Game and cloud business outperformed Tencent Q1 revenue back to double-digit growth!

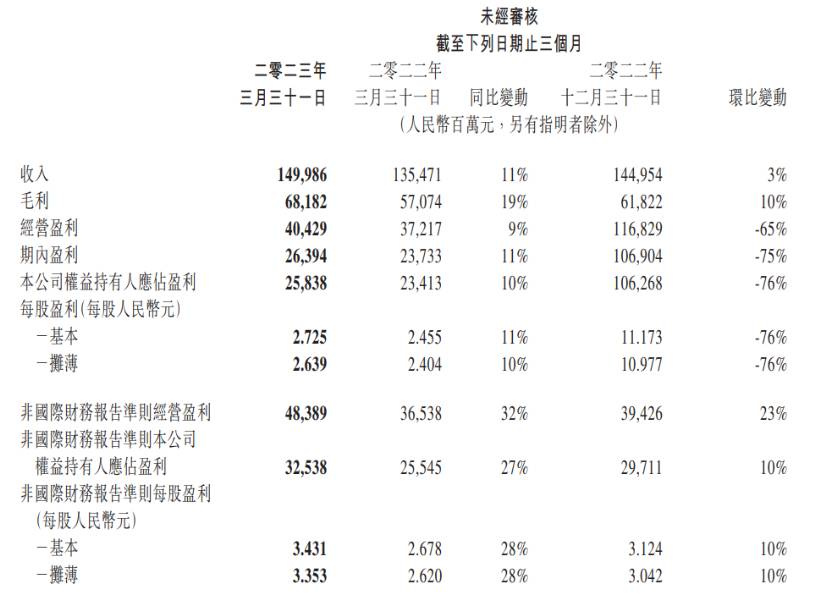

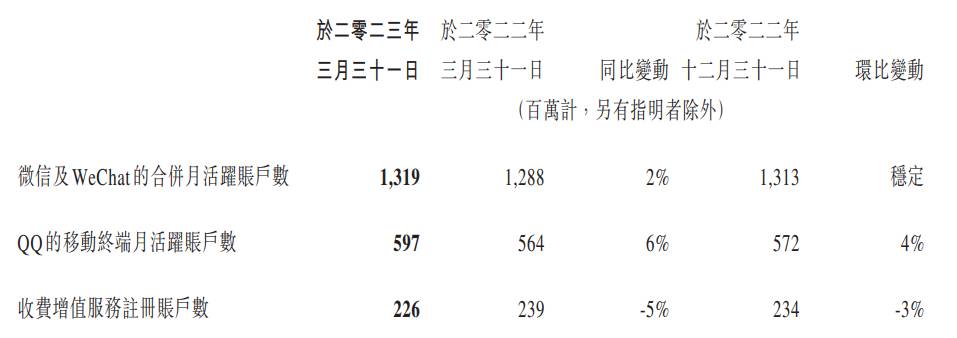

On the evening of May 17, Tencent released its first quarter fiscal 2023 results report.。Performance data show that Tencent's revenue in the first quarter was 1499.Rmb8.6bn, up 11% YoY; net profit 258.3.8 billion yuan, up 10% year-on-year。As of May 16, southbound funds have bought Tencent for seven consecutive trading days, totaling more than HK $4 billion.。

On the evening of May 17, Tencent released its first quarter fiscal 2023 results report.。Performance data show that Tencent's revenue in the first quarter reached 1499.8.6 billion yuan (RMB, the same below), up 11% YoY and 3% YoY; net profit 258.3.8 billion yuan, up 10% year-on-year, down 76% month-on-month; under non-IFRS, net profit was 325.RMB3.8 billion, up 27% YoY and 10% QoQ; diluted EPS 2.64 yuan, up 10% YoY, down 76% YoY。

In terms of users, the combined monthly active accounts of WeChat and WeChat in the first quarter were 13.900 million, up 2% year-on-year, stable month-on-month; QQ mobile terminal monthly active accounts number 5.9.7 billion, up 6% YoY and 4% YoY; registered users of fee-based value-added services were 2.2.6 billion, down 5% YoY, down 3% YoY。Tencent said it has adopted a new technology architecture in QQ to optimize development efficiency, enhance security and enhance the screen experience.。The new technology architecture will significantly strengthen QQ's future cross-platform product deployment。

The video number ecology is becoming more active, and long video subscription revenue is declining.

