In the first quarter, Berkshire continued to increase its holdings of Apple and Western Oil regional bank stocks, which were liquidated by the "stock god."

On May 15, Berkshire Hathaway, owned by Warren Buffett, released its 13F position report for the quarter ended 2023.。

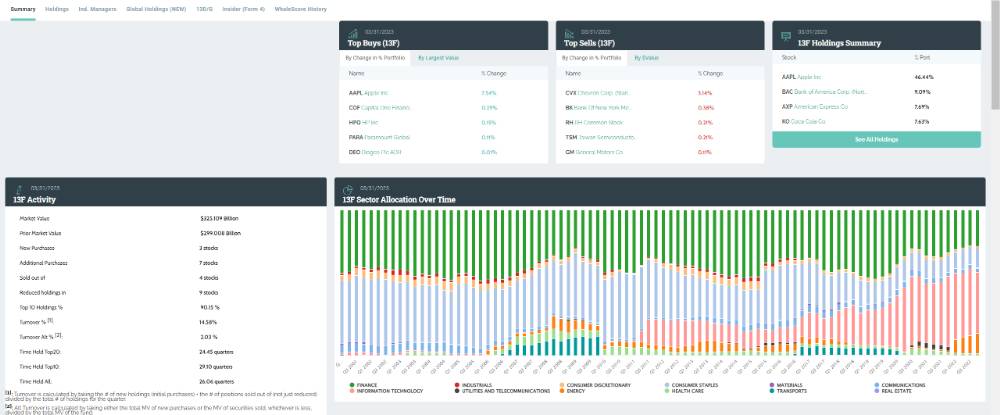

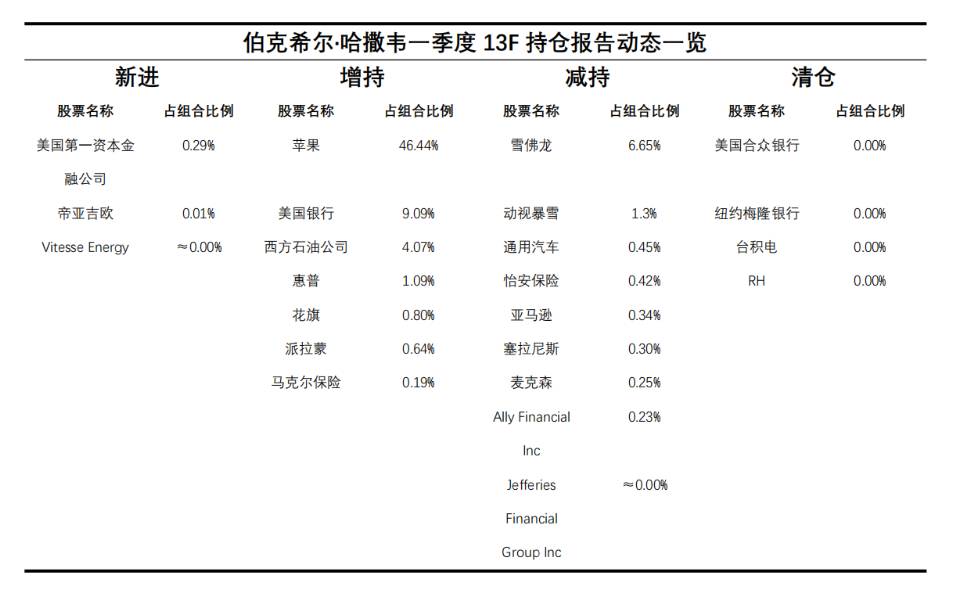

On May 15, Berkshire Hathaway, owned by Warren Buffett, released its 13F position report for the quarter ended 2023.。The data shows that the total market value of Berkshire's positions in the first quarter rose from 2,990.US $08 million to 3251.$0.9 billion。In terms of position adjustment actions, Berkshire entered 3 new shares, increased its holdings of 7 shares, reduced its holdings of 9 shares, and liquidated 4 shares in the first quarter, with the top 10 stocks accounting for 90% of the net asset value of the portfolio..15%。

