Q2 profit shrinks by nearly 60% Goldman Sachs is potholed by Apple Card!

In the second quarter of this year, Goldman Sachs not only recorded its lowest quarterly profit in nearly three years, but also made it the first top Wall Street bank to underperform in the current earnings season.。

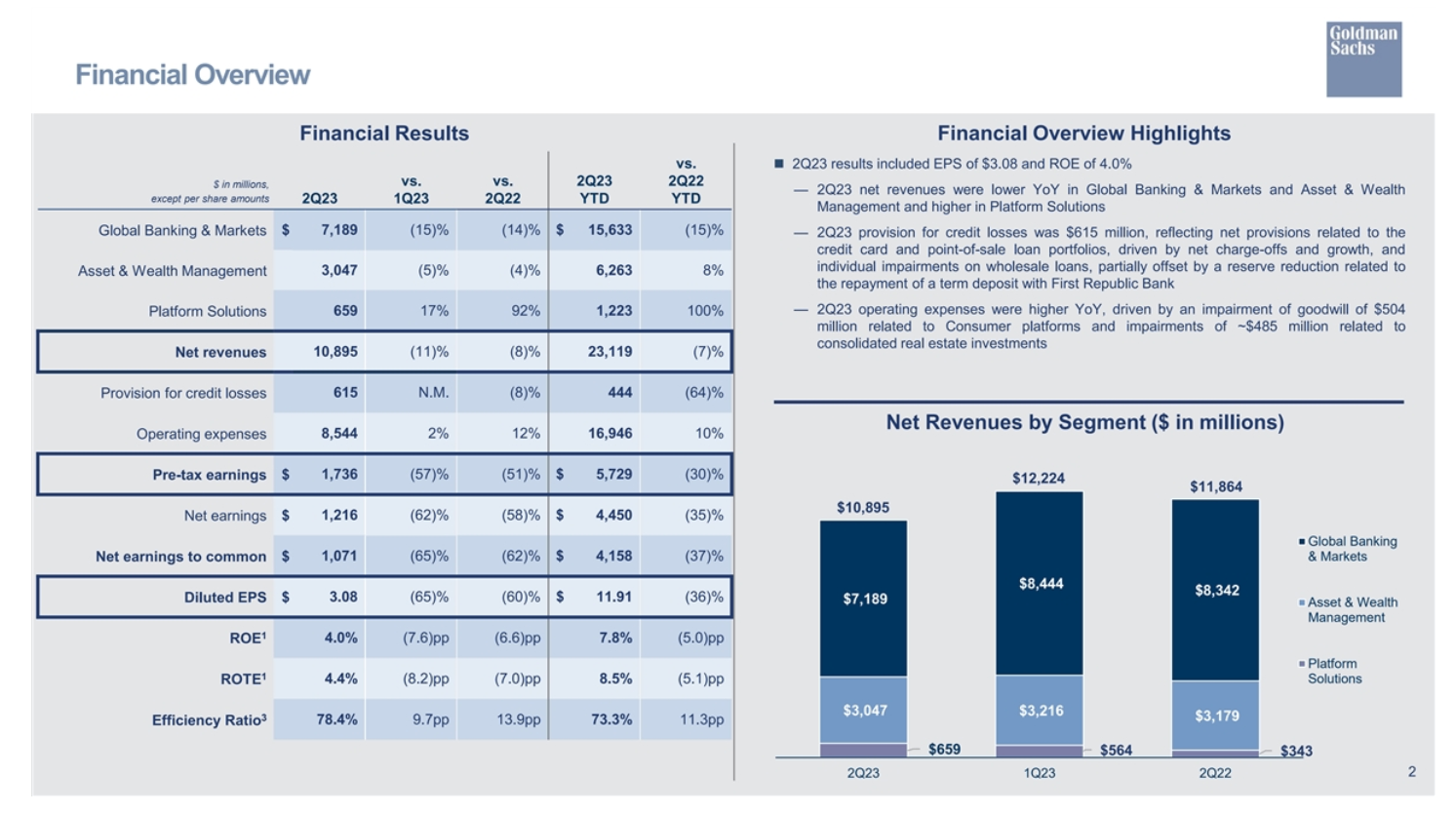

Goldman Sachs, a leading Wall Street investment bank, released its second-quarter 2023 results on July 19.。The company's second-quarter revenue was $10.9 billion, down 8.2%, expected 104.$600 million; EPS of 3.$08, compared to 7 a year earlier.$73, expected at 4.$14; profit down 58% from a year ago to 12.$200 million。Notably, Goldman recorded nearly $1 billion in impairments and losses in its real estate investment and consumer lending businesses during the quarter.。