In terms of video numbers, the use of Tencent's video numbers continued to grow in the first quarter, with both user usage and playback rising rapidly.。Tencent has improved the creator ecology by upgrading its support for new creators and strengthening its infrastructure to bring goods, with the number of active creators and average daily video uploads in the first quarter more than twice as many as in the same period last year, and the number of creators with more than 10,000 fans more than three times as many as in the same period last year.。In addition, video numbers attract new advertisers and new budgets from existing advertisers, and the average eCPM of video numbers is higher than other short video platforms.。In addition to video numbers, music also saw growth。Tencent says first-quarter music subscription revenue up 30% year-on-year。

In the online advertising business, online advertising revenue rose 17% year-on-year to $21 billion in the first quarter, thanks to new revenue sources for video numbers, an increase in ads in applets and a recovery in mobile advertising alliances.。Tencent said advertising spending in most industries rose year-on-year against the backdrop of China's consumer recovery, while Tencent's upgraded advertising infrastructure further amplified this benefit。Tencent mentioned in its earnings report that the company has upgraded its machine learning platform for advertising, integrating deep learning models and standardized product libraries to bring advertisers better ad targeting capabilities and higher conversion rates.。

In terms of long video, the number of paid members fell 9% year-on-year to 1 in the first quarter..1.3 billion, while subscription revenue fell 6% year-over-year.。Tencent explained that it was mainly affected by the delay in content scheduling。Domestic long video playback platform three giants "love you Teng," among them, Youku has obviously fallen behind, now with "Zhen Huan Biography," "Country Love" and other dramas "old age."。The most intense competition is Tencent and iQiyi。In the first quarter, the average number of subscribers per day reached 1.28.9 billion, a record。Thanks to the hit drama "Frenzy," the number of episodes broadcast with the entire platform of iQiyi rose year-on-year.。By contrast, Tencent doesn't have a quality hit show to get its hands on。In April, Tencent launched a high-quality TV series "long season," although the word-of-mouth burst, but from the "explosion" is still far away。Nowadays, viewers are more in pursuit of high-quality long videos, and the previous "traffic" model is becoming more and more impassable, Tencent said, "We are optimizing content to meet the changing needs of users."。At the same time, Tencent also said that it is expanding its cooperation with short video services to enhance the popularity of long video content and seize more commercial opportunities.。"

Both local and international games recorded growth, and "King of Glory" helped Tencent attract gold globally.

In terms of the local game market, revenue from the Glory of Kings, Dungeons and Warriors: A Century of Innovation and Crossing the Line of Fire increased, as well as incremental revenue from the recently released Dark Zone Breakthrough, which grew 6% to $35.1 billion in the first quarter.。In addition, due to the continued promotion of the minor protection program, the length and flow of minor games in the first quarter accounted for only 0% of the total length of games in Tencent's local market..4% and 0 of the total flow.7%, down 96% and 90% respectively from the same period three years ago。

International gaming market revenue grew 25% to $13.2 billion, up 18% after currency fluctuations, driven by the strong performance of the recently released "Victory Goddess: Nikki" and "Triple Match 3D" and the solid growth of VALORANT.。At present, overseas game revenue has reached 38% of local game revenue.。

From the perspective of global gold absorption, "King of Glory" has carried the banner of Tencent's game business.。According to Sensor Tower store intelligence data, in the first quarter, Tencent's "King of Glory" for three consecutive months won the global hand tour bestseller list。January-March in the global App Store and Google Play respectively 2.$500 million, 2.$2.5 billion and 2.$1.5 billion。

Tencent announces cloud business "discount," the domestic cloud market smoke gradually

Tencent reported that revenue from its financial technology and corporate services business rose 14% year-on-year to $48.7 billion in the first quarter, accounting for 32% of total revenue.。Fintech services accelerated year-over-year, mainly due to a recovery in commercial payment activity from a rebound in Chinese consumption。Revenue from the enterprise services business, on the other hand, grew at a positive year-on-year rate during the period, thanks to increased sales of some cloud services and the first revenue generation from technical service fees related to live video delivery transactions.。

At present, the overall growth rate of the domestic cloud market is slowing down, and the competition among major manufacturers is fierce.。On May 16, Tencent Cloud announced a number of core cloud products, including cloud servers, databases, cloud networks, cloud security and other price cuts, of which the cloud server price cut the highest, reaching 40%, the price reduction policy will take effect on June 1.。

Alibaba Cloud and Mobile Cloud both announced price cuts。Alibaba Cloud announced last month that its core product prices were cut by 15% to 50% across the board, with storage products falling by up to 50%.。China Mobile, on the other hand, said that mobile cloud universal entry-level cloud hosts and universal network-optimized cloud hosts are all reduced by 60%。

Qiu Yuepeng, Vice President of Tencent Group, COO of Cloud and Smart Industry Group, and President of Tencent Cloud, said, "Under the healthy and sustainable strategy, Tencent Cloud is more focused on products.。Through a series of means such as technological innovation and supply chain integration, we continue to build the ultimate cost performance of our core products, and will further release technical dividends to users through price adjustments.。"

Tencent, for its part, believes that the impact of the price cut in the cloud business on Tencent as a whole is not significant。Cloud computing as a single-digit percentage of Tencent's total revenue。Of these, price cuts apply only to infrastructure services, a subset of the medium single digits。For Tencent as a whole, this is not a major business。Tencent also said that it is now more important to continue to increase its competitive advantage in the cloud business and continue to provide customers with the best service.。

