Buffett will sell HP at a loss. What's wrong?

Buffett's Berkshire Hathaway (Berkshire Hathaway) has sold more than 8 million HP shares in half a month, cashing in more than $200 million.。

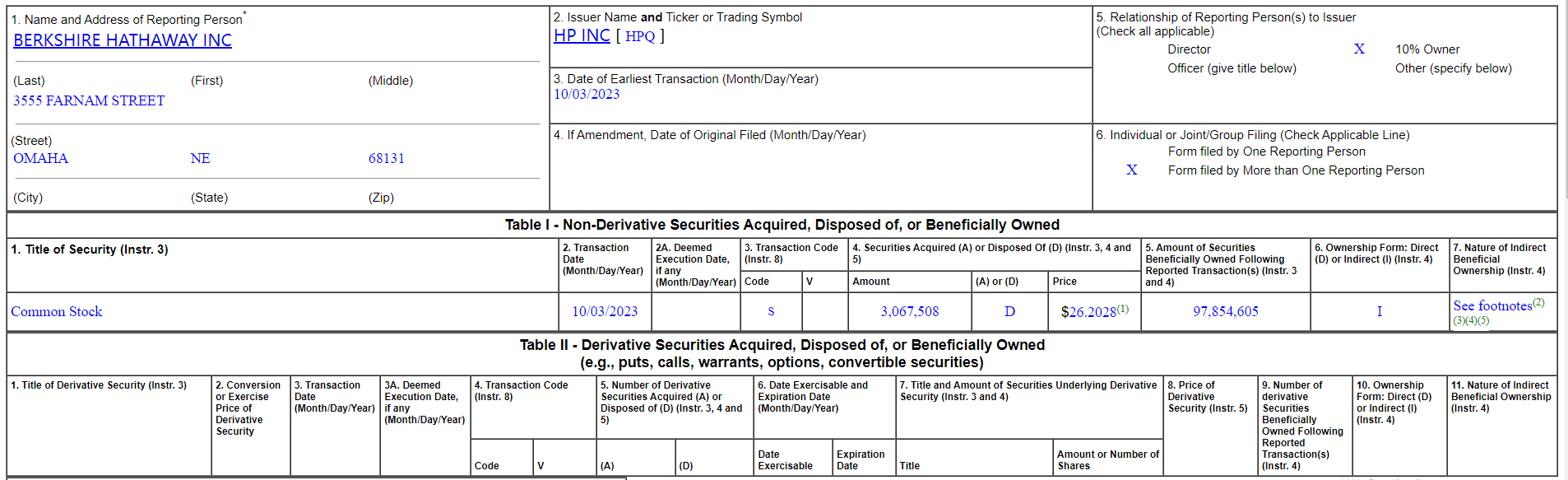

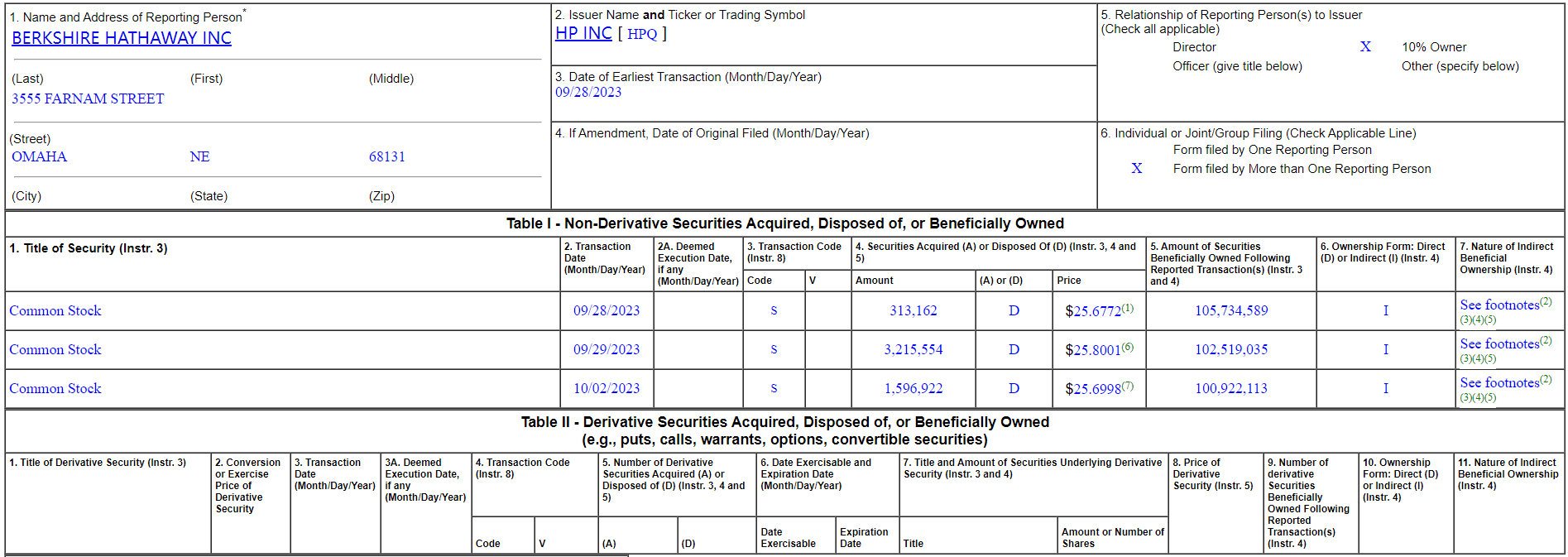

On October 5, local time, Buffett's Berkshire Hathaway (Berkshire Hathaway) said in a filing with the U.S. Securities and Exchange Commission (SEC) that it sold more than 3 million HP shares on October 3 at a selling price of 26 per share..$2, with which Buffett cashed out more than $80 million.。

Notably, this is the second time in half a month that Berkshire has disclosed that it is dumping HP's stock。According to Berkshire's October 2 filing with the Securities and Exchange Commission, it sold a total of 5.1 million HP shares on September 28, September 29, and October 2, at an average price of 25 per share..$73, worth about 1.300 million dollars。

In addition, Berkshire was also selling HP shares last month, selling a total of about 5.5 million HP shares, or about $29 per share, involving an amount of nearly 1.600 million dollars。