Net loss 6.$6.7 BILLION! GOLDMAN SACRED BY CONSUMER CREDIT UNIT

Overall, this report is not satisfactory.。Earnings per share fell short of expectations, not to mention that profits during the reporting period actually fell nearly 60% year-on-year, which was a big surprise.。While Citi and Damo's second-quarter earnings were also not good, down 36% and 13%, respectively, they were also far less serious than Goldman Sachs'.。In the second quarter of this year, Goldman Sachs not only recorded its lowest quarterly profit in nearly three years, but also made it the first top Wall Street bank to underperform in the current earnings season.。

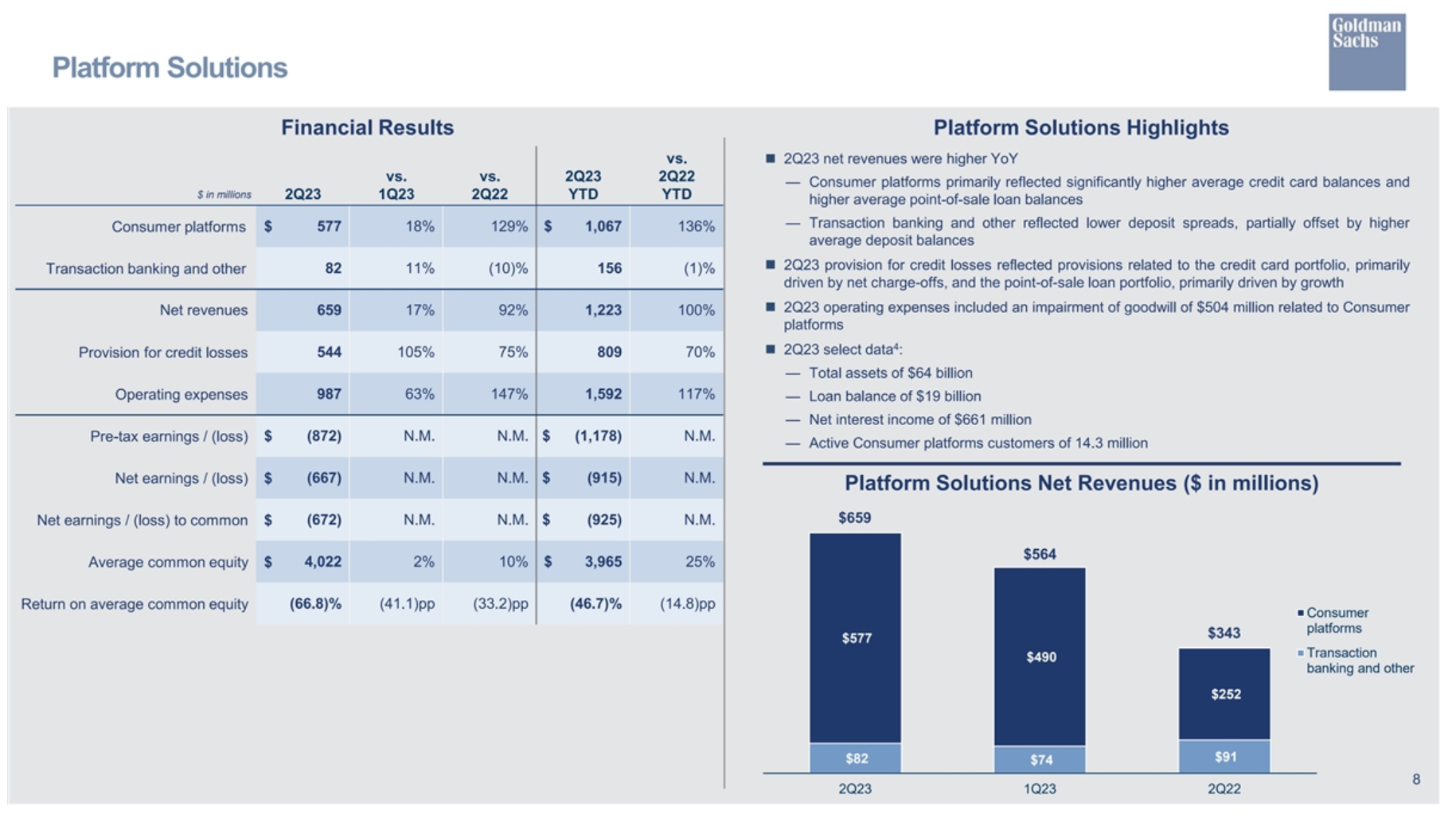

The reason for this is that Goldman Sachs' Platform Solutions division has been severely held back, with a net loss of 6.$6.7 billion, pre-tax loss up to 8.$7.2 billion。The division, which translates as "Platform Resolution," is actually Goldman Sachs' consumer credit division, covering GM's credit cards, some of Goldman's consumer banking services, and the Apple Card business that was on fire some time ago.。

According to the published report, while the sector's revenue increased overall, its provision for credit losses was as high as 5.$4.4 billion, while operating expenses are as high as $9.$8.7 billion。According to outside analysis, it is not clear how much of the department's losses came from Apple Card, but the percentage is expected to be small.。In the first half of this year, Platform Solutions has become a big loss for Goldman Sachs, and according to calculations, in just six months, the division's net loss has been as high as 9.$1.5 billion。According to the media, Goldman Sachs has now considered launching a partnership with Apple on the Apple Card business, preparing to transfer its packaging to American Express.。

Goldman's proud investment banking business also underperformed during the reporting period。Revenue from the business fell 20 percent year-over-year, while trading fell 14 percent, also dragging down Goldman's net profit.。In addition, Goldman's return on equity increased from 11 in the previous quarter..6% and 10% in the same period last year.6% fell sharply to 4%, and the bank said in an investor note that excluding asset write-downs, its return on equity for the quarter was 9.2%。The weaker-than-expected earnings and return on equity also illustrates the challenges Goldman Sachs faces as it moves deeper into the waters of business reform, namely phasing out its once-highly anticipated consumer lending business and making adjustments to its asset management model.。

