Add more Western Oil holdings to 25%! Buffett: not seeking to control Western Oil

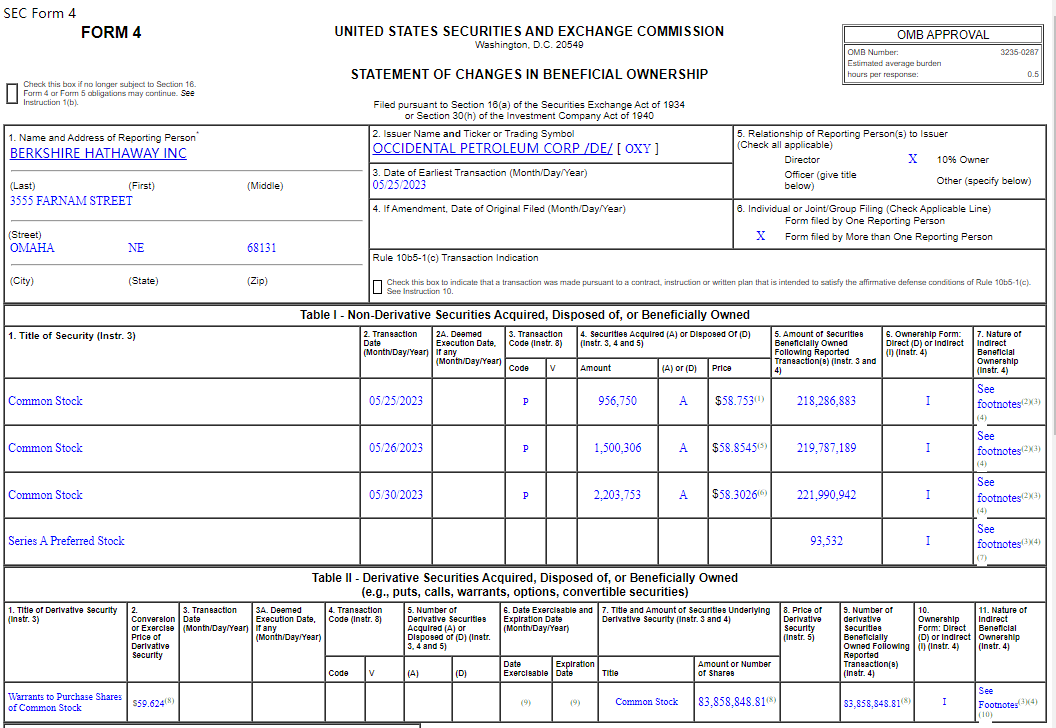

On May 30, local time, according to documents disclosed by the U.S. Securities and Exchange Commission (SEC), Warren Buffett's Berkshire Hathaway increased its holdings of Occidental Petroleum by a total of 466 on May 25, 26 and 30, respectively.080,000 shares of common stock, valued at approximately 2.$7.3 billion。

On May 30, local time, according to documents disclosed by the U.S. Securities and Exchange Commission (SEC), Warren Buffett's Berkshire Hathaway (Berkshire Hathaway) on May 25, 26, 30, respectively, to 58 per share..75, 58.85, 58.$30 Increase in Western Oil Total 466.080,000 shares of common stock, with a total value of approximately 2.$7.3 billion。

It's worth noting that this increase is not Berkshire's first move to increase its holdings of Western Oil this month。Earlier this month, Berkshire bought Western Petroleum for six consecutive trading days from May 11 to May 18, increasing its holdings by 5.62 million shares, with an average purchase price of 56-58.Between 66, it costs about 3.$2.7 billion。

After increasing its holdings over the month, Berkshire Hathaway has so far held a total of 2.2.2 billion shares of Occidental Petroleum common stock, worth about $13 billion, with a stake of 24.9%。It's hard not to raise the suspicion that Buffett might want to buy the entire company of Occidental Petroleum。

But previously Buffett said at Berkshire's annual meeting in May that he was not seeking to control Western oil.。At the meeting, Buffett also praised Occidental Petroleum and the company's CEO Vicki Hollub, and said he may continue to buy more shares.。The recent move to increase his holdings also validates his claims, but it's unclear how high a stake Buffett is willing to hold in Occidental Petroleum。

Buffett has repeatedly increased his holdings of Western oil during the month or because of the relatively weak performance of oil and gas prices at this stage, thus conducting a "bottoming out" operation.。Yesterday (May 30), as oil prices fell below $70 a barrel, Occidental's share price fell slightly 0.6% to 58.59 USD。

According to media reports, Buffett seems to prefer buying a stake in Occidental Petroleum at less than $60 per share。As of now, Berkshire Hathaway's average bid for Occidental Oil is likely to be around $55。

Berkshire's increase in holdings has supported Western Petroleum's stock trading volume。Yesterday, Berkshire Hathaway bought 2.2 million shares, accounting for more than 15% of Occidental Petroleum's share trading volume on the day。

In addition, Berkshire holds approximately $9.4 billion worth of preferred stock with an 8% dividend yield on Occidental Petroleum, as well as 84 million warrants。The warrants may purchase Occidental Petroleum's common stock at an exercise price of approximately $59 per share。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.