Previously, Berkshire held more than 12% of HP's stock, and after the latest sell-off, Berkshire's stake in HP has fallen to about 10%。The SEC requires investors holding more than 10% of their shares in any particular entity to continuously disclose transactions, while investors holding less than 10% can update quarterly。This means that Berkshire will no longer need to disclose to the public if it continues to sell HP's shares.。

When Berkshire first bought HP's stock early last year, the company was trading at more than $30。HP's shares have fallen nearly 14% in the past month and have been hovering around $26 for nearly a week.。In other words, Berkshire's recent sell-off has actually been a discounted sale。

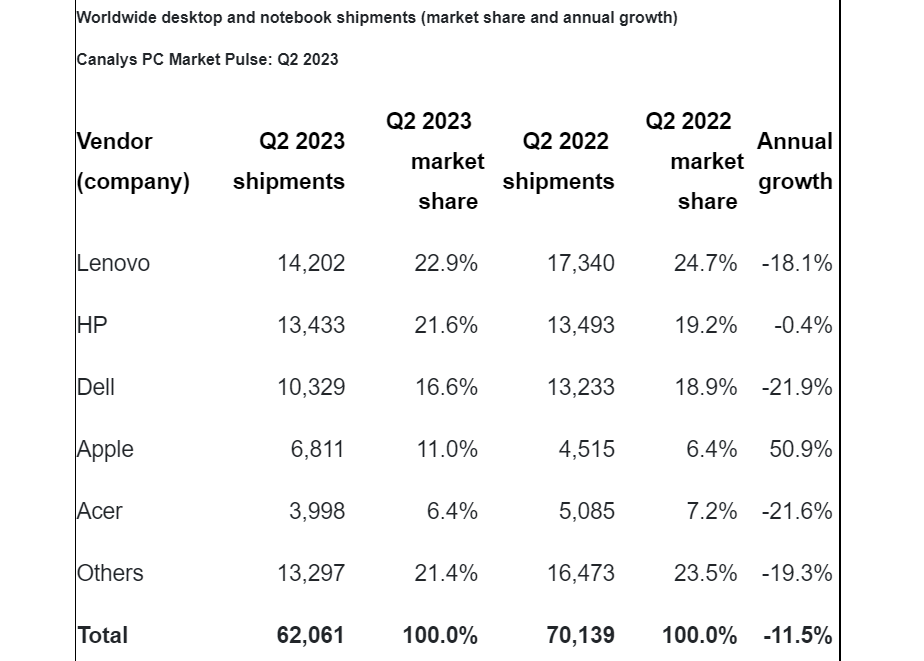

Buffett is selling HP shares at a loss, possibly related to the weakness of the global PC market。According to Canalys, the global PC market continued to decline in the second quarter of 2023, with total desktop and laptop shipments falling 11.5% to 62.1 million units。However, the decline in the overall market has slowed.。Prior to this, global PC shipments fell by more than 30% for the second consecutive quarter。Second quarter shipments increased 11.9%, indicating that the market is expected to accelerate the recovery in the second half of this year。

