The three major Hong Kong stock indexes all fell sharply and the Hang Seng Index lost 19,000 points!

On June 29, all three major Hong Kong stock indexes fell sharply, with the SOE index down 1 as of today's close..45%, at 6,426.59 points; Hang Seng Tech down 1.71%, at 3933.44 points; Hang Seng Tech down 1.24%, at 18,934.36 points。

On June 29, all three major Hong Kong stock indexes fell sharply, with the SOE index down 1 as of today's close..45%, at 6,426.59 points; Hang Seng Tech down 1.71%, at 3933.44 points; Hang Seng Tech down 1.24%, at 18,934.36 points。

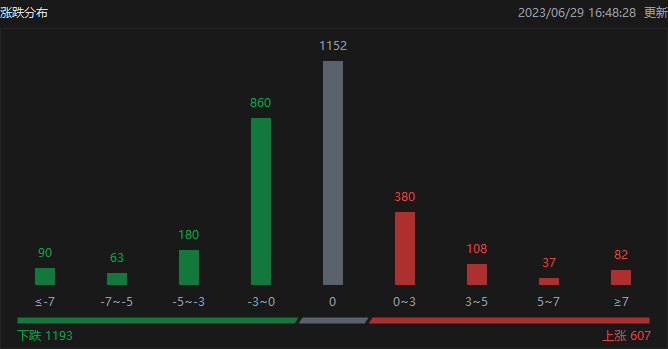

By the close, Hong Kong stocks rose 607, fell 1192 and closed flat at 1153。

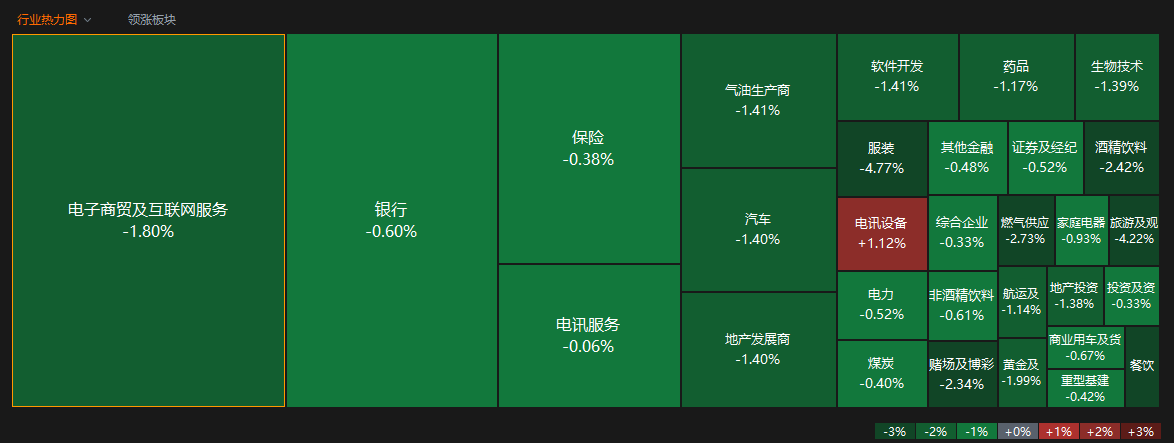

In terms of sectors, a few sectors, except telecommunications equipment, rose, while the rest fell to varying degrees.。Among them, clothing, tourism, gambling, alcoholic beverages sector led the decline.。

On the day of the hot plate breakdown, the network stocks collectively weakened。Among them, Baidu Group fell more than 4%, Jingdong, Bilibili fell nearly 4%, Weibo fell nearly 3%, Ali fell more than 2%, Meituan fell nearly 2%, Tencent is relatively good, down only 0.77%。

Bank stocks, Bank of Tianjin today rose nearly 3% led bank stocks, Dah Sing Bank rose more than 1%, in addition to the vast majority of bank stocks are down nearly / more than 1%。

Auto stocks were mixed, only Xiaopeng Auto rose, or more than 1%, both Weilai and Ideal Auto fell, with Ideal Auto falling more than 2% to lead the decline in auto stocks.。

On the news, Xiaopeng's new model G6 will go on sale on June 29 and start delivery in July.。It is reported that on June 12, Xiaopeng automobile announced that Xiaopeng G6 72 hours booking users over 2.50,000 people。In addition, Xiaopeng Motors recently announced that it will launch two smart electric models for the European market.。

CICC previously released a research report that maintained Xiaopeng Auto-W "outperform industry" rating, earnings forecast unchanged; considering that G6 competitive pricing is expected to drive valuation improvement, the target price increased by 9.8% to HK $45。

ChatGPT concept stocks generally fell, the U.S. chart fell more than 3%, Zhihu fell more than 2%, Shang Tang fell more than 1%, Yuewen Group fell slightly.。

International News

Fed: 23 U.S. banks that took part in its annual stress test all survived

The Fed says all 23 U.S. banks taking part in its annual stress tests have withstood a severe recession。Although the banks are expected to lose $541 billion, they are able to maintain minimum capital levels while continuing to provide credit in a hypothetical recession.。This clears the way for the U.S. banking industry to open a new round of dividends and buybacks.。

Powell gives the possibility of consecutive rate hikes in July and September, saying it may take years to fight inflation

Federal Reserve Chairman Powell said interest rate restrictions are not long enough to allow inflation to reach the target, more tightening is expected, most policymakers are expected to raise interest rates twice this year, do not rule out two consecutive meetings to raise interest rates, core inflation is expected to 2025 to fall back to the Fed's 2% target。

Highlights of Hong Kong Stocks

On June 28, HKEx announced that it plans to launch a new initial public offering settlement platform FINI (Fast Interface for New Issue) in October this year, which is an important reform of HKEx's market, shortening the time between the pricing of new shares and the start of trading of shares from T + 5 to T + 2.。

HKEx will launch final preparations before the launch in July-August and calls on FINI users to actively participate in the upcoming market exercise.。

Institutional Review

Huatai Securities said that the long-term trend of increasing liquidity in Hong Kong stocks remains unchanged, short-term or welcome decompression, while incremental capital entry or still waiting for more positive signals。The introduction of the dual counter system is expected to promote the long-term inflow of domestic and foreign capital into Hong Kong stocks; in addition, the "Belt and Road" catalyzed by China or into the Middle East sovereign wealth fund allocation optimization, Hong Kong stocks as offshore RMB assets, is expected to long-term access to incremental capital allocation from the Middle East。

Tianfeng Securities said that the current valuation of Hong Kong stocks is at an all-time low of about 2.2% of historical quantiles。Looking ahead to the six-month dimension, the bank believes that with the implementation of policies to promote the continued recovery of the domestic economy, corporate earnings upward, as well as the liquidity environment of Hong Kong stocks tends to improve, Hong Kong stocks in the volatility of the gradual repair of the momentum is more adequate.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.