High-end process steadily advancing China Resources Beer's profit is expected to reach double-digit growth this year

On March 24, China Resources Beer released its 2022 annual results announcement。Financial data show that the company's operating income in 2022 352.600 million yuan, an increase of 5.6%。

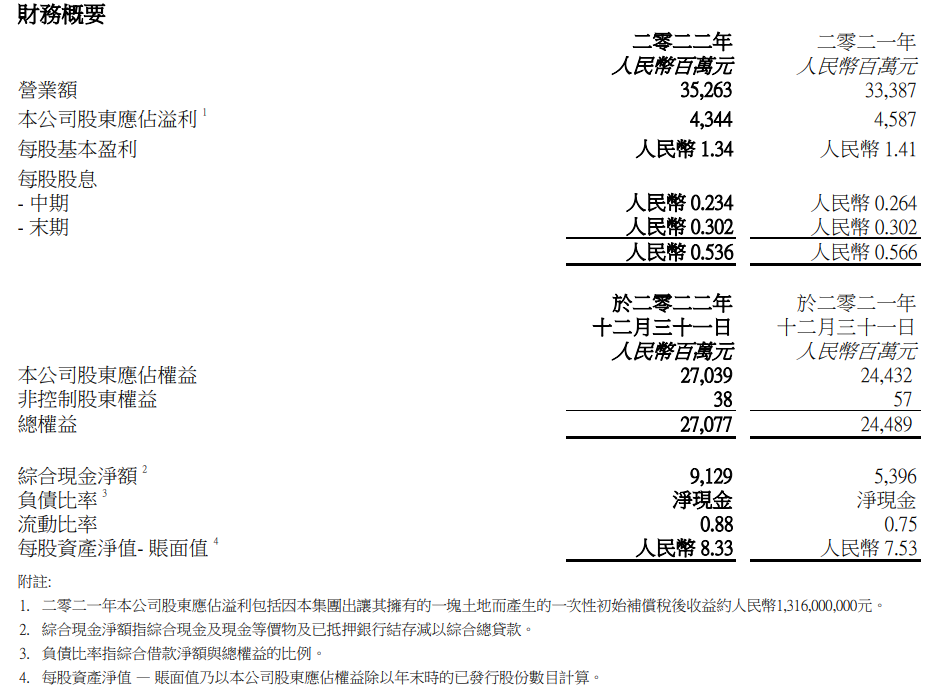

On March 24, China Resources Beer released its 2022 annual results announcement。Financial data show that the company's operating income in 2022 reached 352.600 million yuan (RMB, the same below), an increase of 5.6%; net profit attributable to parent 43.400 million yuan, a decrease of 5.3%。In the second half of last year, the company's operating income was 137.700 million yuan, an increase of 3.9%; net profit attributable to parent 5.400 million yuan, a year-on-year increase of 83.1%。

CR Beer says 2022 is a difficult year。

In the external environment, mainland China continues to be affected by the epidemic, putting downward pressure on the economy。In terms of channels, local drinking channels are closed for some of the time, which has a significant impact on overall beer sales.。In the face of many unfavorable factors, the company makes plans in advance, adjusts resource use strategies in a timely manner, strengthens employee protection, ensures that logistics, production and raw material supply are guaranteed, and minimizes the negative impact of the epidemic through various initiatives.。

First of all, in terms of sales, China Resources Beer continues to promote the "decisive battle high-end" strategy, through various theme promotion and channel marketing activities, continue to cultivate and promote the key brands, enhance brand awareness and product sales.。By region, in terms of Chinese brands, the company promotes brand influence through spokesmen and sponsors various variety shows to expose brands and increase sales.。In addition, the company also opened up new areas of meta-universe marketing, launched the first snowflake brand virtual human "LimX," in order to enhance the brand's influence in the virtual world and young people, driving the "brave to the end of the world" superX "and" snowflake pure life "two products sales in 2022 continued to grow.。In terms of international brands, the company has held a number of promotion, marketing and naming activities with the help of the Champions League and the "Heineken" audio theme, driving the "Heineken" brand to continue to record double-digit sales growth in 2022.。Overall, the company's overall beer sales in 2022 increased by 0% year-on-year..4% to about 11,096,000 kiloliters, with steady sales growth beginning to bear fruit。