Among them, HP shipped 13,433 units in the second quarter of this year, down 0.4%, the downward trend slowed sharply, after the first quarter recorded a year-on-year decline of 24.1%。HP's market share was 21 in the second quarter..6%, up 2.4 percentage points, down 0.6 percentage points。In terms of shipments, HP is the world's second-largest supplier after Lenovo, with its market share lagging Lenovo by 1-2 percentage points。

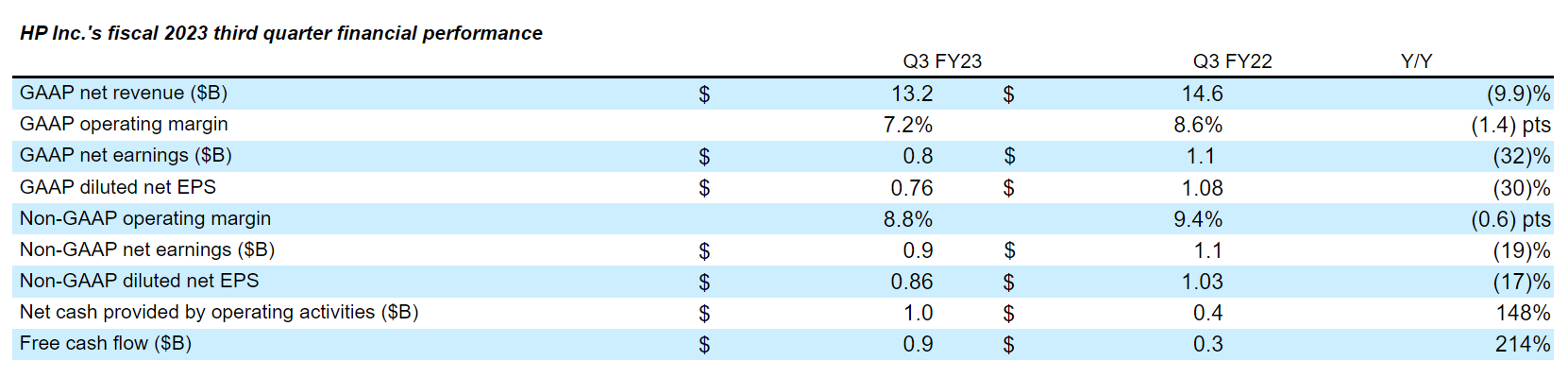

In the case of a weak external environment, HP's earnings are not very "good-looking."。At the end of August, HP released its third-quarter 2023 earnings report.。Under U.S. General Accounting Standards (GAAP), HP achieved net revenue of $13.2 billion in the third quarter of fiscal 2023, down 9.9%; net profit was $800 million, down 32% YoY; margin was 7.2%, down 1% from the same period last year.4 percentage points。diluted net earnings per share of 0.$76, down from $1.08 USD。

For the next earnings forecast, the Company expects diluted net earnings per share for the fourth quarter to be 0.$65 to 0.Between $77。In addition, HP cut its full-year earnings per share forecast by 15 cents to 3 cents per share..$23 to $3.Between $35。

HP sees the weakness in the global PC market as a protracted battle, as evidenced by HP's lowered profit forecast。HP's CEO Enrique Lores said: "While we expect another quarter of quarter-on-quarter growth in the fourth quarter, the external environment has not improved as quickly as expected, so we are adjusting our expectations.。"

In this scenario, HP expects the company's other businesses to grow faster than its core business (PC business), including gaming, hosting services, consumer digital services and 3D.。

It's not yet known whether Buffett will continue to sell HP's stock or whether Buffett's motivation for selling is really not bullish on HP, or whether he will sell first and then buy again from the bottom, and more information will have to wait until Berkshire's quarterly update.。Since the most recent HP stock sale occurred in the fourth quarter of this year, a quarterly update containing relevant information will not be released until February of next year。

Although Buffett is known as the "stock god," he is not a "hundred shots" in stock selection, especially in technology-related fields.。In fact, Buffett has shied away from investing in tech stocks for years because he believes it's too hard to pick long-term "winners" in a fast-growing industry.。

Despite the success of Buffett's investment in Apple and the fact that Apple is still a major holding in Berkshire's portfolio, Buffett has also "stumbled" on other technology companies, the more famous of which is IBM.。Buffett started buying IBM stock in 2011, but IBM subsequently did not perform as well as expected, failing to give it a hefty return。In 2018, Buffett admitted he was wrong about IBM。Eventually, after six years of holding IBM shares, he sold the company's stock at a small premium.。

Will HP be the "IBM 2" of Buffett's investment career?.0, "still to be tested by time。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.