2022 net profit plunges 44% YoY.How long can 3% Bubble Mart's "glimmer of light" last

On March 29, Bubble Mart released its 2022 annual results announcement.。The company's annual revenue reached 46.1.7 billion yuan, up 2.8%, the total number of registered members reached 2600.40,000 people。

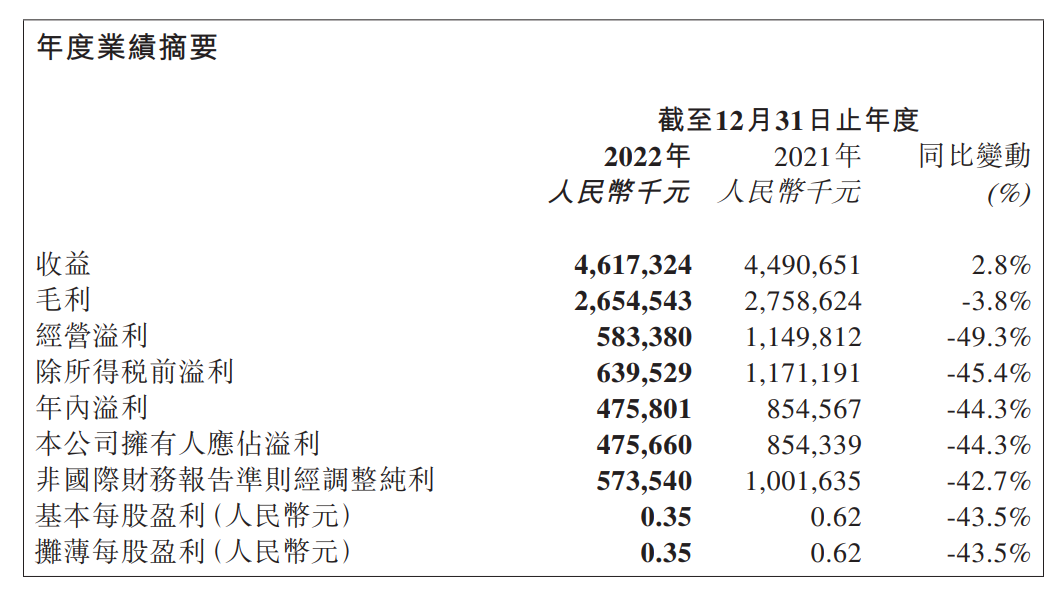

On March 29, Bubble Mart released its 2022 annual results announcement.。The company's annual revenue reached 46.1.7 billion yuan (RMB, the same below), up 2.8%, the total number of registered members reached 2600.40,000 people。In addition, the company owner should account for profit of 4..7.6 billion yuan; basic earnings per share 0.$35, proposed final dividend of 8 per share.70 points。

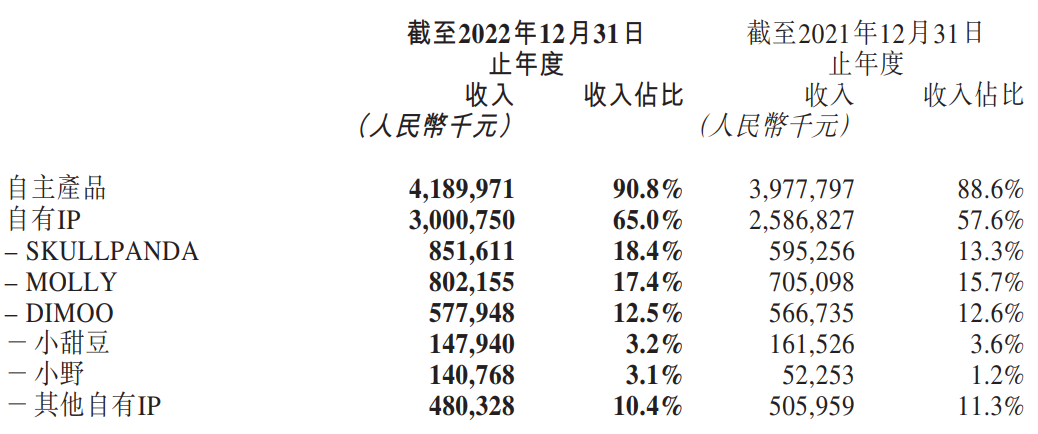

Head IP performance continued to be strong, overseas market revenue increased by 147.1%