Then, in terms of product structure, the company continued to promote its high-end and above beer products, promote the construction of a diversified brand portfolio, and moderately adjust the prices of some products, so that the overall average selling price of products in 2022 increased by 5% year-on-year..2%, expand profit margins。The downside is that the company's overall gross margin in 2022 fell by 0% year-on-year due to a significant increase in the cost of raw materials and packaging materials for its products due to geopolitical and global supply chain disruptions..7%。

Secondly, in terms of cost reduction and efficiency enhancement, the company promotes the concept of "living a tight life" and takes a number of measures to control operating expenses.。The company's sales and distribution expenses in 2022 were roughly the same as in 2021, while the cost of sales ratio decreased by 1% compared to 2021..1 percentage point to 19.1%。In addition, CR Brewery's secondary recognition of employee compensation and resettlement costs and impairment losses on fixed assets related to plant closures in 2022 totaled approximately RMB2.$3.5 billion, down 3.9% from 2021.3 per cent, together with the introduction of "tight days" measures, resulting in administrative and other costs falling by 8 per cent in 2022 compared to last year..3%。

Finally, in terms of expanding its non-beer business, China Resources Beer, through its indirect wholly-owned subsidiary China Resources Liquor Holdings Limited (China Resources Liquor), acquired Guizhou Jinsha Cellar Liquor Company Limited (Guizhou Jinsha) on 25 October 2022 55.19% equity interest, signed a capital increase, share purchase and shareholder agreement to further expand China Resources Beer's presence in the liquor business, providing an important and strategic opportunity for China Resources Beer to diversify its liquor portfolio and revenue streams.。The delivery of the equity transfer was completed on January 10, 2023, and Guizhou Jinsha became an indirect non-wholly owned subsidiary of China Resources Beer on the same day.

In the face of this hard-won achievement, Hou Xiaohai, Executive Director and CEO of China Resources Beer, said that in 2022, under the guidance of the "decisive battle high-end, quality development" strategy, through the "Chinese brand + international brand" rich product portfolio, high-end development, lean management and green low-carbon development and other initiatives, the company has effectively improved the management efficiency of the enterprise, optimized cost control, improved capacity efficiency and expanded brand influence.。

In addition, China Resources Beer, with the acquisition of Guizhou Jinsha Cellar Wine Co..19% of the shares, and actively build a "beer + liquor dual energy business model, further strengthening the competitiveness of China Resources Beer in China's liquor industry."。Looking to the future, Hou Xiaohai said that 2023 is the first year of the last three years of China Resources Beer's "3 + 3 + 3" corporate development strategy, and is a key node in the new stage of "winning high-end."。The company will build China Resources Beer into a diversified liquor company through top-level restructuring, brand building, organizational transformation, digital marketing and liquor business development, and make steady progress towards the goal of "being a leader in the new world of beer" and "being an explorer in the new world of liquor."。