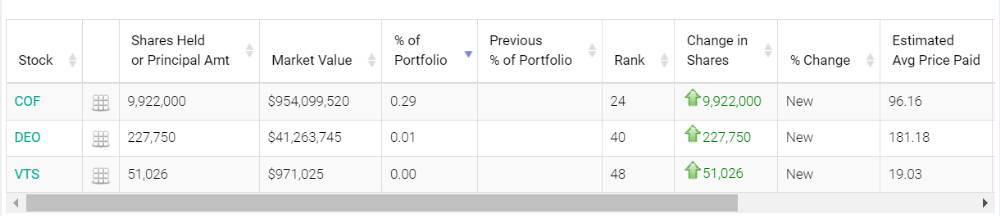

Specifically, in terms of new stocks, Berkshire opened a position in the first quarter at First Capital Finance Corporation (Capital One) 992..20,000 shares, with a position value of 90,000.$5.4 billion; building a position in Diageo, a well-known British winery 22.80,000 shares, with a position value of 4,126.$40,000; open position US energy investment firm Vitesse Energy 5.10,000 shares, with a position value of 97.$10,000。

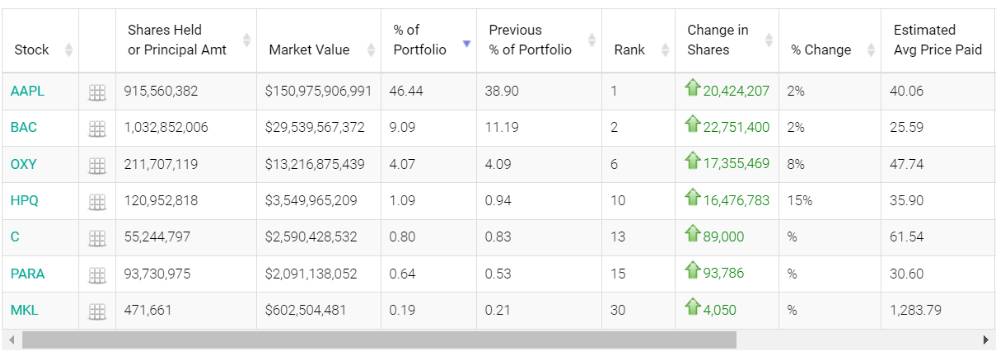

In terms of stock holdings, Berkshire increased its holdings of Apple (Apple, Inc.) in the first quarter..), Bank of America Corp..), Occidental Petroleum Corp (Occidental Petroleum Corp..), HP, Citigroup, Paramount Global and Markel Corp..) Seven stocks。

Among them, Berkshire increased its holdings by the largest proportion of HP, reaching 15%, followed by Western Oil, which also increased its holdings by 8%.。

It's worth noting that Berkshire has been steadily adding to its position in Occidental Petroleum since March last year, and by the end of last year, Occidental Petroleum had quickly reached the top 10 of its heavy position list, with a stake of $12.7 billion.。At the Berkshire Hathaway shareholder meeting on the 8th of this month, Buffett said that investing in Occidental was a completely wise decision and was very optimistic about Occidental's location in the Permian Basin and its numerous high-quality wells。At the time, he also revealed that he greatly appreciated Occidental's management and did not rule out continuing to increase his holdings in the future, but was satisfied with his existing position。

And Buffett's move to add positions seems to be continuing, with May 16, according to the latest disclosure from the Securities and Exchange Commission (SEC), Berkshire bought nearly 1 more in the open market on Thursday, Friday and Monday..$300 million in Western oil shares。

In addition, Berkshire also increased its holdings of Apple and Bank of America shares by 2%, respectively, and made small increases in Citi, Paramount and Markle Insurance.。

Apple's increase in holdings is not surprising。Buffett has praised Apple many times in public and has been very chagrined by the previous sale of Apple stock, saying he made a mistake。In addition, Buffett has been actively selling his bank shares since 2020, but only for Bank of America。He has said that I like Bank of America's executive president Brian Moynihan very much, I just don't want to sell it.。"