Breakdown, on the product design side, Bubble Mart's head IP performance continues to be strong。Among them, in 2022, SKULLPANDA revenue 8.500 million yuan, up 43.1%。Among them, the IP launched its fifth series of Night City in January 2022 with a full-year revenue of 2.300 million yuan。MOLLY, as a classic IP, will generate $800 million in revenue in 2022, up 13.8%, while the DIMOO series revenue 5.800 million yuan。

In terms of high-end IP, Bubble Mart has also made a breakthrough, the company continues to cultivate its high-end brand "MEGA Collection Series" in 2022, and with Han Merrill Lynch, Okubo, Basquiat and other artists to launch a joint artist model.。In 2022, Bubble Mart earns 4% on its MEGA series.700 million yuan。

On the channel side, offline, in 2022, in response to the uncertainty of the outbreak, the company slowed the pace of opening offline stores and robot stores.。On the online channel, Bubble Mart achieved RMB 9 in 2022 through its WeChat platform self-developed applet..500 million yuan of income.In terms of membership operations, the company's user digitalization has expanded rapidly, with the cumulative total number of registered members as of December 31, 2022 up from 1,958 at the end of 2021..0 million to 2,600.40,000 new registered members 642.40,000 people。Percentage of sales contributed by members in 2022 93.1%, member repurchase rate of 50.7%。

In Hong Kong, Macao, Taiwan and overseas business, the company continues to promote the DTC (Direct To Customer) strategy.。By the end of 2022, the company had 43 stores in Hong Kong, Macao, Taiwan and overseas (including joint ventures and franchises), 120 robot stores (including joint ventures and franchises), 13 cross-border e-commerce platform sites, and opened its first offline stores in the UK, New Zealand, the United States and Australia in 2022.。For the full year 2022, Bubble Mart's overseas market revenue increased by 147 YoY..1%, but this revenue only accounts for 9.8%。

Net profit fell sharply last year, the company's operations were seriously affected by the epidemic.

It is worth noting that, as the "blind box first share," the company's net profit in 2022 for the first time in the public data decline, and the decline was alarming, reaching 44.3%。In addition, Bubble Mart's gross margin fell to 57 in 2022..5%, compared to 63 in 2020.4%, 61 in 2021.4%。

In response, Bubble Mart said the outbreak may be an important reason why the company's earnings data came under pressure last year.。First, in mid-2022, Bubble Mart's offline stores, robot stores and online logistics will all be affected to varying degrees by the epidemic.。According to the financial report, in 2022, the number of Bubble Mart offline retail stores closed for one week to three months reached 232, while the number of robot stores closed for one week to three months reached 627.。Second, as the company's dealers were affected by the outbreak, resulting in a decline in store sales and inventory accumulation, it significantly reduced product purchases, dragging down its revenue.。Finally, the company's online channel revenue also recorded a year-over-year decline due to the impact of the epidemic on logistics and consumer spending power。

Dragged down by triple negatives, despite Bubble Mart's advertising and marketing costs last year from RMB 1 in 2021..600 million yuan growth soared 48.1% to 2022 RMB 2.300 million yuan, or can not save this unsatisfactory annual financial report。

After a long drought, the sales of sweet dew increased by 30% quarter on quarter, and there was a glimmer of light at the end of 2023.

