Berkshire Q2 results turn a profit Holding cash reserves as high as $147 billion!

On August 5, local time, Warren Buffet's Berkshire Hathaway announced its second-quarter results.。The company turned a profit in the second quarter, driven by insurance business and investment income.。

On August 5, local time, Warren Buffet's Berkshire Hathaway announced its second-quarter results.。The company turned a profit in the second quarter, driven by insurance business and investment income.。

Berkshire's second-quarter net profit was $35.9 billion, compared with a net loss of $43.6 billion in the same period last year, according to performance data.。Revenue of $92.5 billion, up 21%。

Stock investments remain Berkshire's investment focus。Berkshire bought $5 billion worth of stock during the quarter, while selling nearly $13 billion worth of stock。In the first half of the year, Berkshire sold more than $18 billion in net shares, compared with $34 billion in net purchases last year.。In the equity portfolio, about 78% of the value is concentrated in five companies, including American Express ($26.4 billion), Apple ($177.6 billion), Bank of America ($29.6 billion), Coca-Cola ($24.1 billion) and Chevron ($19.4 billion).。

Apple stock is the # 1 stock in Berkshire's portfolio by market capitalization。In terms of number of shares, the first place is Bank of America's stock.。As of March 1, Berkshire held 12 of the bank's.9% of outstanding shares。

Buffett had predicted in May that Berkshire's insurance underwriting business would improve earnings, and that business did see a significant increase in the second quarter, with earnings up 74% to 12.500 million dollars。Berkshire-owned insurer Geico has struggled with losses, but has posted its second consecutive quarter of good results this year, driven by rising average premiums and falling advertising costs.。

Railroads are the worst performing category of Berkshire's investments。BNSF Rail profits down 24% as pay and benefits costs rise due to lower freight volumes, higher headcount and higher wages。

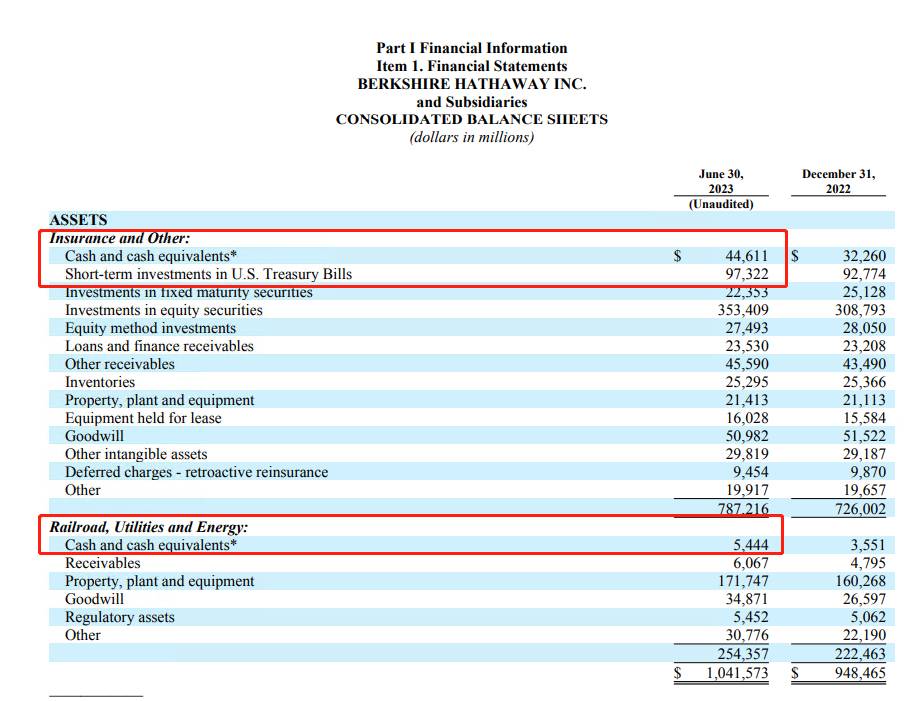

Also attracting the market's attention, Berkshire's second-quarter report showed that the company's cash reserves (including cash and short-term Treasuries) increased by $17 billion from the previous quarter to 1,473.$7.7 billion, coming to the second-highest level in history, after $149 billion at the end of 2021.。

Berkshire's cash is mostly in the form of U.S. short-term Treasuries, which the company earns from U.S. short-term Treasury yields against the backdrop of the Fed's aggressive rate hikes。

Last week, Fitch downgraded the U.S. long-term foreign currency debt rating to AA + from AAA, citing an expected deterioration in the U.S. fiscal position over the next three years and a high and growing government debt burden.。Unlike the market's fierce criticism, Buffett's response to this was mediocre。He acknowledged that Fitch had some good points, but said investors should not worry too much.。Buffett says his fund will continue to buy U.S. Treasuries。

Berkshire is one of the world's largest holders of U.S. government debt.。Buffett remains confident in U.S. Treasuries and the dollar。He said: "The dollar is the world's reserve currency and that's what everyone knows.。"

On X (formerly Twitter), a netizen compared Buffett's attitude towards U.S. Treasuries with that of billionaire Bill Ackman (Bill Ackman), who claimed to be shorting U.S. Treasuries.。

Ackerman responded: "We're actually in agreement.。Buffett would never buy a 30-year Treasury note at a price close to current yields.。His purchases were simply cash management using short-term government bonds.。We also invest cash in short-term government bonds.。"

But such high cash reserves also highlight the problem that Buffett is struggling to acquire targets at high valuations or find "bargains" in the stock market.。

In addition, Berkshire has been conducting share buybacks, with $1.4 billion in share buybacks in the second quarter and more than $4 billion in share buybacks in the last quarter.。The rise in Berkshire's share price is the main reason for the decline in the size of its buybacks.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.