China Mobile's revenue still maintains double-digit growth with a full-year dividend of over 80 billion yuan!

On March 23, China Mobile released its 2022 annual results announcement。The company's full-year revenue last year was RMB937.3 billion, up 10.5%。

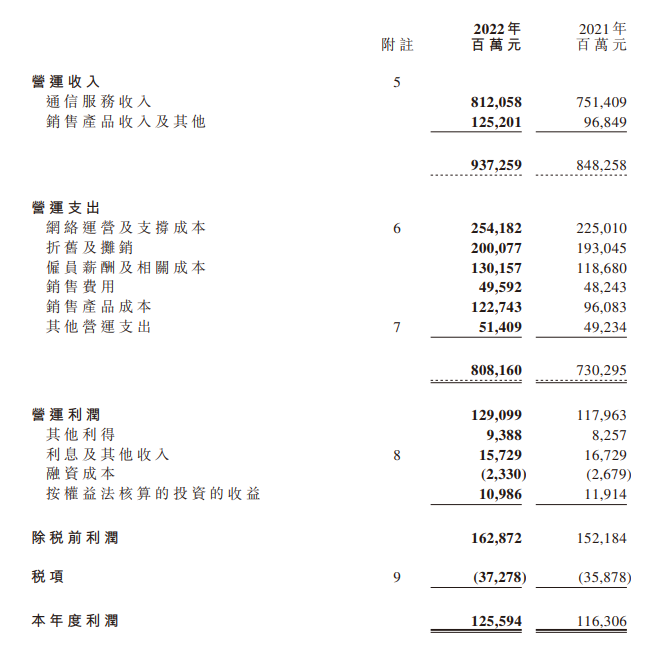

On March 23, China Mobile released its 2022 annual results announcement。The company's full-year revenue last year was 937.3 billion yuan (RMB, the same below), up 10.5%; of which, communications services revenue was 812.1 billion yuan, up 8.1%; profit attributable to shareholders was 125.5 billion yuan, up 8.0%; EBITDA was $329.2 billion, up 5.8%; Basic earnings per share 5.88 yuan; Proposed final dividend of 2 per share.HK $21。

In the face of the brilliant answer sheet handed over, China Mobile said that in 2022, the company will concentrate on the difficulties and challenges brought about by the complex and volatile external environment, firmly grasp the valuable opportunities of the vigorous development of the digital economy, anchor the positioning of "world-class information service technology and innovation company," focus on building a new type of information infrastructure focusing on 5G, computing power network and capacity, innovate and build a new type of information service system with "connectivity +。

According to the financial report, China Mobile's CHBN customer size and revenue scale will grow across the board in 2022, with HBN revenue accounting for 39% of communications services revenue..8%, up 4.1 percentage point。Thanks to the rapid expansion of 5G applications, mobile cloud, digital content, smart home and other businesses, digital transformation revenue reached 207.6 billion yuan, an increase of 30.3%。On the whole, the company's efforts to create a digital transformation revenue growth "second curve" has been fruitful, the revenue structure is more balanced and stable, the momentum of sustainable growth is increasing, and the ability to resist risks has been significantly improved.。In addition, the earnings report said that the company's proposed dividend payout ratio would be 67% in 2022 and that profits distributed in cash in 2023 would rise to more than 70% of the company's shareholders' share of profits for the year.。According to the financial report, China Mobile's net profit in 2022 will be 125.5 billion yuan, and dividends will exceed 80 billion yuan.。

After the earnings release, Citi released a research report saying that China Mobile maintained double-digit revenue growth last year, with service revenue up 8.1%, but dragged down by the large-scale operation of 5G and the development needs of the DICT business, the company's profit margin increased from 36 in 2021..7% to 35.1%。In addition, the bank said that China Mobile's deployed integrated operating strategy has improved its revenue structure and that digital transformation has become its strongest revenue driver, with customer base and revenue growing in all of its CHBN markets.。As a result, the bank maintains its "buy" rating on China Mobile and believes that the company has a leading market position as a potential 5G beneficiary, while setting its price target at 65..HK $31 up sharply to HK $81。

HSBC Global said it expects China Mobile's capital spending to fall by about 1% year-on-year this year, but the investment in computing services may increase from 33.5 billion yuan to 45 billion yuan.。The bank noted that Chinese telecom companies have the advantages of wide coverage, mature data processing and management capabilities, and expect the growth of this business to help them grow their service revenue by a compound of 5% and EBITDA by a compound of 4% from 2022 to 2025..3%, but may dilute gross margin growth。As a result, the bank raised China Mobile's target price slightly from HK $80 to HK $82 and maintained its "buy" rating.。

CICC, for its part, released a report saying that China Mobile's results last year were in line with the bank's expectations and that it was optimistic that the company would continue to develop its own core architecture and continue to enhance its cloud computing capabilities.。In addition, the bank noted that China Mobile's dividend payout ratio rose 7 percentage points to 67 percent last year, exceeding the bank's previous estimate of 65 percent, arguing that the company values shareholder returns and has a high dividend yield, which is attractive for investment.。As a result, CICC raised its China Mobile target price by 13.3% to HK $85。

As of today's Hong Kong stocks close, China Mobile closed down 1.65%, reported 62.HK $55。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.