In the face of market concerns, at the results conference held yesterday afternoon, Bubble Matt finally brought you long-lost good news。

Bubble Mart said the company's overall sales recovery is already underway, with more than 30% growth in the first quarter of this year compared to the fourth quarter of last year.。In addition, the company said it is generally optimistic about its full-year 2023 growth forecast, with growth rates expected to be between 30% and 40%.。The company's next steps will be to improve gross margins and control expense ratios, with net margins expected to grow significantly faster than revenue growth this year。

The company also said it hopes to open 80-90 overseas stores and 200 robot stores, 70% of which are located in East and Southeast Asia and 30% in Europe, America and Australia.。But the company reiterated that its offline remains a focus, while confident in overseas growth.。

For the current fire of artificial intelligence, bubble Matt said, AI can help companies improve efficiency, but in the creation of IP and art creation, AI still has a gap。However, the company does not rule out the use of AI software to improve work efficiency, but still due to copyright issues must be cautious。At the same time, the company embraces new AI technologies such as ChatGPT and midjourney, believing that they can help improve work efficiency and reduce personnel costs.。

The stock price fell 80% in three years and Zhang Kun couldn't sit still.

Compared to the highlight of 2021, Bubble Mart's current share price has fallen by 80%。In 2018 and 2019, the year-on-year increase in Bubble Mart revenue was 225.49%, 227.19%, while in 2020, Bubble Mart revenue growth fell to double-digit 49.3%, recorded a sharp decline。By 2021, despite the year-on-year 78.The 7 per cent growth rate was a significant improvement over the previous year, but for the first time in the first half of the year, there was no increase in revenue.。

In this way, Bubble Mart's 2022 revenue increased slightly by 2.8% of the results, even how can not take。What is even more worrying is that if Bubble Mart can still use the "epidemic" as a shield in 2022, it will only be "shirtless" in 2023.。

In the face of worrying data, even Zhang Kun, a value investment practitioner who has always been willing to "accompany the growth of enterprises and share the fruits of enterprises," can't sit still.。According to the latest Yifangda Quality Corporate Fund Annual Report, Zhang Kun has liquidated his position across the board.。The market believes that Zhang Kun is likely not making gains on Bubble Mart。

Credit Suisse Slightly Downgrades Bubble Mart Earnings Per Share Goldman Sachs Focuses on Its Gross Margin Recovery

After the results were released, Credit Suisse published a research report saying that Bubble Mart's revenue rose 3 percent to $4.6 billion last year and adjusted net profit fell 43 percent to $5..7.3 billion yuan。Management expects the Group's revenue to grow by 30-40% year-on-year this year, mainly due to offline traffic recovery, online channel construction and overseas expansion; gross margin will increase by 1-3 percentage points year-on-year, and gross margin will stabilize at more than 60%。The bank also said it expected the growth trend to improve further, taking into account the low base since March last year, the launch of new series, the expansion of business lines and the acceleration of overseas expansion.。The bank cut its 2024 earnings per share forecast by 6% and expects sales and net profit to grow at a CAGR of 25% and 43%, respectively, from 2022 to 2025.。In addition, the bank raised the company's target price from HK $20 to 22.HK $5 and maintains OUTPERFORM rating。

Goldman Sachs said Bubble Mart's net profit for the second half of 2022 fell short of the bank's expectations, and revenue and gross margin declined and operating expenses increased。The bank is optimistic that the company will maintain a good short-term recovery on a high base, but still has to wait for the specifics of a recovery in gross margins。The bank believes that the trend of the company's complex designs and products has not improved, and the company's inventory has not yet returned to normal levels.。In addition, the bank is bullish on Bubble Mart raising its OPEX ratio to drive revenue sales and new business improvements to capture diversified consumer demand.。In summary, the bank raised its 2023 net profit forecast by 4%, maintaining its HK $20 target price and "neutral" rating.。

As of today's close, Bubble Mate rose 11 times during the day..63%, closed at 21.HK $70。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.