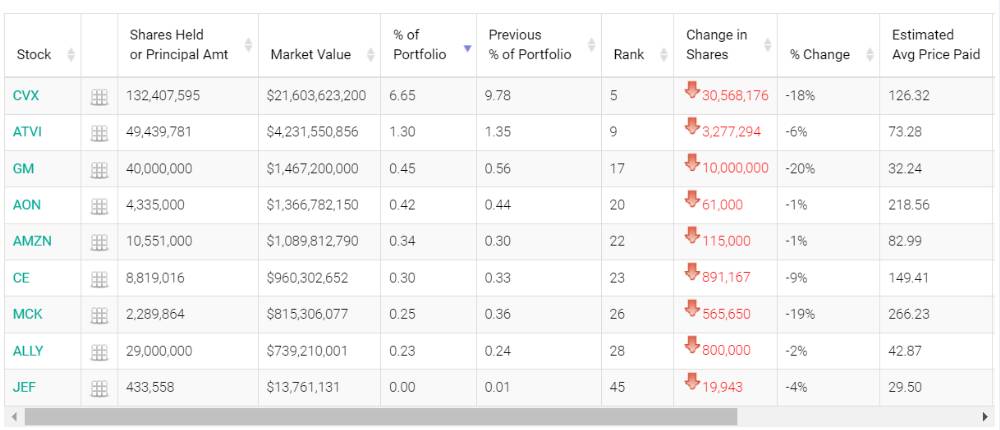

In terms of stock reductions, Berkshire reduced its holdings of nine stocks during the reporting period, namely Chevron (Chevron Corp..), Activision Blizzard (Activision Blizzard, Inc.), General Motors (General Motors Co..), Aon Insurance (Aon Plc), Amazon (Amazon.com, Inc.), Celanese Corp.), McKesson Corp.), Ally Financial Inc, Jefferies Financial Group Inc。

Of these, Berkshire's largest reduction in GM's holdings, at 20 percent, is not without warning。Earlier at the shareholder meeting, Buffett said that historically, the auto industry has been very difficult。He also said Berkshire is unlikely to invest in automaker stocks like General Motors or Ford, preferring the car dealership business。

In addition, Berkshire's holdings in pharmaceutical distribution company Myxon and energy and mining company Chevron have fallen by 19% and 18%, respectively, and both now have positions in their portfolios of only 0.25% and 6.65%。

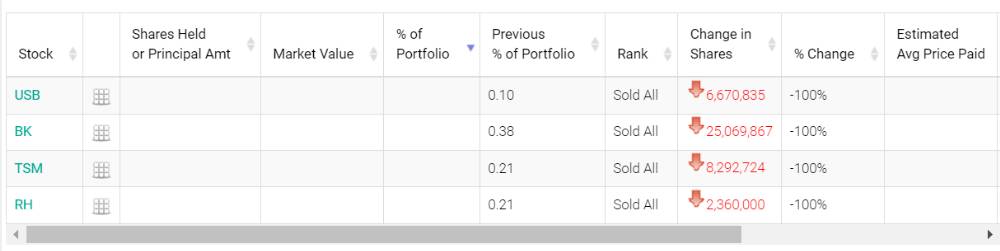

In terms of liquidating stocks, Berkshire emptied United Bank of America during the reporting period (U.S.Bancorp, The Bank of New York Mellon Corp.), TSMC (Taiwan Semiconductor Manufacturing Co..Ltd.) and luxury furniture retailer RH。

Berkshire's clearance of two financial stocks comes as no surprise。The banking crisis is still in doubt, and the credit crunch is still putting many regional banks in the United States under intense pressure.。In addition to Berkshire, Bridgewater also liquidated its financial stocks significantly in the first quarter。In response, Buffett has said he has been selling bank stocks because his interest in the industry has waned。

As of the end of the first quarter, Berkshire's top 10 heavyweight stocks were Apple, Bank of America, American Express, Coca-Cola, Chevron, Occidental Petroleum, Kraft Heinz, Moody's, Activision Blizzard and Hewlett-Packard.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.