Buffett Cashes Out $850 Million More, Accelerates Sale Of Bank Of America Stock

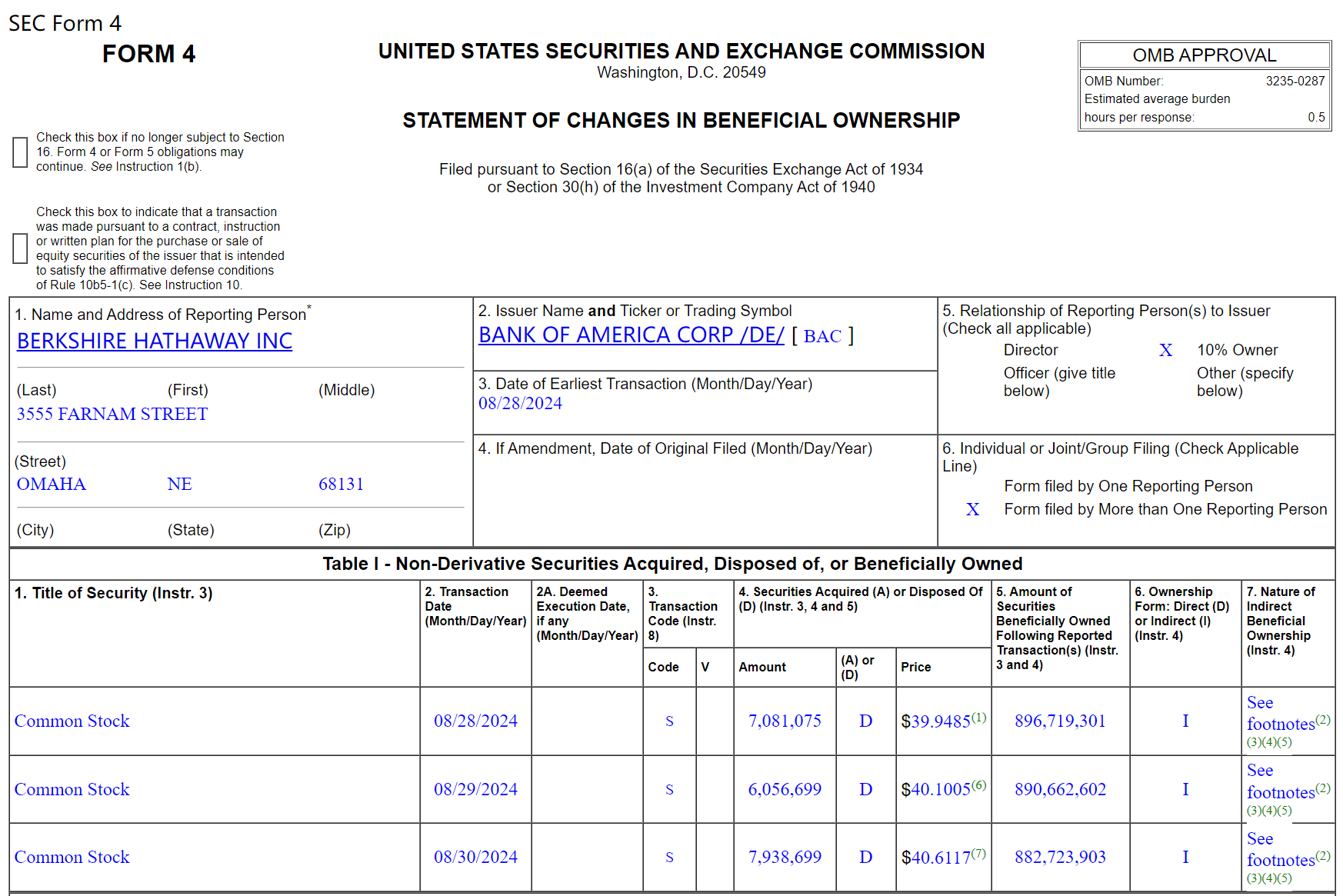

According to the latest filing, Berkshire Hathaway sold 21.1 million shares of Bank of America stock over the three-day period of Aug. 28-30, at an average selling price of $40.24, for a total of nearly $850 million in cash.

Warren Buffett is accelerating his selling of Bank of America shares.

On Aug. 30, local time, Berkshire Hathaway sold 21.1 million shares of Bank of America stock over the three days from Aug. 28 to 30 at an average selling price of $40.24, cashing out nearly $850 million, according to documents the company filed with the SEC.

Since July 17, Warren Buffett has been throwing Bank of America shares one after another, in the past 33 trading days, Berkshire has 21 trading days in the sale of Bank of America shares. According to statistics, Berkshire sold a total of 150.1 million shares, with an average selling price of $41.33 per share, accumulating about $6.2 billion in cash.

For Berkshire and Bank of America, each other in their own terms are very important.

Bank of America is one of Berkshire's longest positions, ranking third in its portfolio behind Apple and American Express.

Meanwhile, Berkshire is the largest shareholder in Bank of America, currently holding about 883 million shares of the banking giant, an 11.4% stake worth a whopping $36 billion. However, once Berkshire's stake drops below 10%, there is no need to disclose the transaction within two business days, as is the case now, and outsiders will have to wait until Berkshire's 13F filing, which is released every quarter, to find out the exact position.

In addition, the outside world is also curious, Buffett will choose to “liquidate” off the Bank of America. Judging from Buffett's past investments, when he begins to sell a large number of shares, he usually sells them all, as he has done in recent years with Paramount Global and several bank shares (including Bank of America and Bank of New York Mellon).

Buffett began investing in Bank of America in 2011, when he spent $5 billion on the bank's preferred stock and warrants. Buffett converted those warrants in 2017, and his Berkshire became the bank's largest shareholder, a position it maintains to this day.

Berkshire's reduction has sparked speculation, but Buffett and Berkshire have not responded to the recent string of sell-offs. There is speculation that Buffett may be concerned about the profitability of the banking sector as the Federal Reserve's expected rate cut is almost certain.

However, from the point of view of Bank of America's stock price this year, its share price increase has not been significantly below average. As of August 30, the bank's shares have risen 21% this year, while the Standard & Poor's 500 Bank Index, which tracks the performance of large banks, has risen 22.6%.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.