Previously, driven by Goldman Sachs Chairman and CEO David Solomon, the bank had been pushing for a reform of its asset management business to adjust to a less capital-intensive model.。As part of the reform, Goldman Sachs has moved away from fully using its own funds to invest in real estate, private equity and other assets, and instead is focusing on raising client funds to invest in these industries。

Chairman and CEO feed the market to eat "reassurance" Goldman Sachs shares closed up 0.97%

At the post-earnings conference, Solomon also interpreted the results of the announcement.。

He said the quarter's results reflect the execution of our strategic objectives.。First, the Global Banking and Markets division delivered solid results in a cyclical downturn, and we remained number one in the M & A transactions we completed, a testament to our best-in-class client assets。Second, the asset and wealth management sector recorded new highs in total regulated assets, management and other fees, and net income from private banking and lending.。He also said that he is fully confident that the continued execution of our strategy will enable us to achieve full-cycle return targets and create significant value for shareholders.。

Solomon continues to endorse Goldman's future performance, stressing that he has felt much better over the past six to eight weeks than he did earlier this year。Looking ahead, he feels that investment banking has fallen to nearly a decade low and that is unlikely to continue.。

In response to concerns about layoffs, Solomon revealed that we have been adjusting the number of employees since January.。Some effective actions have been taken so far and we will keep a close eye on revenue。If anything changes, adjustments will continue to be made.。

Wall Street head banks cut 2 jobs in the first half of the year, according to media statistics, as trading and capital market activity fell short of expectations..10,000 people。As a result, expenses related to severance payments pushed up costs for the top six banks, with expenses related to personnel changes and compensation rising 6 per cent to $95.5 billion, which was also reflected in their earnings reports.。According to Solomon, Goldman Sachs' layoffs are likely to continue if results for the second half of the year do not meet expectations。

Boosted by Solomon's speech, U.S. stocks, Goldman Sachs fell more than 1 at one point on Wednesday..The 5% share price bucked the trend and ended up 0.97%, at 340.55美元。

On July 20, Goldman Sachs announced that the bank would be ex-dividend on August 30, 2023, with a dividend of 2 per share..75美元。The relevant dividend equity registration date is August 31, 2023, except for the net date of August 30, 2023 and the dividend date of September 28, 2023.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.