Hawkinsight Hong Kong Market Closing Roundup (1.18) Hong Kong stocks stopped falling and recovered, shipping stocks and pharmaceutical stocks were popular.

On January 18, the three major indexes of Hong Kong stocks stopped falling and recovered today, while the three major indexes recovered in shock.。Hang Seng closed up 0 at close.75% at 15,391.79 points。

On January 18, the three major indexes of Hong Kong stocks stopped falling and recovered today, while the three major indexes recovered in shock.。Hang Seng closed up 0 at close.75% at 15,391.79 points; Hang Seng SOE Index closes up 0.76%, at 5172.05: 00, 5343.3 points; Hang Seng Tech Index closes up 0.51%, at 3176.08

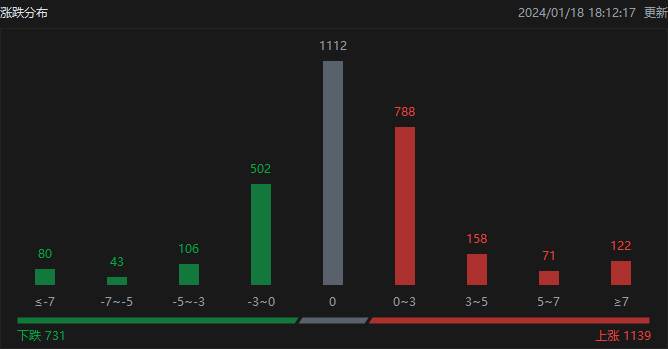

In terms of the distribution of ups and downs, as of the day's close, Hong Kong stocks rose 1,139, fell 731, and closed flat at 1,112.

On the day of the Hong Kong stock market, North Water traded net buy 5.HK $8.5 billion, of which the Hong Kong Stock Connect (Shanghai) traded a net purchase of 8.HK $4.7 billion, net sale of Hong Kong Stock Connect (Shenzhen) transactions 2.HK $6.2 billion。

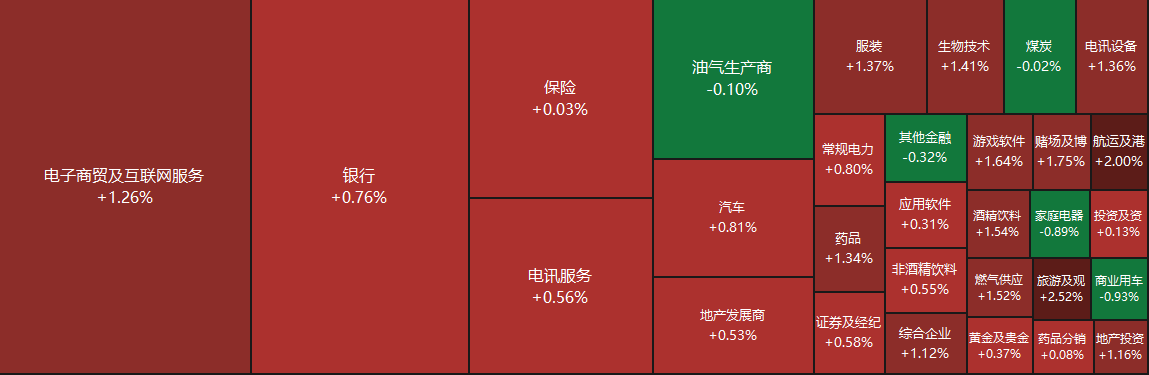

Sectors and Fundamentals

From the disk point of view, the network stocks throughout the day active, Baidu rose more than 3%, beep mile up nearly 3%, NetEase rose nearly 2%, Alibaba, Meituan, Xiaomi, Tencent rose more than 1%, Jingdong fell nearly 2%

Fundamentally, according to the incomplete statistics of the Middle School, as of now, a few real estate enterprises such as R & F, Rongchuang and Aoyuan have basically completed the restructuring or extension of domestic and foreign bonds;。Liu Shui, director of corporate research at the China Index Research Institute, believes that in 2024, more debt restructuring of enterprises at risk will make significant progress, and the risk clearance of real estate enterprises will speed up.。At the same time, the successful debt restructuring of some real estate enterprises has a strong reference significance for the debt restructuring and risk resolution of other insured enterprises.。Dongguan Securities previously said that after a wide range of industry reshuffle, high-quality head enterprises industry concentration will be further enhanced, and with the industry fundamentals repair, real estate enterprises profit performance will also bottom up。

Vincent Clerc, chief executive of shipping giant Maersk, said on Wednesday that global shipping disruptions caused by attacks on ships in the Red Sea could last at least a few months.。A recent research report by Jefferies said that in 2023, the average freight rate in Asia and Europe was about $1,550 / FEU, but it has now more than doubled to more than $3,500 / FEU。So far, many shipping giants have raised their 2024 earnings forecasts, and many have even predicted that the global shipping industry's recession will end this year, most likely at the end of the third quarter.。However, some opponents point out that there is still an oversupply of containers in the global shipping industry.。

Increase or decrease in institutional holdings

According to the Hong Kong Stock Exchange, on January 12, Xiaomo increased its holdings of Vanke's 351.88.07 million shares, priced at 6 per share.HK $4,931, with a total increase of approximately 2,284.HK $800,000。The latest number of holdings after the increase is about 1..3.5 billion shares, with a change in shareholding to 6.11%。

On January 12, FMR LLC increased its holdings of Quanfeng Holdings 4.710,000 shares, priced at 20 per share.HK $1,342, total increase of approximately 94.HK $830,000。The latest number of shares held after the increase is about 5111..910,000 shares, with a change in shareholding to 100,000.00%。

January 12, Komo increases holdings of Follett Glass 266.92.7 million shares, priced at 14.HK $6,549, with a total increase of approximately 3,911.HK $790,000。The latest number of shares held after the increase is about 5977..870,000 shares, shareholding changed to 130,000.28%。

New Stock News

On January 16, Galan Group announced that the company decided to change its name from "Galan (Group) Co., Ltd." to "Shanghai Natural Hall Group Co., Ltd."。

It is worth mentioning that in September last year, there was market news that Galan Group was working with Huatai International and UBS on an IPO, considering a listing in Hong Kong as early as 2024, and was planning to raise no more than $500 million (about RMB 36.700 million yuan)

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.