In addition to seizing domestic market share, Tencent Cloud has been expanding overseas in recent years.。It is reported that Tencent Cloud's computing infrastructure network currently covers 26 geographic regions on five continents and has 70 availability zones.。Tencent cloud database TDSQL has successfully entered the Indonesian market, serving local financial institutions。

AI big model mix is progressing well, Tencent says AI regulation is necessary

For the hot AI topic, Tencent's conference call mentioned that its AI big model hybrid is making good progress, model building is progressing smoothly.。"In general, AI is making good progress. For Tencent, the core user service will not be disturbed, but it can benefit a lot from the big model.。"

Tencent said it has made corresponding progress in data, model sequences, infrastructure and many other areas.。"The big model is a growth multiplier for the industry and Tencent. It can improve service quality, increase liquidity efficiency, and reduce costs。"

Earlier media reports said that Tencent has set up a "mixed assistant" project team for ChatGPT-like conversational products, which will work with Tencent's internal multi-party team to build a large parameter language model, with the goal of improving Tencent's intelligent assistant tools and creating Tencent's intelligent assistant through the training of stable performance reinforcement learning algorithms.。

Questions about AI regulation。Tencent said: "This is not something unique to China, even around the world, there has been a lot of public discussion about regulation in the United States, and even the founders of OpenAI have been testifying and calling for regulation of the industry.。So we thought it was necessary。"

In addition, it is worth noting that according to Tencent's quarterly report, the group has 106,221 employees, with 108,436 employees at the end of last year, compared with 116,213 employees in the same period last year.。Calculations show that Tencent reduced its employees by more than 2,000 in the first quarter and nearly 10,000 in the past year.。The number of employees showed a downward trend。

For Tencent's Q1 earnings report, Xiaomo released a research report saying it was more confident in the group's earnings outlook。The bank said it was pleasantly surprised that Tencent's profit margin structure continued to improve due to a shift in revenue structure and continued cost-effectiveness.。Tencent's adjusted operating profit in the first quarter exceeded the bank's expectations by 19%.。Adjusted earnings per share growth accelerated from 19 per cent in the fourth quarter of last year to 28 per cent in the first quarter of this year, and the bank expects its growth to accelerate further for the rest of the year, to 30 per cent.。

Xiaomo said Tencent's online game revenue growth accelerated year-on-year, supported by strong momentum in domestic and international markets, and the strong momentum is expected to continue。The bank raised Tencent Holdings' H-share price target to HK $440 from HK $430, with a rating of "overweight."。

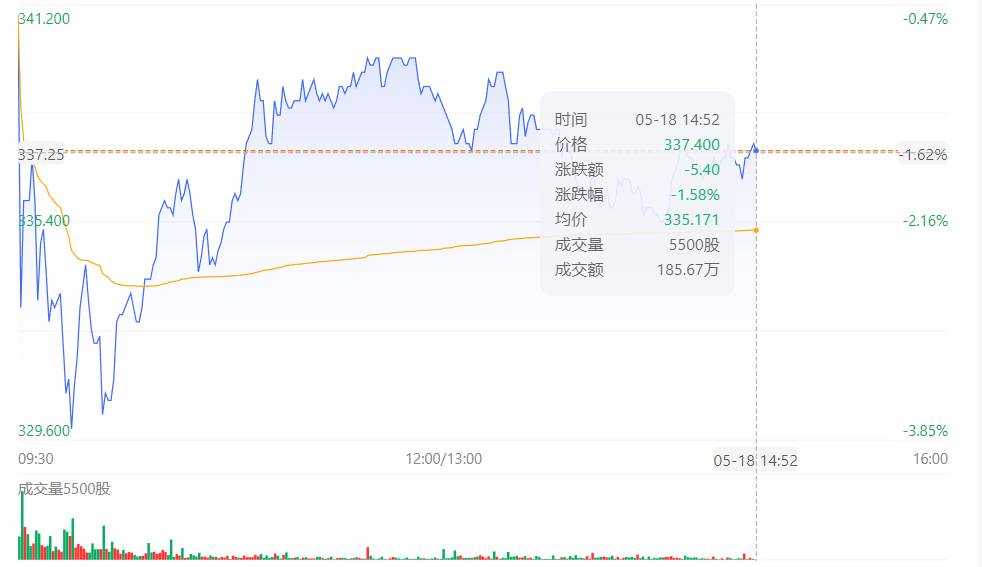

Today, as of press time, Tencent Holdings fell 1.58%, now 337.4 Hong Kong dollars。It is worth mentioning that as of May 16, southbound funds have bought Tencent for seven consecutive trading days, totaling more than HK $4 billion.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.