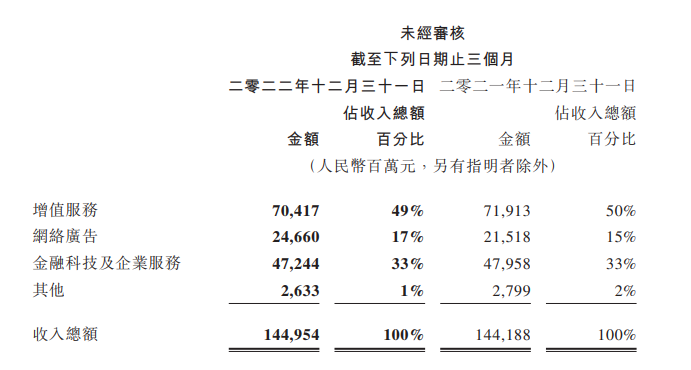

By business, value-added services business。Tencent Q4 value-added services revenue fell 2% year-on-year to RMB 70.4 billion。Segmented, the gaming business still dominates the value-added services business。Among them, the international market game revenue increased by 5% to 13.9 billion yuan, after removing the impact of exchange rates and other factors, the overall increase of 11%。Compared to the international market, game revenue in the domestic market declined, with data showing that game revenue in the local market fell 6% to RMB27.9 billion.。Social network revenue also fell 2% to RMB28.6 billion

network advertising business。Tencent Q4 online advertising revenue increased 15% to RMB 24.7 billion。Advertising spending by advertisers in e-commerce platforms, fast-moving consumer goods and games increased significantly year-on-year.。Social and other advertising revenue rose 17% to RMB21.4 billion, helped by strong demand for video number and applet advertising and the recovery of mobile advertising alliances.。Media advertising revenue increased 4% to RMB3.3 billion, reflecting improved monetization of music content advertising。

Fintech and Corporate Services Business。Fintech services revenue growth slowed year-over-year from last quarter as the outbreak briefly dampened payment activity。Tencent Q4 Fintech and Corporate Services Revenue Down 1% YoY to RMB47.2 Billion。

In terms of social platforms, the combined monthly active accounts of Tencent's core social platforms WeChat and WeChat reached 13.13.2 billion, up 3.5%; QQ's mobile terminal has 5 active accounts per month.7.2 billion, up 3.6%; The number of registered accounts for fee-based value-added services reached about 2.3.4 billion, a decrease of 1.1%。

Overall, the overall performance of Tencent Q4 is still better than expected, and the growth rate is back in double digits, but still far from a few years ago, by reducing costs and increasing efficiency.。

How is Tencent's AI track progressing?

Regarding the recent fire in the artificial intelligence track, some investment bank analysts raised questions on Tencent's artificial intelligence and ChatGPT products released by domestic and foreign competitors during the earnings call.。

Tencent President Liu Chiping said that with regard to ChatGPT products and artificial intelligence, first of all, this area will greatly boost the company's growth rate, because the company's business is mainly social, communication and gaming, serving the needs of users to users, which contains high-quality content, generative technology and basic model technology can naturally provide a very important complementary role.。Therefore, the company will inevitably invest all kinds of resources to build its own basic model technology, which will also be applied to various businesses in the future, and may also give birth to the company's new business, driving the company from meeting the needs of users to users, to user-to-machine service areas.。

Liu added that the whole process will be long-term, and chatbots are just one of many products we will release in the future, and we see them as long-term development opportunities rather than threats that need to be urgently addressed.。And said Tencent currently has the strength to build competitive products, the resources to use scenarios, the advantages of data, the blessing of cloud computing infrastructure, the long-term practice of building artificial intelligence applications to provide assistance to existing businesses.。

In addition, on the topic of artificial intelligence, the financial report also mentioned that the group is investing in artificial intelligence capabilities and cloud infrastructure to embrace the trend of basic models, which will help to upgrade existing products and services, explore and launch new products.。

A number of institutions have raised their Tencent target prices.

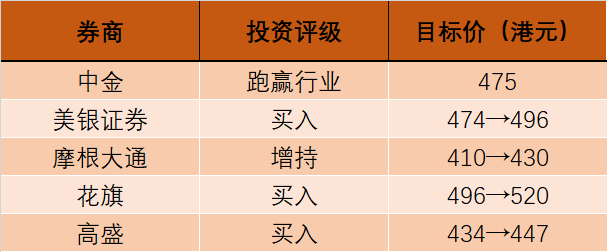

After the earnings announcement, a number of institutions were satisfied with Tencent's performance, and also made some adjustments to its rating and target price.。

Among them, CICC released a research report saying that Tencent's non-IFRS net profit 4Q22 increased 19% year-on-year to 29.7 billion yuan under a low base, and the bank believes that the year-on-year growth rate of 1Q23 profit side will be better than 4Q22 under the background of macro recovery.。Looking ahead to the full year, Tencent's high-margin businesses, such as games, advertising and payments, will continue to help growth on the profit side.。Therefore, it maintains its "outperform industry" rating and keeps its 2023 / 24 revenue and earnings forecast unchanged, with a target price of HK $475, which is 36% higher than the current share price..8% upside。

Bank of America Securities also reiterated Tencent's "buy" rating in its latest research report, while raising its target price slightly by 5% to HK $496.。The bank said the favourable environment brought about by reopening and macro recovery had seen signs of a positive recovery for the group, with year-to-date average daily commercial payments having rebounded in double digits year-on-year.。And the regulatory environment is also normalizing, with Bank of America expecting Tencent to revive revenue growth and expand margins across multiple business lines。

In addition, Goldman Sachs, Xiaomo and Citi also said that with the gradual improvement of the macro environment, Tencent is expected to achieve stronger and sustainable growth prospects in the next few quarters, driven by multiple growth in each business.。In the latest research report, the three investment banks have raised Tencent's target price, of which Xiaomo raised the company's target price from HK $410 to HK $430, giving it an "overweight" rating; Citi also raised its target price from HK $496 to HK $520 and reiterated its "buy" rating; Goldman Sachs maintained its "buy" rating, with its target price rising from HK $434 to HK $447.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.