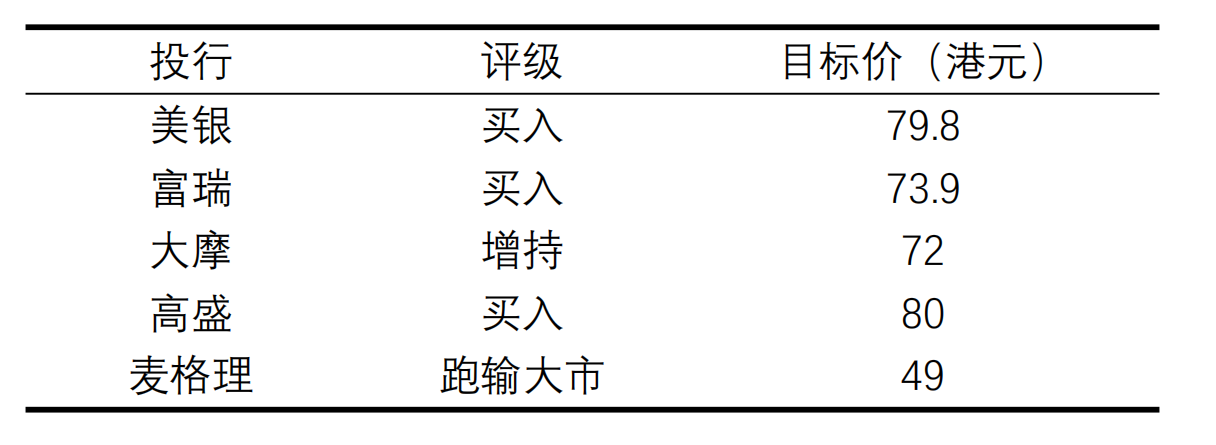

In the face of the brilliant answer sheet handed over by China Resources Beer, the investment banks have paid great attention after the performance.。

After the earnings release, Bank of America Securities released a research report saying that China Resources Beer's performance is solid and the outlook is optimistic.。Bank of America expects the company's earnings per share to grow at a CAGR of 20% to 25% in 2022-25, and should be above trend this year。As a result, the bank raised its earnings per share forecast for China Resources Beer by 6% for 2023 and 2024, respectively, and raised its target price by 6% to 79.HK $8, while noting that the increase not only reflects Run Beer's strength in its beer business, but that the bank also took into account its liquor acquisition last year.。The bank maintained its "buy" rating on Run Beer and said it remained one of its top consumer brands.。

China Resources Beer's recurring EBITDA and sales figures last year were in line with expectations, but net profit fell 5.3% to about RMB 4.3 billion, higher than the bank and market expectations。In addition, the bank noted that the company's management has a medium-term strategy for both its brewery and its liquor business.。As a result, the bank raised its net profit forecast for this year and next by 4.5% and 4%, while setting its target price from 70.7 HK dollar rises to 73.HK $9 to reflect its earnings forecast adjustment and acquisition of Sands Liquor and maintain Run Beer's "buy" rating。

Damo, on the other hand, said that Run Beer's target for 2023 is to record positive sales growth, with the bank predicting that sales of sub-high-end and above products will rise by more than 20%, accounting for 23% to 25% of overall sales, but the figure was only 19% last year; and the company has set expectations and development strategies for the acquired Sands industry, which is expected to be completed within this year.。As a result, the bank raised its recurring earnings forecast for this year and next by 4% to 5%, and raised its target price from HK $67 to HK $72, maintaining its "overweight" rating.。

Goldman Sachs published a research note noting that Runbrewery's performance remained solid in last year's difficult operating environment and that management's outlook for long-term high-end and recent strong sales recovery is positive。At the same time, the bank pointed out that Run Beer's management's target for this year is to achieve positive growth in both the average price and sales volume of the company's products.。In addition, Goldman Sachs expects sales to grow 17% year-over-year this year; recurring EBIT to grow 44% year-over-year。As a result, the bank's target price for Run Beer remains unchanged at HK $80 and maintains a "buy" rating, while keeping the company on its convinced buy list.。

Macquarie, on the other hand, said China Resources Beer's sales volume and average sales price in the second half of last year increased by 1.7% and 1.8%; gross margin declined by 1% in the second half of the year due to higher input costs..8% to 32.9%。The bank noted that the company's management aims to achieve 10 billion yuan in sales for Sands within three years.。The bank also said it cut its 2023 adjusted EBIT forecast by 0% due to lower-than-expected revenue growth.9%, but raised its forecast for 2024 by 1.9% to reflect the company's ongoing cost savings policy。As a result, the bank maintained Run Beer's "outperform" rating and fine-tuned its target price upward from HK $45 to HK $49.。

By the close of trading on March 27, China Resources Beer edged up 0.08% at 62.HK $95。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.